First chart show the ASI movement during the period from the death of Velupulle Prabakaran and dawn of peace 2009 upto January 2015 in which President Sirisena took over the country after winning the Presidential electionwith Mahinda Rajapakse. As you can see market has gained significantly during this period backed by stong economic fundamentals. All Share Price index performed exceptionally well, high corporate earning resulting from lower inflation and low borrowing costs. Exchange rates were well managed. Simply to say Mahinda Rajapakse not only handed over a peaceful country to Maithripala Sirisena, but he also a prosperous country with a booming economy and a vibrant stock market.

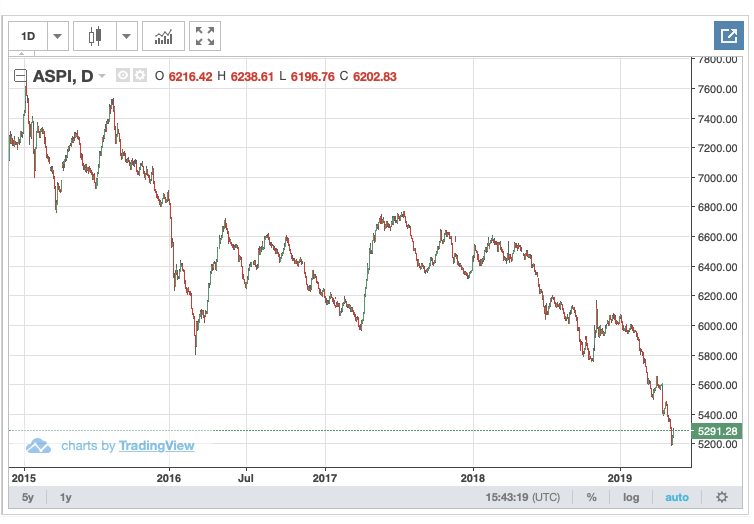

Now look at the second chart below. This simply indicate the economic mismanagement during the period of the President Sirisens's government which is still not over. Government under the pretext of Yahaplanaya blatantly mismanaged the economy resulting in destruction of the strong economy that was handed over by Present Rajapakse in 2015. Short sighted economic and fiscal policies resulted in lower corporate earnings, high inflation, high borrowing cost and significant devaluation of the rupee during this period. End result of this action was the crashing stock market. From a high of 7000 ASI now down to 5000 levels. The turn of events in April 2019 simulate the scenario opposite to the dawn of peace in 2009. Question is where is the bottom and what would be the ultimate consequences of rebirth of terrerism to the performance of the stock market and ASI.

My personal view is ASI is likely to get close to the level of 2009 unless something good happens before 2021.

Last edited by Quibit on Wed Oct 30, 2019 5:15 pm; edited 2 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home