SRILANKAN AIRLINES :

Prime Minister Ranil Wickremesinghe said he would propose to privatize SriLankan Airlines, which is making massive losses at present.

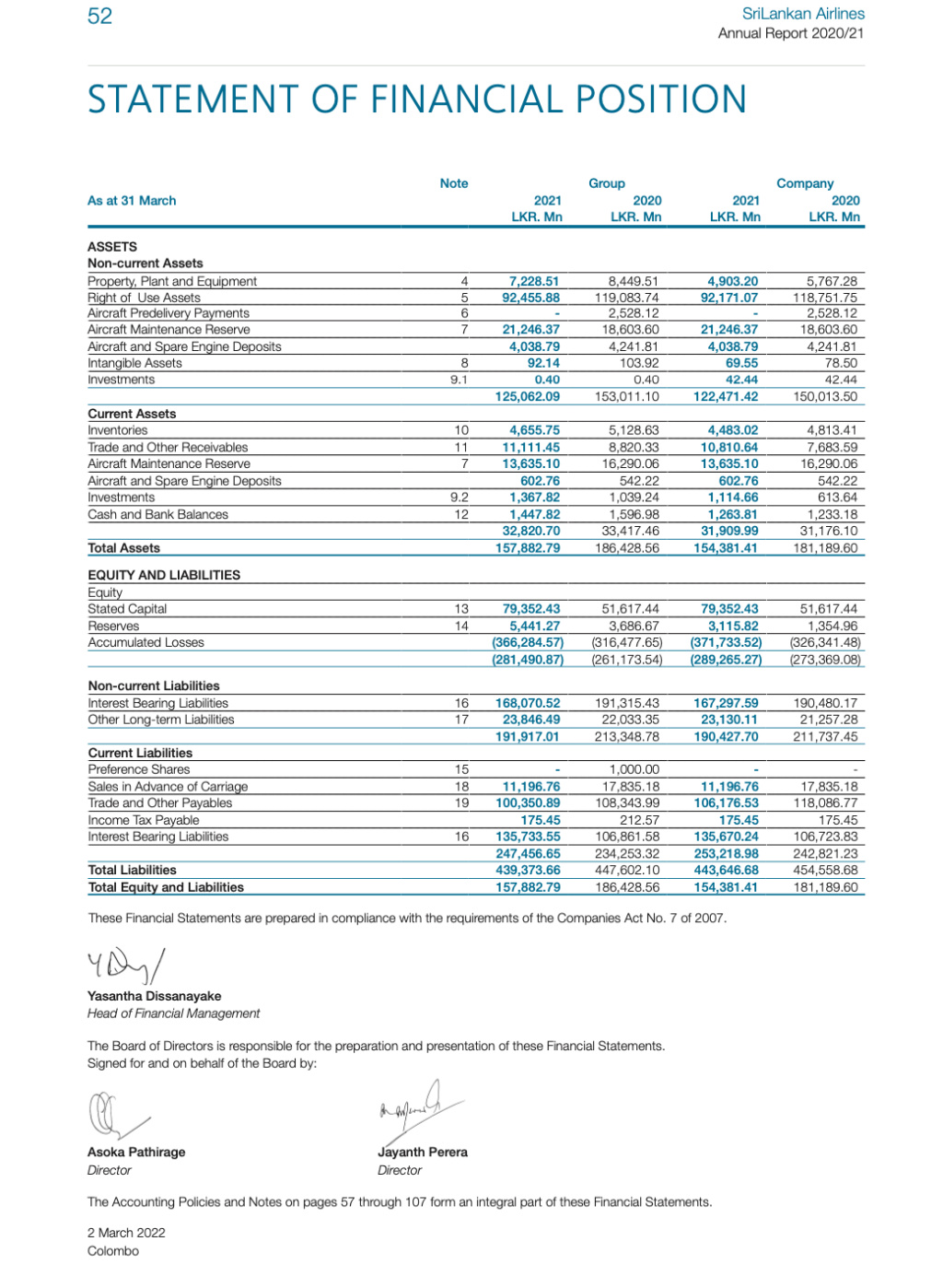

SriLankan Airlines suffered a loss of Rs. 45 Billion in 2021 alone. By March 31st, 2022, the total loss was Rs. 372 Billion.

“Even if we privatize SriLankan Airlines, we will have to incur the losses. These losses have to be borne also by the innocent people who have never stepped inside a plane,” said the Prime Minister.

https://www.newsfirst.lk/2022/05/16/video-key-takeaways-from-prime-minister-ranil-wickremesinghes-address-to-the-nation/

SriLankan Airlines flies to profitability

SriLankan Airlines yesterday announced its return to profitability, including a record high figure in over two decades at core level, boosted by higher passenger and cargo business.

The national carrier said in December it posted a Company net profit of $ 9.25 million and a Group profit of $ 10.66 million. “It was the first profitable month for the airline since the onset of the pandemic in early 2020,” the airline said.

The revenues were up by almost 200% to $ 75 million from a year earlier and reached over 80% of the pre-pandemic level. Further, the airline reported a profit of $ 11.43 million for December 2021 at air transportation level, which is the highest recorded profit from Air Transportation in over 20 years.

SriLankan Airlines Chairman Ashok Pathirage said: “The sacrifices made by all our staff members have paved the way for a positive start for the New Year. During the past two years, we implemented multifaceted initiatives to reduce operational costs, for which each and every employee of the SriLankan family contributed, and we are reaping the benefits of our efforts today.

https://www.ft.lk/top-story/SriLankan-Airlines-flies-to-profitability/26-729032

SriLankan Airlines says made profit in March 2022 quarter

ECONOMYNEXT – State-run SriLankan Airlines said it had made a profit of 1.7 million US dollars in the March 2022 quarter after cutting costs and re-negotiating contracts.

The carrier said it was the first time it had reported a March quarter profit since 2006.

“The airline was able to achieve this financial turnaround through various measures in its 2021-22 financial year including scaling down staff costs and overheads; renegotiating supplier contracts; increasing cargo revenue; and creating an ambitious growth plan capitalizing on pent-up travel demand,” the SriLankan said in a statement.

The airline said its passenger revenues had reached 75 percent of what it had in the fourth quarter of 2019-2020 after which the country closed airports due to the Coronavirus pandemic carrying 700,000 passengers.

SriLankan had carried the majority of tourists to the country.

“SriLankan is also a net foreign currency earner for the country owing to a sizeable share of its revenue being generated from international markets,” the airline said.

In December 2021 SriLankan had also made a profit bringing the total in the past four months to 12 million US dollars. The December quarter was also profitable the airline said.

The airline did not say how much it lost from March 2021 to November 2021 or the December quarter profit.

SriLankan Airlines started making losses after then-President and current Prime Minister Mahinda Rajapaksa removed Emirates Airlines as managing agent and 40 percent shareholder.

SriLankan Airlines in April had advertised for 11 wide body aircraft (A330 models/Boeing) and 10 narrow body (A320 variants or A221/Embraer models) to replace aircraft where leases were expiring and to expand the fleet.

SriLankan had leased aircraft at one time at high rates but after the pandemic prices had fallen.

SriLankan requested proposals at a time when the country was facing default due to money printed by the central bank which triggered forex shortages and sovereign default.

https://economynext.com/srilankan-airlines-says-made-profit-in-march-2022-quarter-93135/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home