Last edited by sriranga on Tue Sep 03, 2013 10:17 am; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

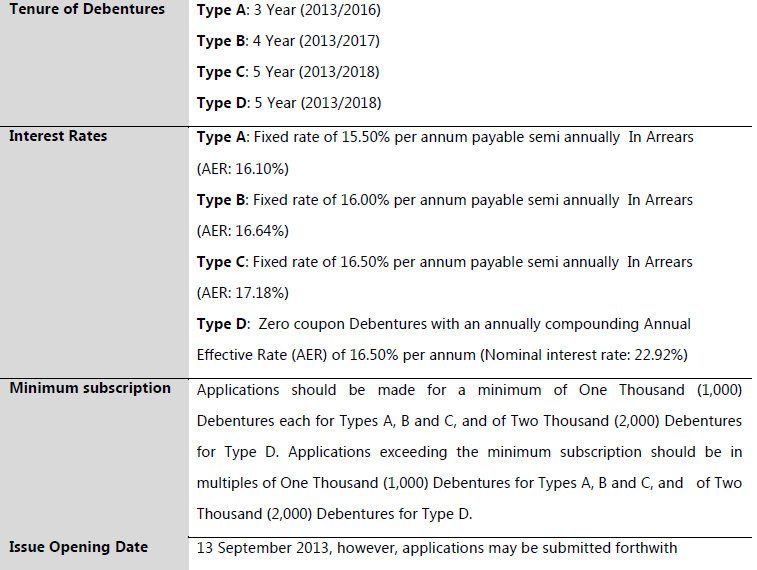

Debenture Issue - Alliance Finance Tue Aug 27, 2013 5:07 pm

Debenture Issue - Alliance Finance Tue Aug 27, 2013 5:07 pm

Last edited by sriranga on Tue Sep 03, 2013 10:17 am; edited 1 time in total

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 5:25 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 5:25 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 5:39 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 5:39 pm

salt wrote:

Its quite risky to invest in mid-low size finance companies now.

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 6:58 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 6:58 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 7:06 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 7:06 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 7:47 pm

Re: Alliance Finance Debenture Issue at a glance Tue Aug 27, 2013 7:47 pm

salt wrote:You may see pressure on margins from two sides

Slow down in business

Increase in defaults of sub prime borrowers

Additionally,

Lost of pawning business

Raising funds in low rates environment

Tightening regulation may squeeze margins

Re: Alliance Finance Debenture Issue at a glance Wed Aug 28, 2013 1:21 am

Re: Alliance Finance Debenture Issue at a glance Wed Aug 28, 2013 1:21 am

Re: Alliance Finance Debenture Issue at a glance Wed Aug 28, 2013 7:25 am

Re: Alliance Finance Debenture Issue at a glance Wed Aug 28, 2013 7:25 am

salt wrote:Unfortunately, we never learn any lesson.

We were unable to select better shares, same way we are unable to select better debts. End of the day, all are pledges, wether it is fixed or not fixed. You make a judgement on the future capacity to pay returns.

Lets blame later on like we blame today.... For over priced IPOs, looting money through public offers..... EXPO, SHL, .... I may not remember all... Only to name a few

Alliance Finance Debenture Issue at a glance Tue Sep 03, 2013 10:12 am

Alliance Finance Debenture Issue at a glance Tue Sep 03, 2013 10:12 am

Re: Alliance Finance Debenture Issue at a glance Tue Sep 03, 2013 11:08 am

Re: Alliance Finance Debenture Issue at a glance Tue Sep 03, 2013 11:08 am

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum