Sri Lanka Bonds Go From Asia’s Worst to Best After China Loan

By Karl Lester M Yap

14 May 2021, 03:30 GMT+5:30

Nation’s dollar bonds rallied 15% this quarter, best in Asia

China signed swap agreement with Sri Lanka: March statement

Sri Lankan government debt is leading gains in Asian dollar bonds this year as investors bet that the nation will avoid defaulting on its short-term notes, with the help of a Chinese funding facility.

Italian investment manager AcomeA SGR S.p.A., which added to its holdings of the nation’s debt securities last quarter, sees the bonds as continuing to offer attractive yields, even if most of the gains have already been made.

The Sri Lankan notes have returned 15% this quarter, extending year-to-date gains to 25%, the best performance for any Asian nation’s U.S. currency debt in 2021, a Bloomberg Barclays index shows. They lost 31% last year, the worst showing in the region.

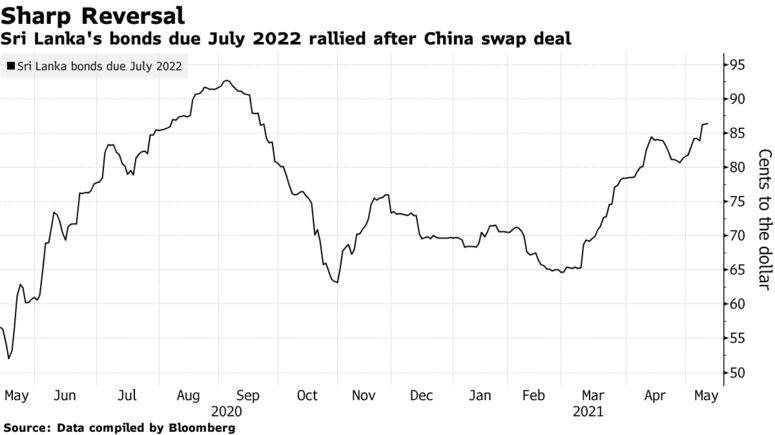

Sri Lanka's bonds due July 2022 rallied after China swap deal

Sri Lanka received a $1.5 billion currency swap line from China in March that eased fears over the government’s ability to pay its debt after having been cut deeper into junk in 2020 by S&P Global Ratings and Moody’s Investors Service. The nation, which is struggling with a resurgence in Covid-19 cases that threatens its tourism industry, has at least $2.5 billion of dollar notes maturing before the end of July 2022, including a $1 billion bond due in a little over two months.

The yield on that debt security is indicated around 16%, while a July 2022 note offers 20%, according to data compiled by Bloomberg.

“Given the latest improvement in the short-term liquidity conditions, we prefer to hold the shorter-end tenors,” said Piero Cingari, fixed-income strategist in Milan, who helps manage 2.9 billion euros ($3.5 billion) of assets at AcomeA.

— With assistance by Anusha Ondaatjie

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home