Hopefully this will save a lot of time for you.

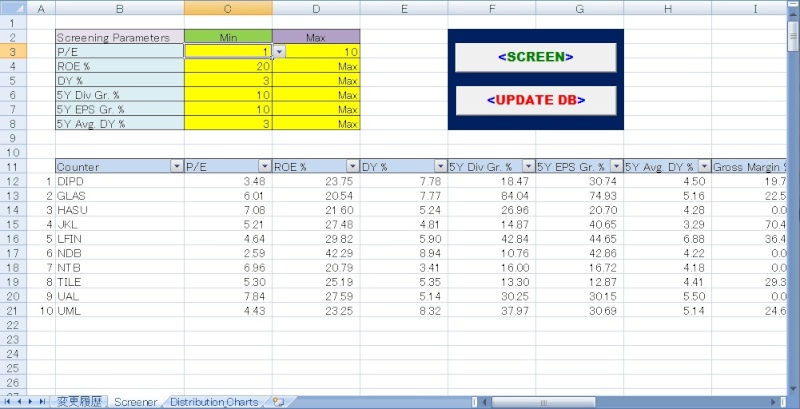

1. P/E Ratio

2. Return On Equity (ROE)

3. Current Dividend Yield

4. Five Year Dividend Growth Rate

5. Five Year EPS Growth Rate

6. Five Year Average Dividend Yield

All you have to do is select the preferred Minimum and Maximum values(YellowCells)

and click on "SCREEN" button.

For example if you want to search for all companies which have,

1)P/E less than 10

2)ROE greater than 20%

3)Current DY greater than 3%

4)Five year dividend growth rate greater than 10%

5)Five year EPS growth rate greater than 10%

6)Five year average dividend yield greater than 3%

Following will be your inputs and screen results.

As you can see above, there are 10 counters which matches your search criteria.

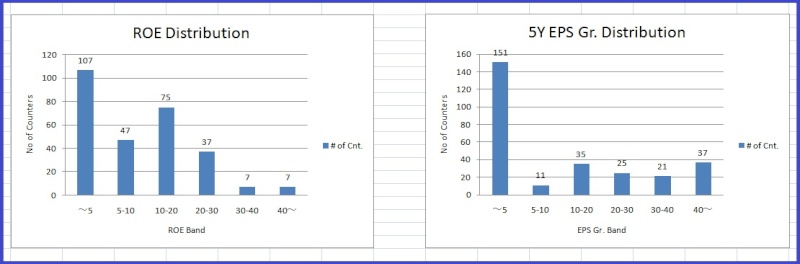

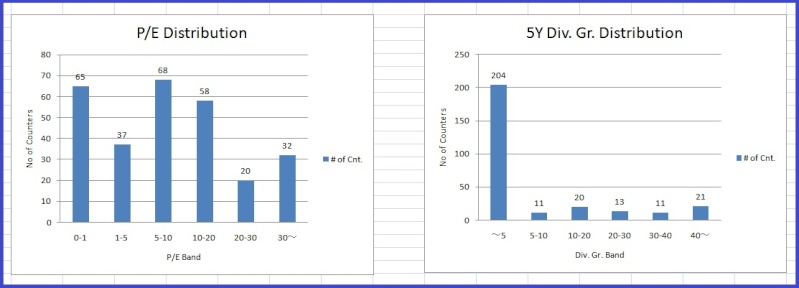

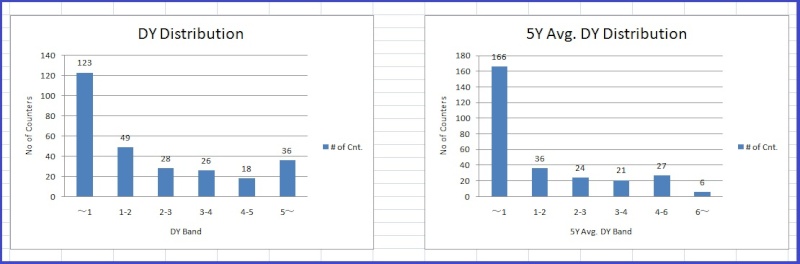

Also it is worth to look at the distribution charts of Screening Parameters.

This will give you the big picture of Colombo Stock Exchange.

Graphs are on "Distribution Charts" sheet.

There are,

・58 counters with five year EPS growth of more than 30%

・51 counters with ROE higher than 20%

・37 counters which are trading P/E below 5

・36 counters which yielded over 5% dividend

・33 counters which paid over 4% dividend for last 5 years

・32 counters with five year dividend growth of more than 30%

Download the tool here

http://www.mediafire.com/view/prbkigussekmvpy/CSE_Screener_1_4_0.xlsm

Note : You should enable Macro and Data Connection from Excel Trust Center for this to work.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home