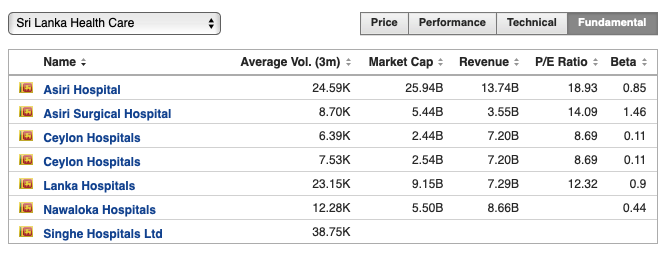

Buy CHL if you are planning to invest for long term or possibly medium term with very low risk and a very good growth. It is a solid share comparing others in the sector.

Availability in the market is going down day to day. Foreign ownership is very very low comparing others. Most of the investors are with long term plan. I have also invested heavily for long term atleast 10 years.

ASIR is the best share when comparing the ROE but I am not prepared to invest for the current level at ASIR.

CHL,ASIR, LHCL, AMSL, NHL.... are expected to have a good future.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home