Accordingly,

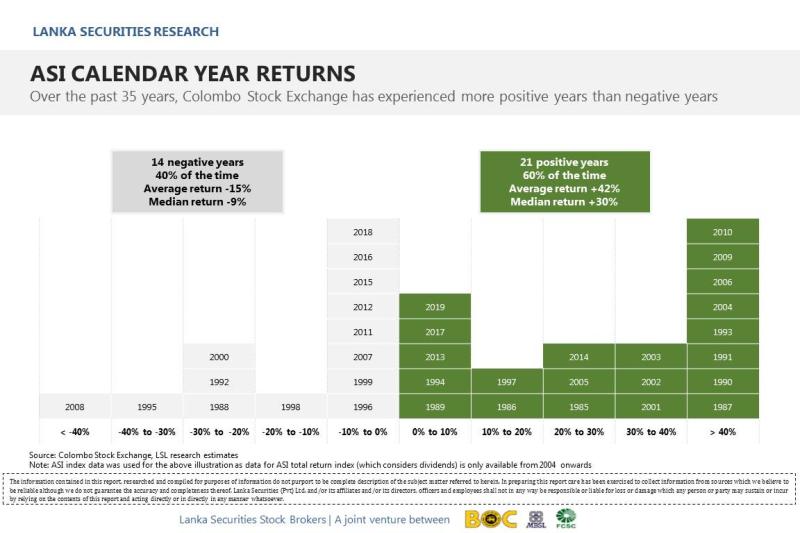

- The stock market has experienced more positive years than negative years

- For the past 35 years, the index posted positive calendar year returns 60% of the time and negative calendar returns 40% of the time

- The worst calendar year return was -41% posted in 2008, during the global financial crisis and at the height of the war. The best return was 125% posted in 2009 at the end of the war

- Regardless of the bad press on the stock market, #listed #equities have delivered #wealth for its participants over time. ASI has posted an average calendar year return of 42% over the positive years and -15% over the negative years

As data indicates, the pattern of #returns differs over the years. Thus anyone who chooses to #invest in listed equities, should learn to accept the negative years. You need courage and patience to stay invested through #bearmarket since no one can consistently time the market to get in and out and skip down years.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home