Dec 18, Colombo: The Colombo Stock Exchange (CSE) announced the changes in S&P Sri Lanka 20 index constituents made by S&P Dow Jones Indices at the 2021 year-end index rebalance.

The exclusions and inclusions as announced by S&P Dow Jones Indices, are effective from 20th December 2021.

The exclusions as announced by S&P Dow Jones Indices, effective from December 20, 2021, are Richard Pieris & Co. PLC and Brown & Company PLC, while the inclusions are Commercial Leasing and Finance PLC and LOLC Finance PLC.

The S&P SL 20 index includes the 20 largest companies, by total market capitalization, listed on the CSE that meet minimum size, liquidity and financial viability thresholds.

The constituents are weighted by float-adjusted market capitalization, subject to a single stock cap of 15%, which is employed to reduce single stock concentration.

The S&P SL 20 index has been designed in accordance with international practices and standards. All stocks are classified according to the Global Industry Classification Standard Public (GICS:registered:), which was co-developed by S&P Dow Jones Indices and MCSI and is widely used by market participants throughout the world.

To be eligible for inclusion, a stock must have a minimum float-adjusted market capitalization of 500 million Sri Lankan rupees (Rs), a six-month median daily value traded of Rs 0.25 million, and have positive net income over the 12 months prior to the rebalancing reference date.

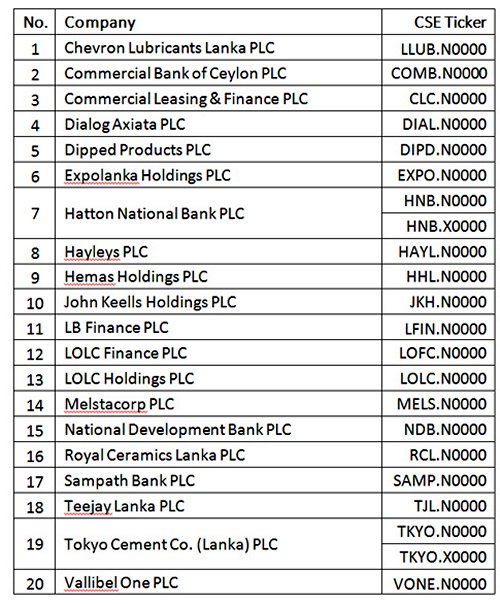

Effective from 21st December 2020 the stocks in the S&P Sri Lanka 20 in alphabetical order are as follows.

http://www.colombopage.com/archive_21B/Dec18_1639802706CH.php

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home