Chinwi wrote: ranferdi wrote:Chinvi is saying mattala andagampura was only 550million usd. At the same time saying that proporttion of eepayment MR loans is onl 1.5 billion. Then that case what have MR done with rest of money.?

.

Not me ranferdi. I quoted people who talk for Yahapalana & Ranil.

Everywhere they say MR wasted money to build Mattala and Magampura, they do not produce returns and that is why we are facing this crisis.

Proportional payment 1.5 billion or any amount is not only MR's loans. That is the balance we have to pay per year for loans taken for decades including war expenditure.

If you really want to see other things done by MR with 'rest of money' just go around the country.

They do not talk about roads and bridges including highways, agricultural developments, educational developments, war expenditure etc. done by MR because people are getting benefits. So they always talk about Magampura and Mattala but do not consider or talk about the cost incurred for them. General public was fooled by these talks during elections and they are still using same lies to hide their inability.

Somehow, what I wanted to study with others is not the loans taken for capital expenditure by any government. MR or RW we can handle that. ( what govt tells about capital expenditure is false)

The huge danger to affect our economy [and CSE] is coming from unbearable recurrent expenditure created by Yahapalana .

For eg. unprecedented increase of salaries of Govt servants for obtaining votes is giving the real trouble.

these people promised huge increase of monthly salary without calculating the total. Just count, for 1.4 million of govt servants ( Im not sure about this 1.4m figure pl correct me if wrong ) increase of 10,000 x 12 x 1.4 m = 168 billion rupees per year (Total expenditure for Mattala and Magampura = 75 billion ! )

They have to find 168 billion per year just to give the increased part of the salary. And this is repetitive. The real problem is here. Not with loans taken for capital expenditure.

I think now everybody can understand where is the problem.

168 billion recurrent per year Vs 75 billion one off expenditure distributed for many years paying back.

That is why I say we can handle Capital expenditure but the problem is with recurrent expenditure .

මේක අපේ පවුලක උනත් එහෙමයි. ඉඩමක් අරන් ගෙයක් හදන ණයක් ගත්තම අඩු ගානෙ වැටිල ඉන්න ගේ හරි තියෙනව. රටක් උනත් බැංකුවක් උනත් ප්රාග්ධන ණය දෙන්නෙ ගෙවීම් හැකියාව මැන බලල. ඒ නිසා එතනත් සහනයක් තියෙනව. ආපසු ගෙවීම තමන් ගේ ආදායම අනුව වසර 10-15 බෙදිල යනව. ඉඩම් මිල වැඩි වෙනව. වසර 10 කට කලින් ගත්ත ගානට දැන් ගන්න බෑ.

කන්න බොන්න, ඇඳුම් පැලඳුම් , විනෝදය, සංචාරය වගේ ඒවට එදා වේල ණය ගන්න උනාම ඒව ඉතුරුවක් නෑ වගේම දිගටම ණය ගන්න වෙනව. අන්තිමේ රටටම ණය වෙලා නැත්තටම නැතිවෙලා යනව.

Dear Chinwi,

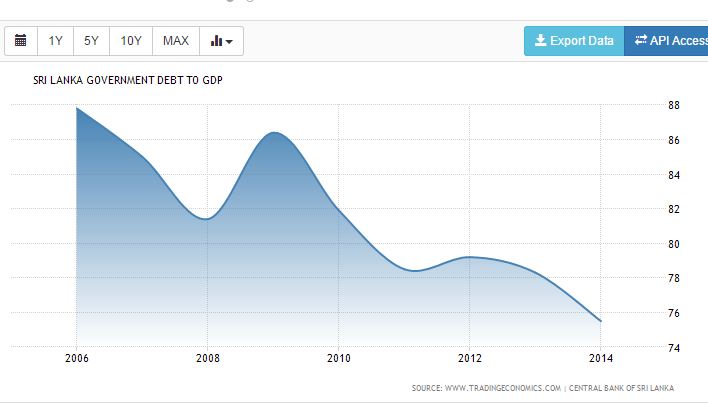

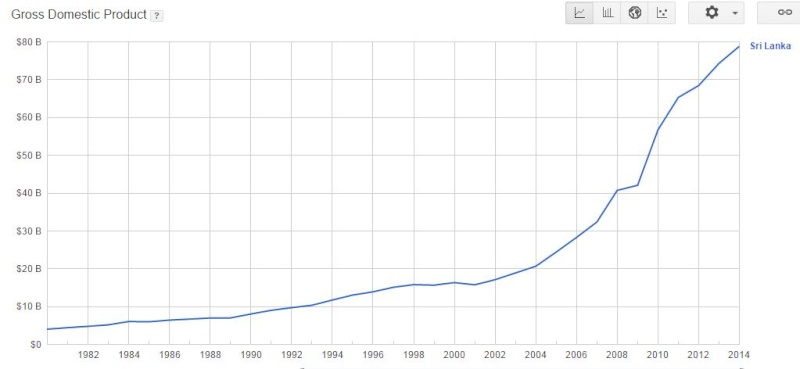

The core of the problem lies in the totality of the loans taken , Total is close to 10,000 Billion LKR or 70Billion USD... Dear Just evalueate the figure when MR taken the government it was just beow 15 billion USD.

MR. Did the roads and some projects thats beneficial to country too.. But most are ended up with failure or yet not fruitfull. The loans has to be taken development needs to be done but to the extend that we will not fall into debt trap.

Yahapalanya did increase the salaries to uphold the lives of the people and increasing salaries will uphold the lives and increase the economic activity increasing revenues, Isn't it?

Please do not try to whitewash the dirts of the crooks.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home