My take on the market for 2021 and beyond

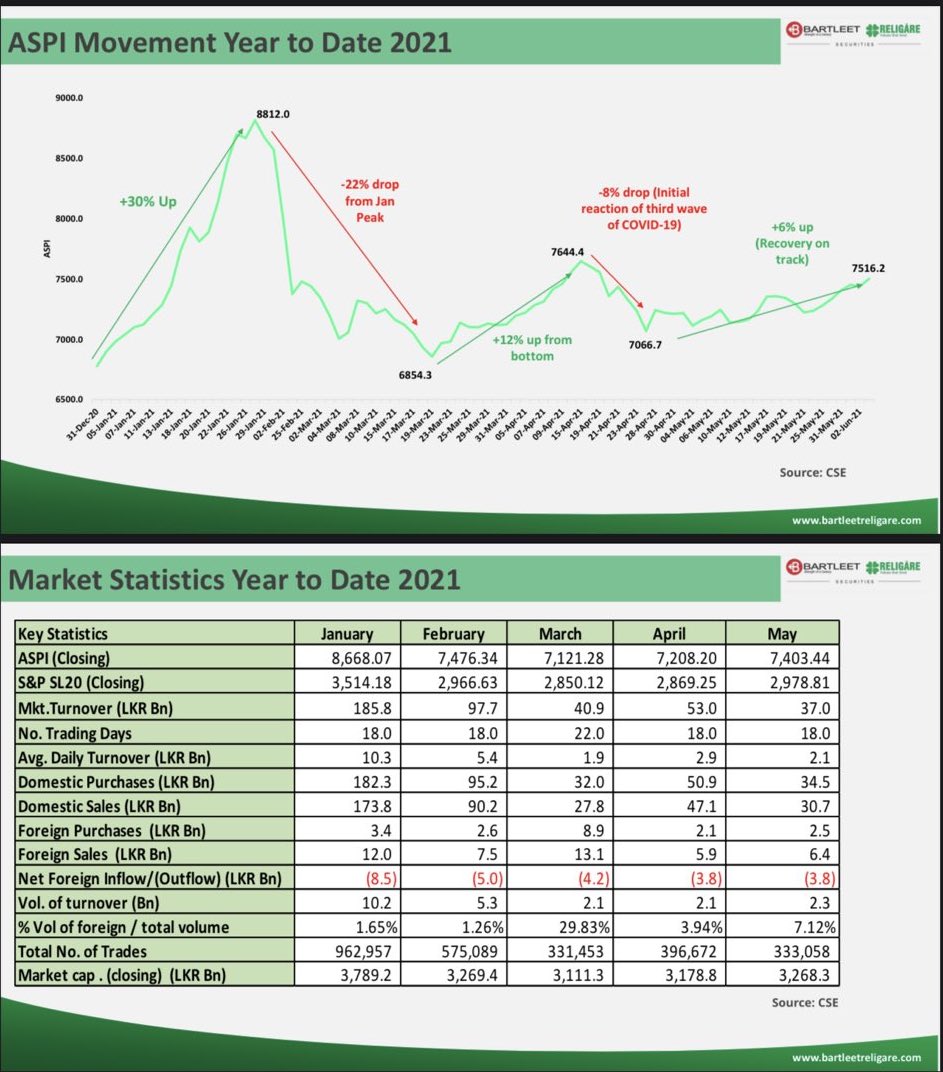

I am pointing out the positives that will drive CSE to the next levels. I gave a prediction with 31 points in October ‘20 when ASPI was 6,000 that it will hit 10,000 by December 2021. By end-January it touched 9,000 and reversed due to the letter by CSE and is struggling slowly to get back there. It was a forced correction and nothing to do with fundamentals, in fact earnings have gone up tremendously and are really undervalued now.

The following events dragged the market down:

February: CSE letter

March: UNHRC resolution

April: Delay in Port City Bill

May: COVID third wave

My 30 positive pointers for take-off:

1. Interest rates very low AWPLR 5.65 Fixed deposits 5%

2. Corporate Tax rates reduced. 28 to 14 – Construction, 28 to 24 – Banks, 28 to 18 – Manufacturing, 28 to 14 – Healthcare

3. VAT rates reduced 15 to 8%. Also threshold increased.

4. Amnesty on unofficial money – to be gazetted soon.

5. Political stability with 2/3rd majority

6. Local manufacturers supported by CESS, after import restrictions, lots of companies have expanded or gone for new investments.

7. Market/business sentiments improved with above concessions.

8. Rupee depreciation. Nov. 19 – 180, Jan. 21 b - 185 – 2.7%, May 21 - 198 - 7.0%. Overall 6.6% average for 1 1/2 years. It’s good for export, remittances and tourism but bad for imports, but less imports now.

9. Business-friendly budget proposals for agriculture, livestock, pharmaceutical logistics, construction, manufacturing, IT, etc.

10. Government projects in infrastructure-road works 100k km, water projects one trillion worth, housing, BIA expansion, highways, power, etc.

11. Currently 289 ongoing projects each over 1 billion, totalling 5 trillion.

12. Port City will be a game changer/take off for FDI and Investments – road shows to follow to attract investments. $ 5 billion in next 5 years and another 10 billion 5-10 years later. It will be an international financial centre.

13. Mergers and acquisition on banks and finance companies and regional players targeting good companies through stock exchange.

14. New Listings in CSE – 200 companies by 2025. 15 companies in pipeline for 2021 with tax concessions.

15. Partial Listing of SOEs through Selendiva Investments

16. Dedicated minister in charge of capital market development.

17. Demutualisation and new SEC act will be another game changer for CSE with a possible foreign exchange partnership and listing.

18. New products to be introduced shortly to the market – REITS, Gold, Short selling and borrowing of shares, New Debt instruments and DVP.

19. Digitalisation with all E services for Account opening, Payments, IPO, Rights, Dividend, CDS and AGM. Even during lockdown all areas can function smoothly.

20. More new accounts opened, especially under 40s, education by CSE, seminars and school curriculum to promote share market opportunities.

21. Social media awareness and enthusiasm among investors.

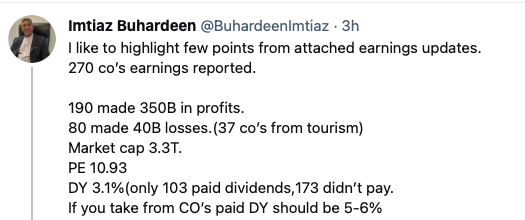

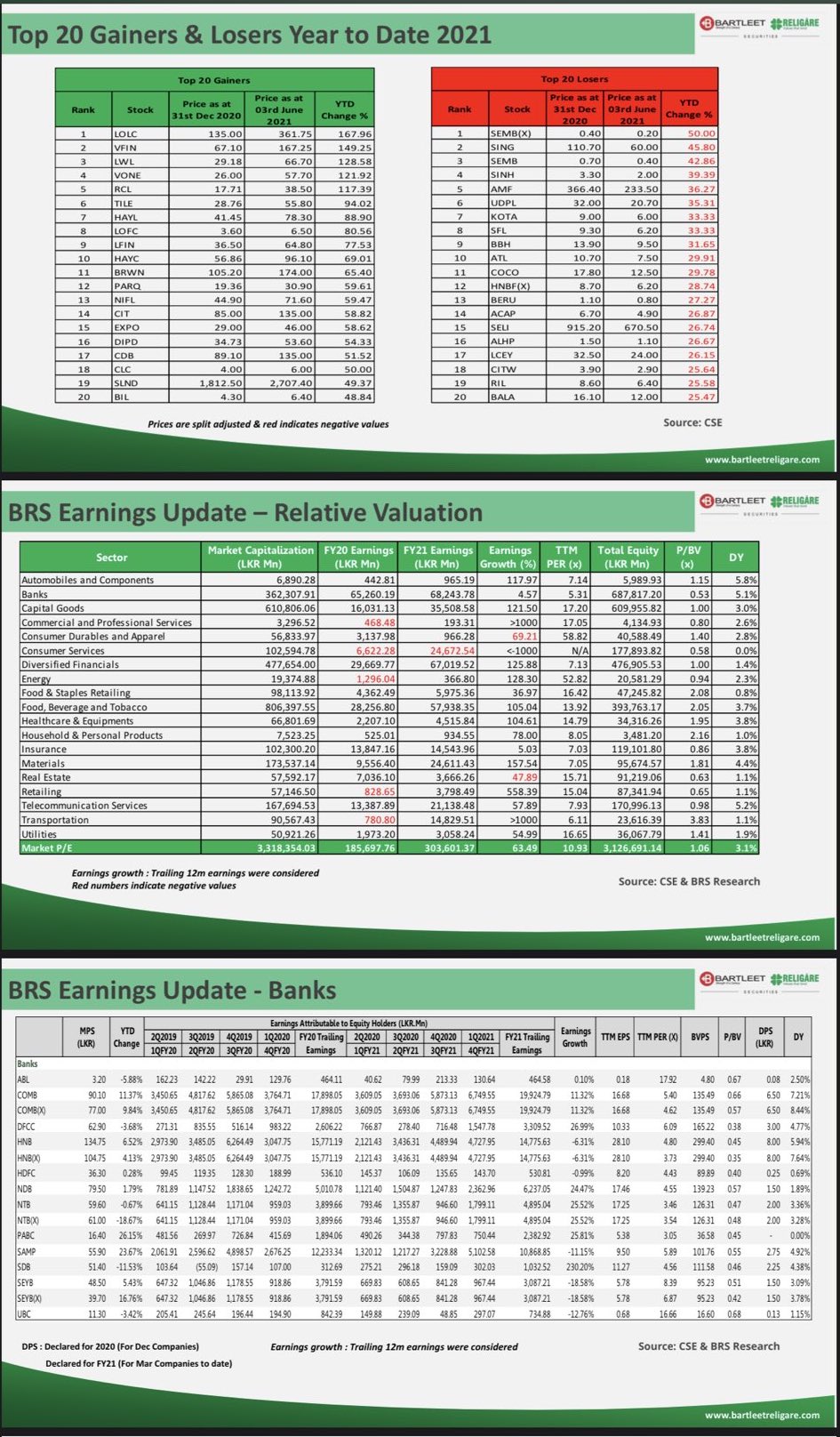

22. Valuations. Currently we are trading at 10 PE (after new results announced) December ‘20 quarter was best ever with 85 b profits, March ‘21 results just coming in has already surpassed December results, we will easily exceed 100 b profits for the quarter, after providing for losses mainly from the tourism sector. If we achieve 350-400 b for a year at a PE of 15 our market cap should be 5-6 trillion; that’s almost double from now. Dividend yield of 2.5-3% means 85-100 billion is paid out from profit-making companies alone. While Singapore PE at 38, India at 31 and Malaysia at 27. At peak in 2011 we were at 29.5.

23. ASPI reached its peak in February 2011, was 7,800 then in January 2021 it broke and went to 9,000. Compared to 2011 and currently, ASPI 7,800-7,300 down 6.4%, Nifty 4,600-15,500 up 237%, Dow 12,000-34,500 up 187%. Most of the other markets also experienced similar growth. Above India and USA had the highest COVID numbers and currently market at record levels. We have not moved only backwards.

24. Stock market cap to GDP we are at only 20% whereas USA at 200; According to Warren Buffet indicator less than 75 is really undervalued. Maybe our stock market is not properly reflected in the economy.

25. Turnover has increased from 1.8 b in 2020 to 4.5 b in 2021, so far, we have surpassed 2020 t/o already. Market cap at 3.3 trillion. CDS accounts 700 k.

26. Total fixed deposits in banks is around 10 trillion earning less than 5% now. Even if 10% is withdrawn and comes to CSE 1 trillion that’s quite a significant amount and more can come in the future.

27. EPF fund is 3 trillion. In this low interest environment 30-40% can come to Equity. At least another 10% comes 300 b.

28. Foreigners have been nett sellers even if you take the last 10 years 820 b buying against 897 b selling, Nett 77 b outflow for last 10 years (2020 and 2021 – 75 b outflow).

29. Without EPF and foreigners we have increased turnover levels and had a reasonable rally, once both and more FD conversion to Equity comes in, we can enjoy a good rally and a more liquid market.

30. COVID is only drag currently, that too with travel restrictions and vaccines to be given, hopefully will be brought under control. Most of the European countries and USA have controlled and vaccination given to more than 35%. Next Asia will follow with improvements.

My targets with above facts:

1. Expect turnover per day 5-10 b by 2022 and 25 b by 2025.

2. Further 1 m new accounts by 2025 (20% of 5 m employed private and public sector)

3. Market cap 5-6 trillion by 2022 and 25 t by 2025.

4. ASPI 10,000 by 31/12/21; 12,500 by 31/5/22; 15,000 by 31/12/22; 30,000 by 31/12/25

(The writer is a high net worth individual and long-term investor in the Colombo stock market.)

https://www.ft.lk/columns/My-take-on-the-market-for-2021-and-beyond/4-718573

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home