Just a summary of key financials with a conservative estimate for FY 2016/17 is given below.

| Rs mn | 2014/15 A | 2015/16 A | 2016/17 F |

| Loans & Advances | 4389 | 5608 | 7,080 |

| Growth in loans & advances | 64% | 28% | 26% |

| Interest income | 1165 | 2087 | 2,780 |

| Growth in interest income | 29% | 79% | 33% |

| Interest yield | 33% | 42% | 44% |

| NPAT | -429 | 162 | 222 |

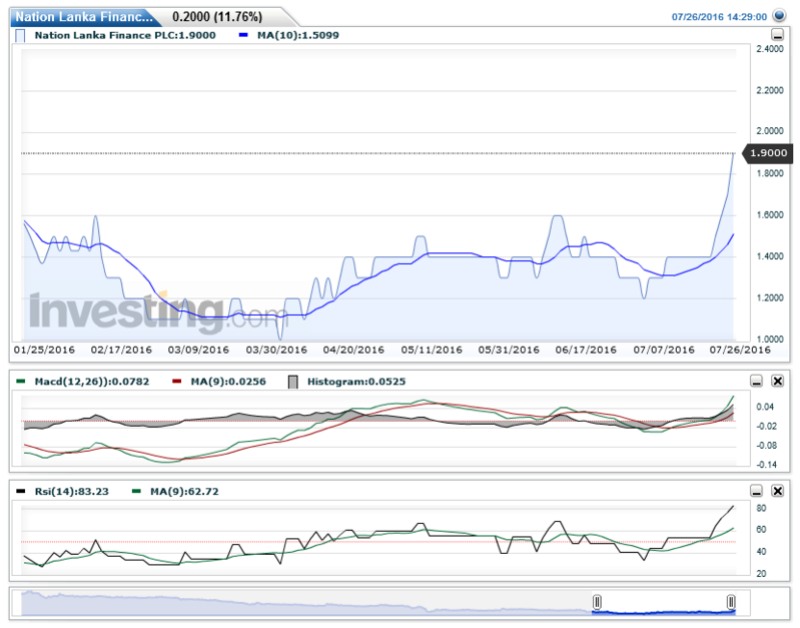

The above PAT was estimated based on very conservative assumptions of loan book growth and PAT margins yet they can generate an EPS of 30 cents for the next financial year which translates to a PE of 6x at the closing price of Rs1.8 but still trading at a discount to the industry PE benchmark. NAV tyrned to positive 1 in 15/16 from a negative 1 in 14/15.

So within 2 to 3 years this company generating a profit in excess of half a billion so that the price should reach Rs5/- which means a lucrative medium term investment for you.

Do your own analysis also to take an informed decision.

Thanks

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home