MONDAY, 18 APRIL 2011 00:00

By Jithendra Antonio

While many local insurers companies continue to compete on price rather than service, Sri Lanka’s insurance market leader Ceylinco Insurance had said that Sri Lanka’s insurance business arena is not a level playing field, with favouritism towards public sector institutions.

“What disappointed us and the majority in the industry was that the playing field was made distinctly uneven with two companies getting most favoured treatment through a circular issued by the Treasury,” Ceylinco Insurance PLC Chairman, Godwin Perera in his annual review for 2010 pointed out.

Furthermore, Ceylinco Insurance PLC (General) Managing Director/CEO Ajith Gunawardena in the Chief Executive Officers’ review stresses that stringent demarcations and wholesome advantages to public sector institutions has undermined the wellbeing of the industry at large.

Speaking to Mirror Business, Ajith Gunawardena said, the government through the treasury had issued a circular (a few months ago), highlighting that the insurance business of state-owned subsidiaries should be given to the state-owned insurer. “This is not fair to the industry,” Gunawardena added.

According to both Godwin Perera and Ajith Gunawardena, Ceylinco Insurance had once again retained market leadership for the seventh successive year. “We were not deterred by competition. In fact, it made us stronger and more determined to succeed.” Perera says in his review.

While the country has a total of 17 insurance players to date, industry sources claim a large portion of Insurance premiums are generated from Sri Lanka’s largest state-owned subsidiaries and state assets such as Sri Lanka Telecom, Ceylon Petroleum Corporation, Ceylon Electricity Board, Sri Lankan Airlines, Litro Gas, Sri Lanka Ports Authority, Sate-owned banks such as Bank of Ceylon, National Savings Bank, People’s Bank and also the MP’s insurance policies.

The move by the treasury to place all insurance business of government assets with Sri Lanka Insurance Corporation, large chunks of insurance and reinsurance premium money will clearly pour into the state-owned insurance arm.

Sri Lanka’s government in mid 2009, regained overall control of previously state-owned Sri Lanka Insurance Corporation (SLIC), after a landmark judgment of Supreme Court delivered on 4 June 2009, where the shares of SLIC were reverted back to the Treasury Secretary. The Harry Jayawardena-led Sri Lanka Insurance was transferred back to the state while SLIC on January 2011 paid Rs. 6.7 billion in monetary terms to Harry Jayawardena-controlled Distilleries Company of Sri Lanka (DCSL), though the Supreme Court in its judgment said that the purchase price of 6.5 billion Rupees be repaid in Treasury Bonds with interest, within a period of two weeks.

Go to Link: http://print.dailymirror.lk/business/127-local/41235.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

[/url]

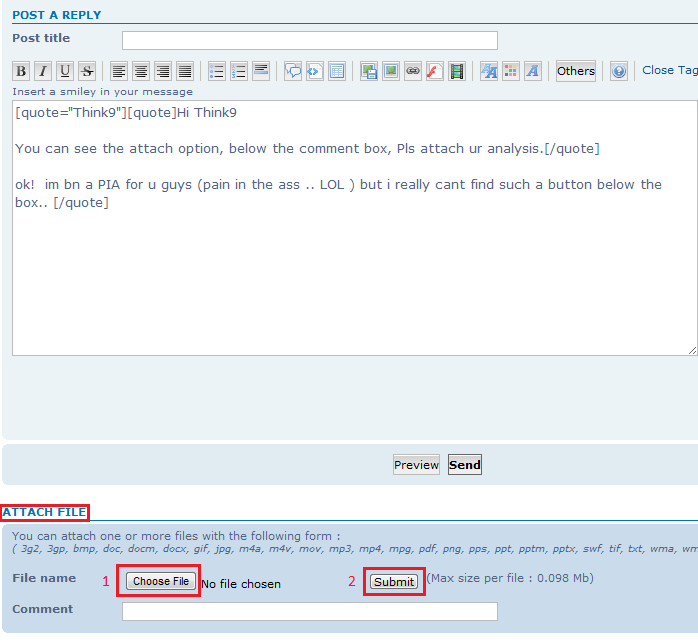

[/url] Insurance Sector Analysis (1).xlsx

Insurance Sector Analysis (1).xlsx