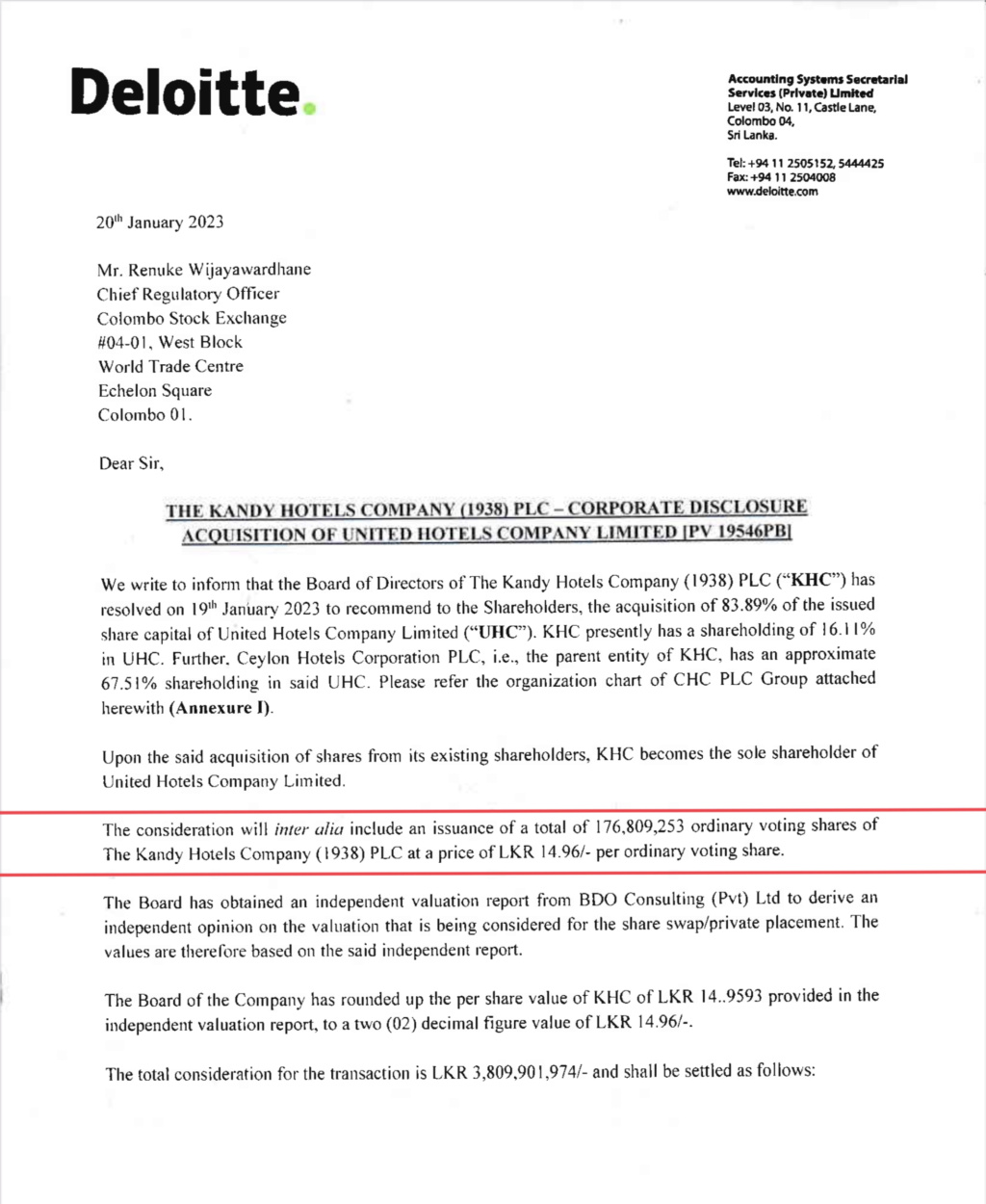

:small_red_triangle: KHC listed the following benefits to existing shareholders following the transaction.

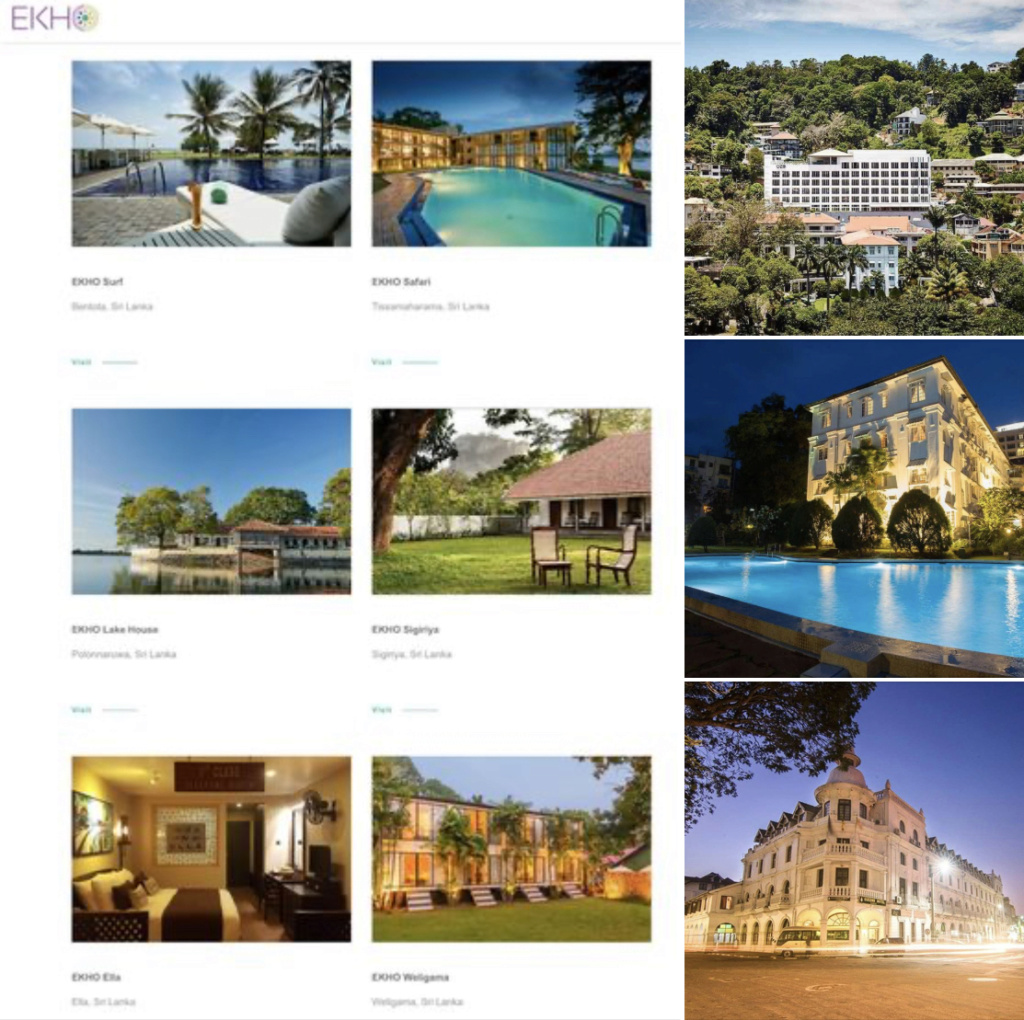

1. With the acquisition of the diversified hotel portfolio of UHC (and its subsidiaries) consisting of the Ekho Surf Hotel Bentota, Ekho Safari Hotel Tissamaharama, The Lake Hotel and the iconic Lake House in Polonnaruwa, KHC will enhance its tourism footprint across key tourist locations, which can cater to a wide variety of clientele

2. Provide the opportunity of a higher earnings base from the combined properties

3. Facilitate access to the significant cash reserves of UHC Group, which are primarily derived from the disposal of the investment in the Maldives as per market announcements made previously by the Parent Company (CHC PLC) that would be available for future investment purposes and or to strengthen the combined balance sheet

4. Create economies of scale and greater synergies by combining common resources, including access to the significant cash pool for future development of the properties

5. Create a much larger and a stronger balance sheet with a combined post restructure Net Asset Value of over Rs. 11 billion, based on the independent valuation report of BDO Consulting Ltd.

6. Streamline the Group structure and make its market attractive by bringing together the key hotel properties of CHC PLC Group under a single umbrella within KHC, post-acquisition

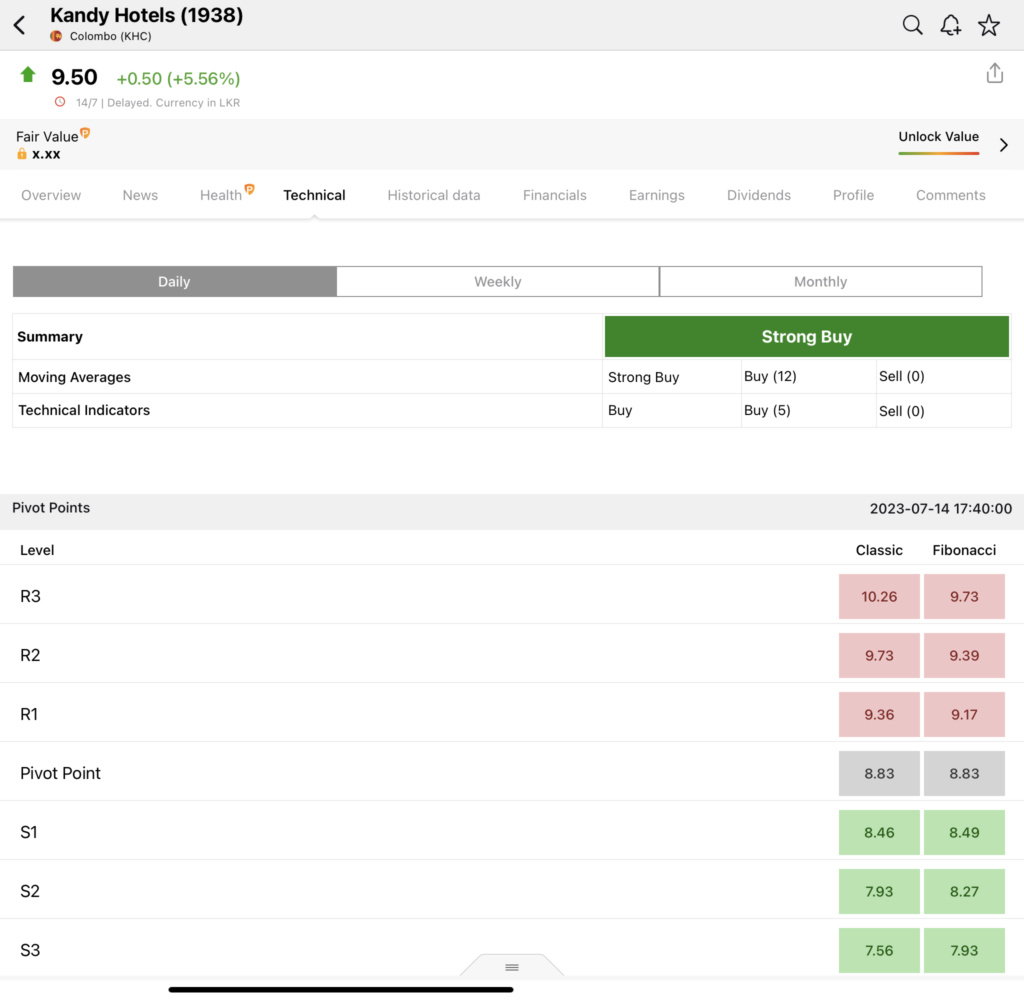

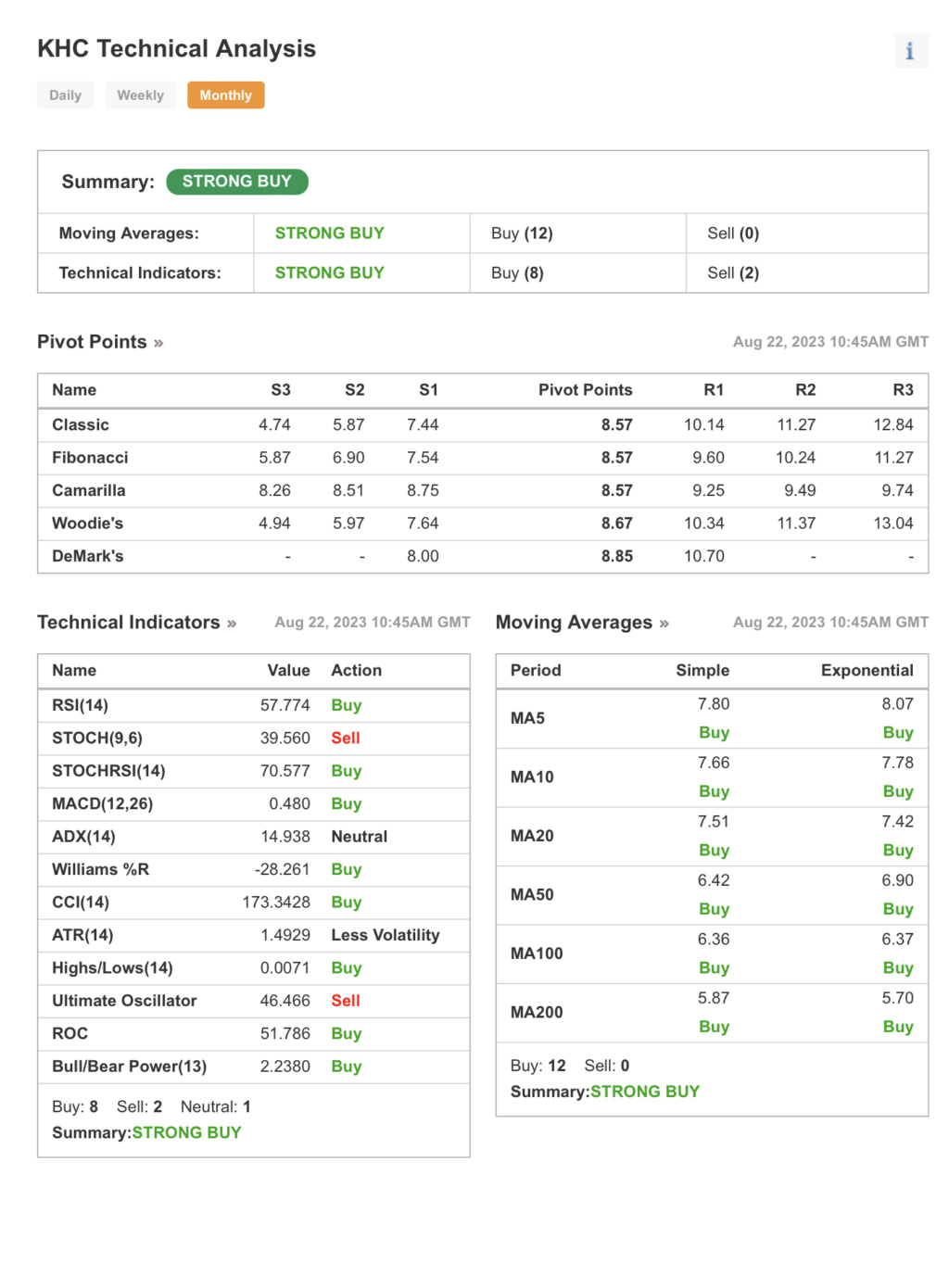

7. Provide an opportunity for KHC to seek an upward re-rating of the valuations of KHC

KHC also said the management plans to take necessary steps to increase the public float which will be below 20% post swap within the stipulated time frame.

https://www.ft.lk/business/Kandy-Hotels-to-become-sole-shareholder-of-United-Hotels-via-Rs-3-8-b-worth-share-swap/34-744869

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

One of the most unnoticed hotel chains in CSE

One of the most unnoticed hotel chains in CSE

EKHO Ella - 14 rooms

EKHO Ella - 14 rooms