would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 4:27 pm

16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 4:27 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 4:37 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 4:37 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 4:43 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 4:43 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 5:24 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 5:24 pm

Last edited by stockback on Thu May 16, 2013 5:59 pm; edited 1 time in total

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 5:37 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 5:37 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 5:41 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 5:41 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 6:20 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 6:20 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 6:41 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 6:41 pm

Jiggysaurus wrote:Surprisingly shareholder friendly move by a historically shareholder unfriendly management.

Good lesson to stingy cash hoarders like KGAL and RENU

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 6:59 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 6:59 pm

troy wrote:I believe this would trigger MAL N over 5 but not sure about the implication on Mal X.

But still feel its also going to increase since this move will further reduce the number of X shares.

Experts pls give your opinions/target prices

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:09 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:09 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:36 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:36 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:39 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:39 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:45 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:45 pm

stockback wrote:what i understood. i may wrong.

company going to buy some amount shares and cancel those shares.

spending 175 m, 14.28% are going to buy and cancel it.

I think share price is going to high after this happen.

14.28% shares are cancelling. this is opposite of Right Issues. Right Issue put share price lower and this one put share price bit high.

experts this is my idea please give me your experts comments.

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:57 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 7:57 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 8:31 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 8:31 pm

Yes what you are telling is true. But there are some problems as well. First thing about MAL.X, their offering price is 3.50, But current trading price is 4.60. So will people sell about 3 million shares at 3.50. I dont think so similarly it seems buying 32 million shares of MAL.N would also be difficult. Those are basic requirements for this has to happen. As well this move will be good to share holders who bought this once the share price dropped below 6 (There is no initial impact for share holders with break even price more than 5, but probably this would be good for people with break even price less than 6 - this is a my assumption only ) but what about people who bought this when this was trading at higher price. I would say more than 6. There will not be any initial benefit for them, 0.75 - 0.80 dividend could have been better for them.But NAV, EPS will be higher after this finished. Future EPS would also be higher if they can maintain at east current profit. So this would finally be a good move for the company's and all share holders future. But to happen all above things they should be able to buy those shares successfully at mentioned prices.stockback wrote:simple.

share price going to over 5 rupees after happen repurchase.

Think About Right Issue. they did.

share price is Rs. 10 and after right issue that fall below right issue price(right issue price Rs.6.75/- )

I think this is like buy share and burn it. so then number of shares will be reduce.

think about 175M using for Dividend. that means that amount will be lost buy company and its going to share holders.

Repurchase and cancelling. minimize the number of shares. Net assest is going to high and also future P/E ratio is going to high value.

I think if we hold share then after repurchase. share price is going to more than Rs. 6-7 easily. with good financial report it can be go further. this is my idea

please think deeply before investing on this.

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 9:16 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Thu May 16, 2013 9:16 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 6:27 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 6:27 am

stockback wrote:Hi SLSTOCK

can you explain bit this.

i don't know how is effect current share price. I don't have that much knowledge

Thank You

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 10:47 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 10:47 am

Malwatte Valley Plantations - Offer to purchase Fri May 17, 2013 11:28 am

Malwatte Valley Plantations - Offer to purchase Fri May 17, 2013 11:28 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 11:33 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 11:33 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 2:05 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Fri May 17, 2013 2:05 pm

stockback wrote:Slstock please give me your ideas about MAL repurchase.

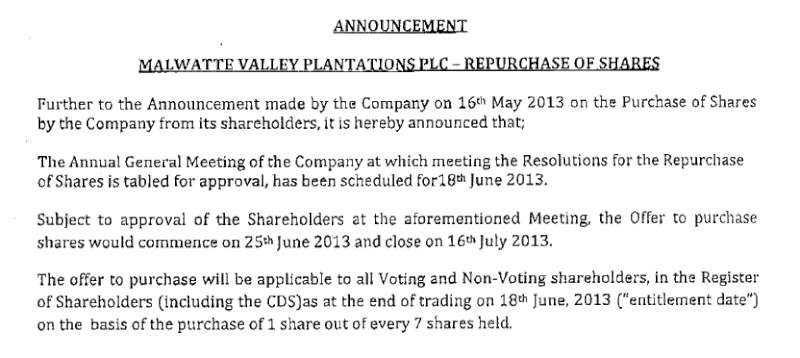

05-June-2013 Malwatte Valley Plantations - Repurchase of Shares Wed Jun 05, 2013 9:32 am

05-June-2013 Malwatte Valley Plantations - Repurchase of Shares Wed Jun 05, 2013 9:32 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Wed Jun 05, 2013 11:40 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Wed Jun 05, 2013 11:40 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Wed Jun 05, 2013 12:15 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Wed Jun 05, 2013 12:15 pm

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Wed Sep 18, 2013 9:52 am

Re: 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares Wed Sep 18, 2013 9:52 amFINANCIAL CHRONICLE™ » CORPORATE CHRONICLE™ » 16-May-2013 Malwatte Valley Plantations - Offer to purchase Ordinary & Non Voting Shares

Permissions in this forum:

You cannot reply to topics in this forum