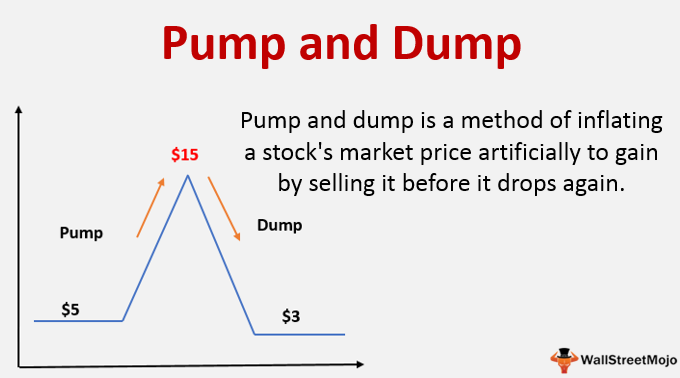

Pump and dump is a term referred to an investment scheme which attempts to boost the price of a company’s stock through false and misleading promotions or highly exaggerated statements. As long as there have been stocks, there have been stock fraudsters who seek to inflate the price of stocks. Usually the con artist is a third party person who is not in any relation to the company about to be scammed. The only In most cases the company itself is clueless that it is part of a scam. It’s chosen because its stock is selling for pennies a share, making it easy for the scammer to acquire a huge number of shares with a minimal investment. Due to the small float of these types of stocks it does not take a lot of new buyers to push a stock higher. Often the promoters will claim to have inside information about an impending development or to use a great combination of economic and stock market indicators to pick stocks. In reality, they are only thieves who will earn a quick profit by gaining lots of investors. Once the price is high enough they sell their shares and stop inflating and promoting the stock which ultimately ends with a sharp fall in prices and thus investors lose their money. Similar but inverse scam is Short and Distort.

HOW PUMP AND DUMP SCAM WORKS

a) You need a worthless stock, with a tight float and which is thinly traded. Small companies are needed as a precondition. Tight float means that most of the stocks are held by insiders and promoters and not by the general public. The reason for this is that it is much easier to manipulate the price of the stock when there are fewer stocks held by the general public since fewer buying of stock is needed to increase the price. You now buy an otherwise worthless stock at low prices. This sets the stage for to make money when the stock price elevates.

b) You start a promotional campaign to create interest in the stock. You use advertising campaigns, cold calls, newsletters, newsgroups, message boards, chat rooms, emails, seminars and any other media to promote the stock. Information used to promote the stock is said to be a rumor, inside information or your unbeatable technical and economical analysis. Investors are being enticed with visions of making the big score, quickly and without much risk. Your promotions will make investors swim in the water of excitement. Essentially, you are playing on the investors strings of greed to try to make the investors feel that he can’t miss the next great investment play.

c) You now attempt to increase the price of a stock. The stock chosen is thinly traded, so you and insiders can quietly raise the price by buying up the stock. Instead of putting bid offers at lower prices, they take the ask bids out and go up the price ladder. Since there is little public float, it doesn’t take a lot of buying to get the price up.

d) You have increased the price of a stock and now dump it at a higher level. You leave with a high profit, while other investors face a sharp ride to the south.

Source: http://www.bustathief.com

Please read the following ling

http://forum.srilankaequity.com/t14251-short-and-distort-naked-short#92022

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home