At this moment we are experiencing a downturn in the CSE and ppl are tend to go for panic selling though can observe some collecting at low. so actually it seems like bearish condition ,just check with the following chart patterns with the trend ASI had

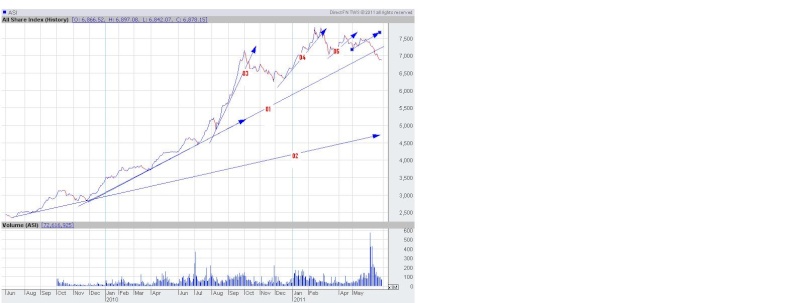

ASI up trends for two year period on daily basis

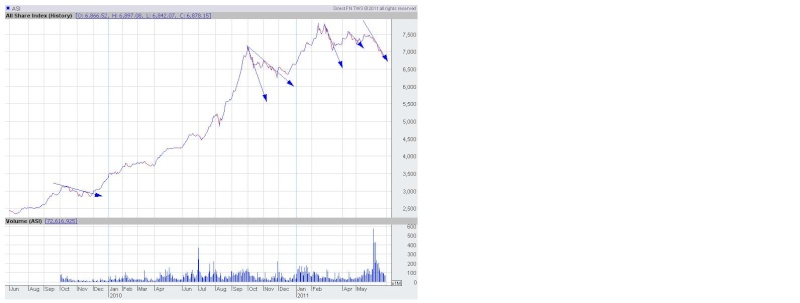

ASI down trends for the period of two years on daily basis

It seems when ever a trend line is penetrated up or down there is a further continuation of the trend ,

see how the ASI changed when the down turn was reversed

And according to the under shown graph if we identify a main trend ,now ASI is reaching back towards the trend line which may go beyond the trend line if ASI hit 6750 nearly,

And ljust have a look at the resistance levels and supports

It seems that ASI is having a resistance at 7500 , can be seen as it has reached double top

and had a support at 7000 , but it was broken and is tend to go down further and seems having some support at 6800 and 6600

when we examine the most resent downtrend we can observe a slight deviation from the down trend and this may be a time starting up an upward trend which may lead to the previous resistance level hitting tripple top.

if the resistance get broken ASI can reach for a higher support level.

And when we observe the current market there were several issues which effected badly on market mostly

IPOs , Introductions, credit clearance , forced selling , panic selling ,and also massive manipulative rallies . these ralllies may lead mentality to dump shares at low profit and to catch the flying rockets,

according to the following observations i do think that there is a high potential to ASI to be green , and there should be a support from volumes too. But thing i am not sure is why the brokers get too worried about their provided credit ?? are they looking ahead of further downturn .. not sure

So i d like to have your valuable comments regarding this , i am not and expert and my profilo is also red , and this moment i m not willing to do any trading only looking forward to cut my losses as soon as possiblle until then i m thinking of creating a new profilo with sound shares which can gv profits even in a downturn..

so this is open for discussion if there are any thing wrong i ll be willingly looking forward to correct , and if some one is to give negatives plz tell me why then i can correct my beliefs. .

Thanks in advance

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home