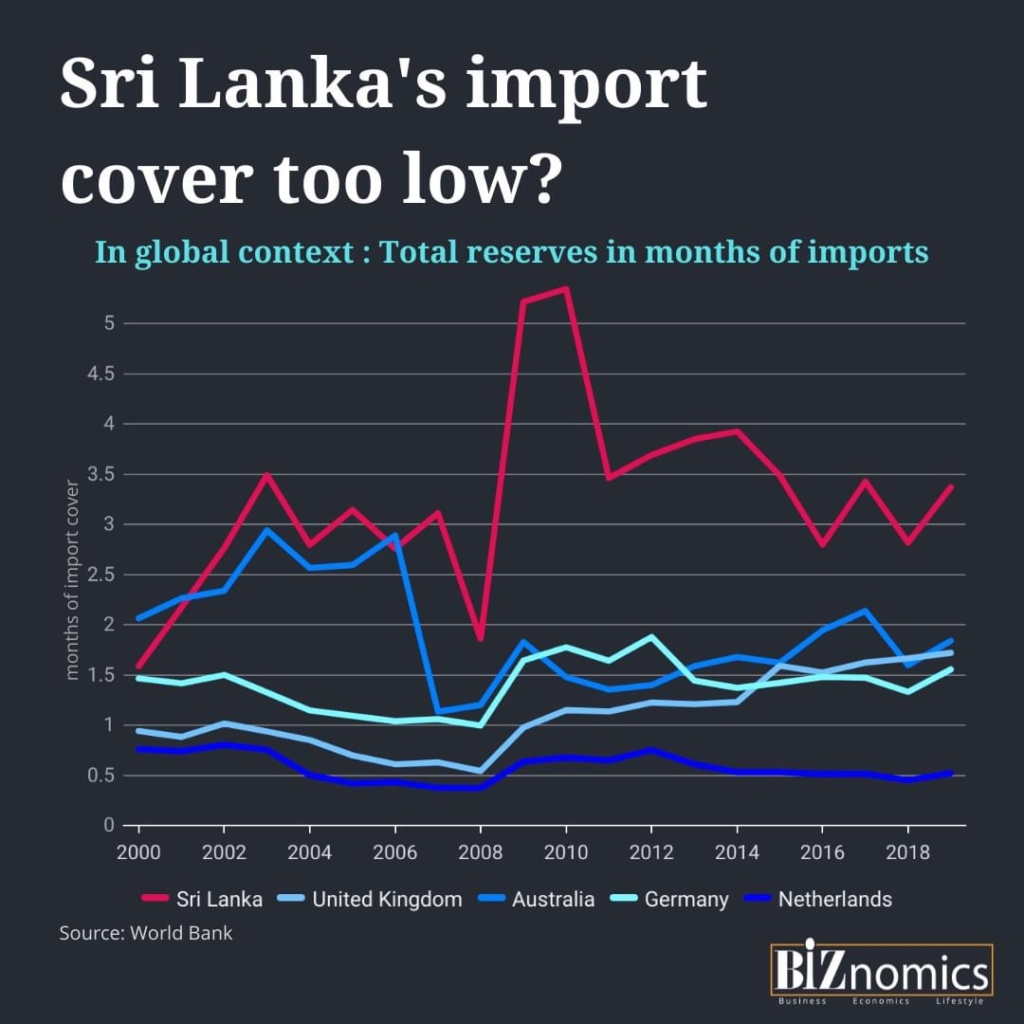

Sri Lanka Gross Official Reserve Cover for months of imports stood at 3.1 months as at April 2021. Is this too low? The media has portrayed the decline in reserves and import cover as a liquidity crisis, creating a negative image that can be very harmful to business sentiment and the economy.

The months of import cover indicates the number of months of imports that can be covered by the reserves held at the central bank. However, the central bank reserves are not directly used for the finance of imports. It is merely an indicator showing the reserves relative to imports, for the ease of comparison between countries.

When we compare Sri Lanka's import cover with developed countries such as the United Kingdom, Netherlands, Germany and Australia we observe that the island has a higher import cover. These developed countries have continued to have lower import cover than Sri Lanka for the past 10 years. It is important to understand the indicator and view it in a global context prior to making a judgment of whether it is negative or not.

#lka #reserves #srilanka #importcover #economy #srilankaeconomy #centralbank #liquidity #SLEconomy

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home