Written below are general themes from conversations with people in the industry:

The industry is happy to see movement by the Stock Exchange and SEC on certain issues. Preparation on the Multi-Currency Board4 and a Clearing House5 are very welcome. Attempts on the Empower Board6 though well-intentioned must be amended in order to be made successful. The capital market has potential. The small liberal island nation is well placed to be a central point to handle investment for the broader SAARC region.

Banks and other financial service providers make a lot of money by processing payment and handling investment. If India were to reach China’s rate of payments proportional to GDP, Sri Lanka could adopt a financial infrastructure similar to that of Hong Kong. Hong Kong’s GDP is comprised of 17.6% financial services and insurance8. Hong Kong benefits from handling financial services of wealthy Chinese businessmen/politicians. Property sales are also big business. These are all large value payments.

India has already taken steps through demonetisation9 and unification of its payments infrastructure10 to improve usage of its formal payments system. One should look to help the movement of Indian funds in and out of Sri Lanka. Regardless, moving Indian held funds in Singapore and Dubai to Sri Lanka is also a possibility. It is a shorter flight and India will prefer a nation with a high propensity to import Indian goods to accrue wealth.

Put in other words; India has a lot of black (illicit), grey (taxes evaded), and offshore wealth. The top one percent of Indians hold more than half of all Indian wealth11. This wealth, however, lies in hard assets (tangible) like property and gold within India or in offshore havens. More sophisticated instrumentation would have better returns12. Sri Lanka through a better capital market and a well-drafted trade agreement with India is well placed to manage this wealth.

This story has become engrained in Colombo circles. What is good for the Port City will be good for Colombo. Given this will the Colombo Stock Exchange survive? It is debatable of whether an investment in excess of a billion dollars in infrastructure will choose to improve or wipe out and replace the current exchange? After all, whatever survives will be referred to as the Colombo Stock Exchange.

Cussedness: The case for replacement

- Small failures

The Stock Exchange tries to be too exclusive. Instead of having multiple boards and making room for a myriad of companies, the exchange has a myriad of rules for maintaining a listing on one of two boards. This exclusivity, however, has not translated to respectable listings. Many listed entities are highly interconnected with other listed entities. Failures of listed companies have been spectacular. If you want to empower companies just create a less restrictive board (the Empower Board) that companies can remain on indefinitely. Let investors be concerned with where they place their money.

With regard to the Multi-Currency Board,12 the industry was hoping that all listed firms by default would be listed in multiple currencies. This would allow for shares in the hotel sector, for example, to be priced in the same currency as their respective revenues. Also under the Foreign Exchange Act, Sri Lankans can invest overseas13 allowing them to legally purchase foreign firms that have been listed in Sri Lanka. Sri Lankans citizens are also allowed to hold foreign currency which they should be able to use to purchase local stocks.

- Moderate failures

The Chairman of the Stock Exchange was recently quoted as saying, “We believe the market liquidity has to improve before we bring in derivatives.”

This as many would know is just an excuse. Most diversified holdings have employee share option schemes. Many such options go underutilised as employees lack the funds to exercise their rights. Both investors and employees would like to trade in said options. This lack of instrumentation made available by the exchange in spite of a clear underlying forward contract within Sri Lankan law is an affront to market stakeholders.

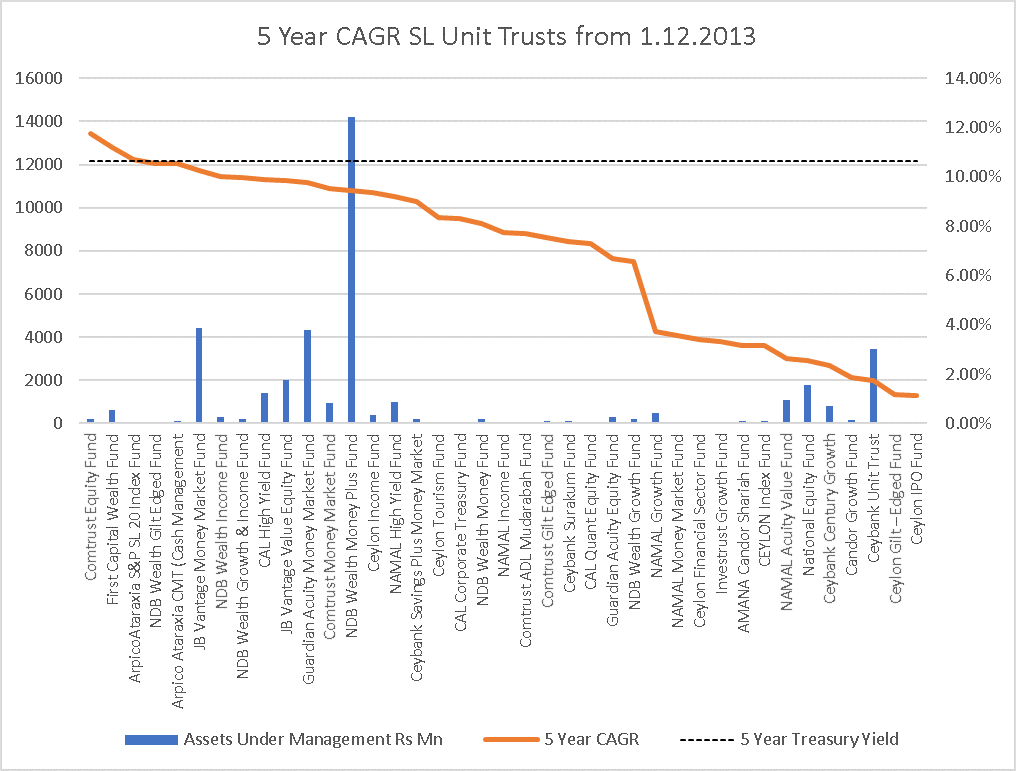

Table 2 shows the 5 Year CAGR of Sri Lanka’s Unit Trusts.14 Though missing many funds without a five-year history the graph shows that most unit trusts have failed to beat the risk free rate on the same time horizon. It also illustrates that there is a problem of distribution of funds. Most funds are in money market products and not in the most profitable products.

Digitization and centralisation are low. Unit trusts maintain their own registries as opposed to it being maintained by the Central Depository System. Registration and interaction with the unit trusts are not through a portal. There exists little-standardized information to allow the comparison of unit trusts. All this discourages people not interested in capital markets from investing.

A free online CDS portal is called for. Shareholders should be able to vote on their company’s resolutions and provide instructions on share buybacks and the like. Unit trusts on the Stock Exchange should be accessible through a central portal allowing users to provide instructions to subscribe and redeem units. Users with multiple CDS accounts should receive one compiled document with all their respective share and unit trust holdings.

- Major failures

Footnotes

- http://www.ft.lk/front-page/REITS-finally-coming-/44-670924

- http://www.ft.lk/front-page/CSE-to-conduct-two-roadshows-in-1H/44-670923

- http://www.ft.lk/top-story/CSE-expresses-optimism-amidst-headwinds/26-670922

- http://www.ft.lk/front-page/CSE-amends-listing--rules-to-make-Multi-Currency-Board-a-reality/44-670386

- http://www.ft.lk/financial-services/China-Securities-Depository-and-Clearing-Corporation-and-CDS--Sri-Lanka-to-pursue-mutual-development/42-669324

- https://www.cse.lk/home/empowerBoard

- https://www.bis.org/speeches/sp181115.pdf

- https://www.censtatd.gov.hk/hkstat/sub/sp80.jsp?tableID=189&ID=0&productType=8

- https://www.ft.com/content/e52dab06-b093-11e6-a37c-f4a01f1b0fa1

- https://www.thehindu.com/business/Economy/What-is-Unified-Payment-Interface/article14593189.ece

- https://www.ndtv.com/business/indias-richest-1-hold-more-than-half-of-national-wealth-oxfam-1980979

- http://fortune.com/longform/equities-stock-market-performance/

- http://www.sundayobserver.lk/2018/07/08/business/sme-board-vital-tool-complement-%E2%80%98enterprise-sri-lanka%E2%80%99-says-mangala

- http://www.dailymirror.lk/article/CSE-amends-Listing-Rules-to-facilitate-secondary-listing-of-foreign-firms--160782.html

- http://www.dfe.lk/web/images/rdevelopment/4ff92b8ebb6bda51cff8bd7e63b2621c-2063-12-E.pdf

- http://utasl.lk/wp-content/uploads/2018/12/Performance-2018-11.pdf

Read at WrongLK or Daily FT or LankaBusiness Online

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home