As per their latest report their NAV is 438 and currently trading around Rs 250. An illiquid counter in the market.

Last year Shaw Wallace sold a 264.65 perch land in Kollpiti for Rs 1.85 billion.

They had a plan to build a 30 stories building called Mayfair city but its put on hold at the moment.

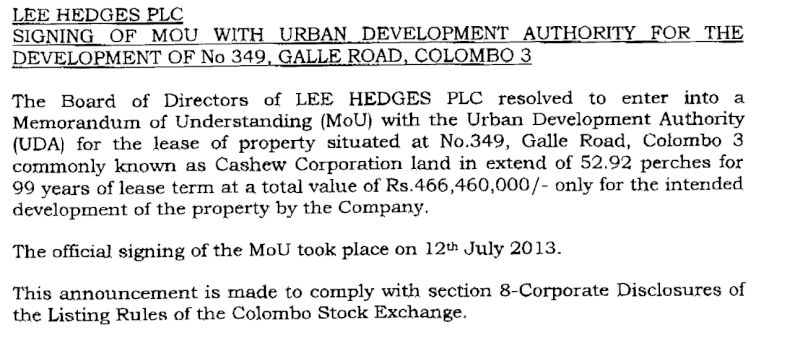

They are trying to secure a 53 perch land from UDA on a 99 year lease and this is adjoining to their current property at Kollupitiya.

My question is, If you know please let me know how much more land they have in Kolpitiya (freehold)? I cannot find any details in their annual report.

Some articles shows before sold 265 perch land, they had 542 perch property in Kollupitiya. So now 277. but as per the latest report current valuation of the land is Rs 614 million. So this article cannot be right.

http://www.lankanewspapers.com/news/2005/3/1052.html

Also what’s the progress of this Mayfair city project?

Thanks

Currently I dont have shares.

Last edited by UKboy on Sun Jun 02, 2013 9:19 pm; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home