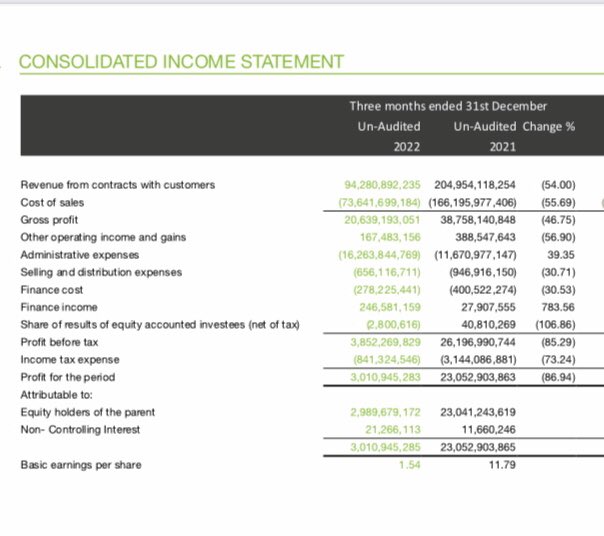

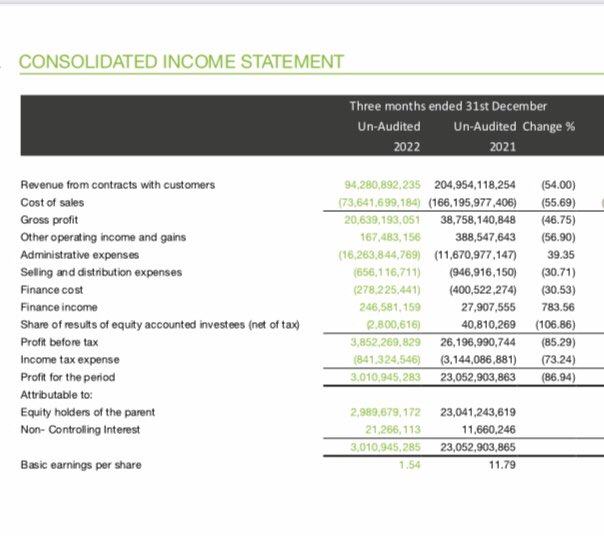

ONTHEMONEY wrote: D.G.Dayaratne wrote:Export do not pay resalable dividend

I think NO ROOM FOR IMPROVEMENT without payment of dividends

If they pay reasonable dividend there will be a cashflow problem.

Will EXPO face internal crisis very soon ?

Pl correct me if i am wrong.

Hi mate,

I am writing after so long in e forum

Anyways, just wanted to shed light about

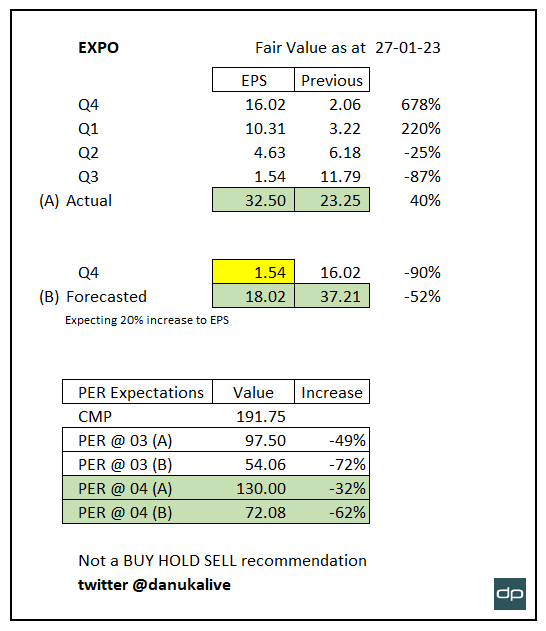

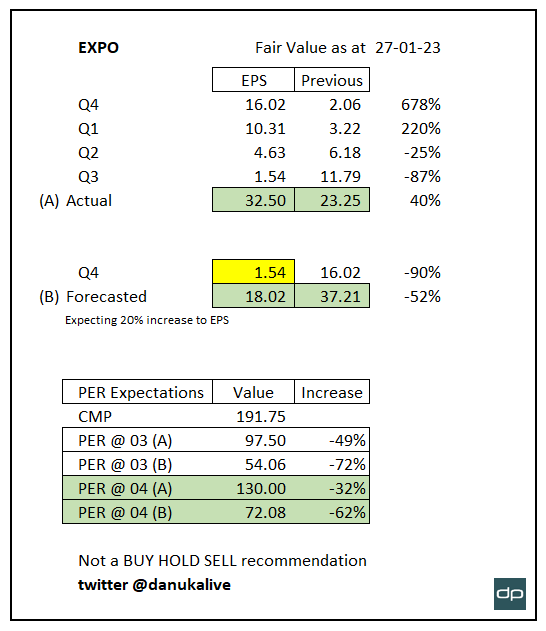

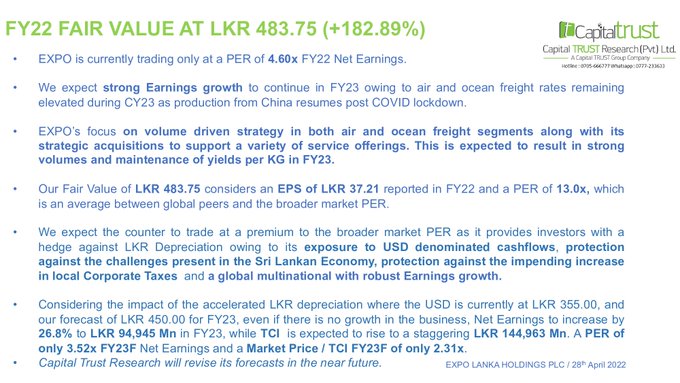

EXPO#EXPO is PHENOMENAL CO. benefits largely on;

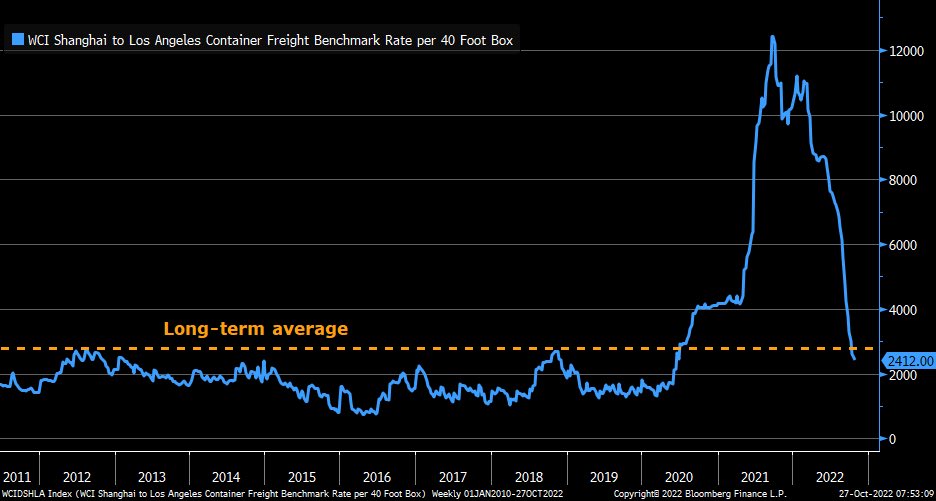

1. C19 & supply shortage

2. Light asset & quick ROI

3. M&A

4. Increased E-COM demand

5. USD/LKR depreciation(92%< earnings in USD

6. Low operational risk since

EXPO in 30+ countries

7. No IMPACT on POWER CUTS

In today’s business world, things are really uncertain. In EXPOs business model, It’s not the broken supply chain, it’s who can triumph over the broken supply chain. Now the C19 OMICRON spread has hit a NEW HIGH GLOBALLY

Furthermore,

EXPO is a company exploited GLOBAL BUSINESS OPPORTUNITIES better than any other BLUE CHIPS in CSE just by OPERATING in LIGHT ASSET AGILE business model

#EXPOs SCALABILITY is HIGH to achieve ANY AMOUNT of PROFITS IMO

DIVIDENDs are low in GROWTH CO. mostly as they allocate FUNDS for NEW INVESTMENTS enhancing business performance. (Ex: AMAZON, GOOGLE)

EXPO is a similar company continuously ACQUIRING to GROW to explore opportunities. Additionally, one can expect a DIVIDEND after the FY is over most probably.

Hence I believe you’re judgment completely wrong

Good Luck

Note - NOT a BUY | SELL or HOLD RECOMMENDATION. DYOA before making an investment decision

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home