xhunter wrote:In my previous post i said , when market increase the probability of having a market dip will also increase and we should act accordingly.

So i thought for some members it will be valuable if i can share what i usually do (99% members , this is not important because they have build up their own strategy to address this, but for the rest this might be important ).

It is simple this is what i did. when market reached very close to 6000, that was one of action point according to my risk mitigating plan. my well planned action was liquidate 10% of my portfolio and keep cash ready.

I never saw this covid is coming or any sort of market dip. honestly i thought market will move to 6200 and then there will be a correction (that is not based on analysis, it is based on the momentum market gained in mid September)

But i can not deviate from the original plan (because that plan was created putting lot of things in to consideration, so my emotions are not important, i should execute the plan).

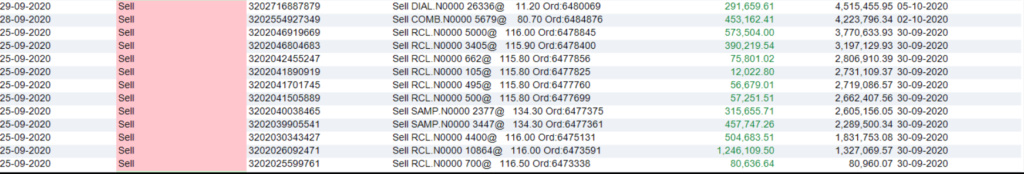

here is the proof , my cash statement.

10% of my portfolio is just 4.5 mn , so you can see what i sold

Why i sold RCL? my target price was 120 , so it came very close that is one of my pick

Why I sold dialog ? i can say the reason, it is unfair to people who invested in dialog (but dialog can be sold even for 11.60)

Why i sold SAMP? my target price was 145, but it develop negative short term momentum

Why i sold COMB? No i didn't sell it, only small portion were sold because i needed to make it 4.5 mn

Hi @xhunter

This was a good transparent post as well as a great advice on how to manage your portfolio and cash.

Would you be able to expand on this post and elaborate on the advice you would like to give considering the current market condition? Would you still be keeping 10% cash freely available?

Thank you.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home