Quarter EPS = 88.80

Annualised EPS = 222.60

Current Market price = 3000.00

Current PER = 3000.00/222.60 = 13.48

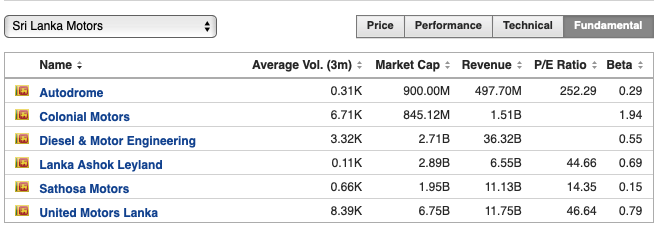

We have seen mega growth on motor sectos UML, COLO, AUTO, SMOT. I am expecting an extra ordinary result from DIMO. I hope it will touch 2000 soon. UML also looks attractive at current market price.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

Motor.xlsx

Motor.xlsx