Look at the math re. Sri Lanka's Debt Dynamic:

Sri Lanka is a USD 85 billion economy. The economy will generate Forex Inflows of around USD 32 billion in 2021, and possibly about USD 2 -3 billion more than that amount, each year, every year, thereafter.

As of now (February 2021), the total ISBs outstanding is USD 14 billion, which is only 16.7% of Sri Lanka's total debt. None of the other Creditors who hold 83.3% of Sri Lanka's Debt seem to show any sign of concern or stress about it's repayment ability.

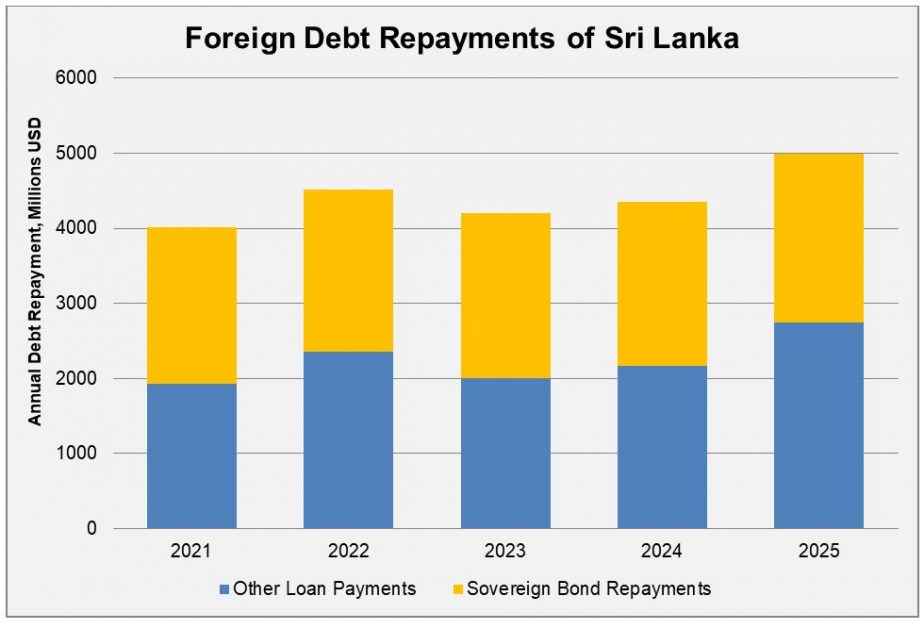

Sri Lanka has to re-pay only around USD 1.0 to 1.5 billion each year until 2029 in it's ISB amortizations for the next 8 years.

In that background, will the authorities be so foolish as to default on a payment of around USD 1.0 to 1.5 billion per annum and risk it's entire economy and impeccable credit history?

In 2014 (GDP - USD 79 billion), the amount of ISBs outstanding was USD 5.0 billion, the interest cost was USD 285 million and the average interest rate was 5.4%. The Rupee was at 131 to the USD.

By 2019 (GDP - USD 83 billion), the Yahapalanaya Osthars had borrowed until the total ISBs outstanding had reached USD 15 billion, and the interest servicing had risen up to USD 1.1 billion at an average interest rate of 7.4%, and the Rupee at 183 per USD.

That's the challenge that we are sorting out.

The same chaps who caused this are now hoping that we will fail, and trying very hard to take the country towards an economic crisis.

But this time too, like in 2007 to 2009, they will be disappointed!

Last edited by CHRONICLE™ on Sun Feb 21, 2021 9:34 pm; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home