- Cabinet approves conditional approval for non-financial companies to raise funds overseas to invest in SL International Sovereign Bonds and SL Development Bonds

- CSE-quoted companies to be allowed to list shares and debentures in foreign exchange to raise funds

- Monetary Board approves twin moves as they will increase interest of foreign investors in SL listed companies, attract foreign currency into country, and reduce pressure on rupee

- Import restrictions of non-essential products extended by 6 months from July

- Cabinet nod for multiple moves on same day

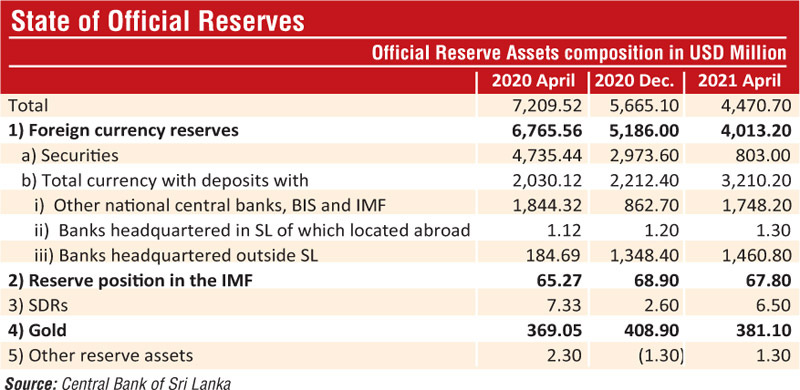

- CB Governor calls for calm and avoidance of undue speculation over country’s foreign reserves and debt servicing challenge

On the same day the Central Bank urged for calm and the avoidance of undue speculation over the country’s financial capacity and debt servicing challenge, the Government on Monday decided on several far-reaching measures to shore up foreign exchange reserves and curb outflows.

At their meeting on Monday, the Cabinet of Ministers agreed on several innovative non-debt creating measures to woo more foreign investments and funds.

One measure was allowing companies incorporated in Sri Lanka to invest in the Government’s International Sovereign Bonds (ISBs) and facilitate local listed companies to raise foreign funds. To stem the outflow of foreign exchange, the Government extended the ban on import of non-essential products by a further six months from July 2021.

The Government said some licensed commercial banks and registered companies in Sri Lanka had expressed interest in obtaining overseas loans to invest in Sri Lankan Government ISBs.

“Taking into account the overall benefits available to the country, the Monetary Board of the Central Bank of Sri Lanka has agreed to allow licensed commercial banks, National Savings Banks and appropriate non-finance companies registered under the Companies Act No. 7 of 2007, to purchase ISBs and Sri Lanka Development Bonds, subject to certain conditions,” a Government statement said yesterday.

Accordingly, the Cabinet of Ministers on Monday approved the proposal presented by the Prime Minister in his capacity as the Minister of Finance, and to submit such orders to Parliament for approval.

With regard to facilitating local companies to raise foreign funds, the Government said the Colombo Stock Exchange had submitted a proposal to list foreign currency denominated shares issued by Sri Lankan registered companies on the CSE, with the aim of increasing the ability of local companies to raise foreign funds in Sri Lanka.

The Government said that at present, the Foreign Exchange Orders No. 2 of 2021 does not permit to be debited to the Business Foreign Currency Account the issuance of debentures or initial shares issued in foreign currency or the payment of dividends or the payments received by distributing of foreign currency.

The Monetary Board had recommended the implementation of the proposal submitted by the CSE considering several factors, such as increasing the interest of foreign investors in Sri Lankan listed companies, attracting foreign currency into the country and increasing its participation, reducing the pressure on the Sri Lankan rupee, and making an alternative instead of Lankan companies going to foreign stock markets for funds.

In view of this Cabinet this week also approved the proposal tabled by the Prime Minister as the Minister of Finance to issue an order under Section 7 (1) of the Foreign Exchange Act No. 12 of 2017 amending the present Order No. 2 of 2021, to make the necessary provisions for the implementation of this proposal and to submit that order to Parliament for approval.

Commenting on the need to continue with import restrictions on non-essential items, the Government said the Central Bank had advised the same so as to minimise the potential risk in the foreign exchange market, as well as maintain stability in the financial system.

The Government first imposed the ban in March last year taking into account the possible negative impact on the country’s foreign reserves and foreign exchange market due to the COVID-19 pandemic. The restrictions were to expire on 1 July 2021. The extension was also approved by Cabinet this week.

On Monday, Central Bank Governor Prof. W.D. Lakshman said that to enable Sri Lanka to successfully service its foreign debt commitment amidst reduced foreign currency inflows and the COVID-19 pandemic, the Government rationalised selected non-essential imports.

“Some of these restrictions have been gradually removed, although the Central Bank is of the view that there is further space to curtail non-essential and non-urgent imports, given the continued challenges emanating from multiple waves of COVID-19,” the Governor said.

He also noted that via these measures the Government and the Central Bank had ensured that trade would not be unduly disrupted, and that intermediate and capital goods imports were given priority in the process of imports.

“Total import values have remained considerably high at a monthly average of $ 1.7 billion during March, April and May 2021. High import values in these months show that importers, particularly of essential goods, have not been overly inconvenienced as the published media reports claim,” he said.

However, the CB Governor said: “I believe that it is in Sri Lanka’s best interest to address the longstanding merchandise trade gap of $ 10 billion – as it places Sri Lanka in a vulnerable position – through careful policy action.”

It was also stated that what the Central Bank is doing now with the participation of all commercial banks, is judicious management of imports and foreign reserves.

“As cash flows are poised to improve in the next few months, the Central Bank will be evaluating the national balance sheet and external macroeconomic conditions in deciding the future policy response,” Prof. Lakshman added.

https://www.ft.lk/top-story/Govt-finds-fresh-ways-to-boost-foreign-inflows/26-719830

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.