The Share Issue Price for Ordinary Voting Shares will be Sri Lankan Rupees Eight (LKR 8.00) per share. The Board of Directors of Luminex is of the opinion that the Share Issue Price is fair and reasonable to the Company and to all existing shareholders of the Company.

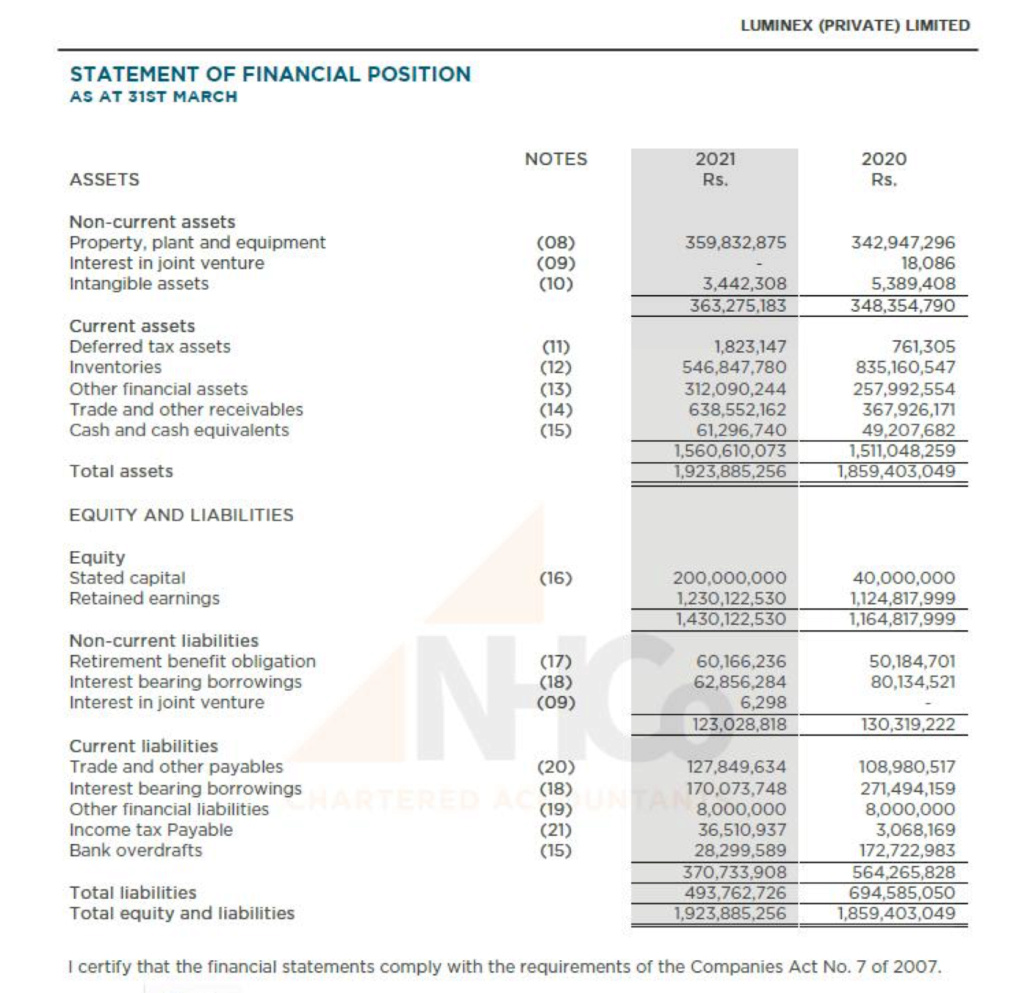

The Share Issue Price was determined by the Company in consultation with the Financial Advisors and Managers to the Issue, Navara Capital Limited, based on the Independent Valuation report prepared by BDO Consulting (Pvt.) Ltd., in line with the Rule 3.1.4c of the CSE Listing Rules. A copy of the Independent Valuation report is enclosed as Annexure II of this Prospectus. The Net Asset Value per share of the Equity (NAV) is Rs.6.86 and Offer Price is 1.16 times the NAV.

Given below is the summary of the valuation based on the methods used for the purposes of arriving at the value of the Shares as detailed in the Independent Valuation report which is enclosed as Annexure II of this Prospectus.

Applicants should read the following summary with the risk factors included under Section 09 of this Prospectus and the details of the Company and its financial statements included in this Prospectus.

As per the independent Valuation report, value range of shares of the Luminex Ltd. is between LKR 6.86 and LKR 17.51. The IPO price is at a discount of 54% based on the Price to earnings valuation method, 14% discount based on the Discounted Cash flow method and a premium of 17% based on the price to book value method.

The average price of LKR 11.22 derived from the above methods is a discount of 29% and this discount has been offered for the IPO investors to provide an upside on their investment.

Attractive Valuations

Net Asset Value (NAV) and Price to Book Value (P/BV)

- Based on NAV per Share of LKR 5.98 as per the latest audited financial statements as at March 31, 2021, P/BV of Luminex is 1.34 times.

- Based on the NAV per share of LKR 6.90 as per the interim financial statements as at September 30 2021, P/BV of Luminex is 1.16 times

- The post-IPO NAV per Share amounts to LKR 6.19, based on the adjusted NAV as at March 31, 2021 and number of Ordinary Shares in issue assuming full subscription of the Offered Shares.

- Offer price is LKR 8.00

- Industry P/BV is given as below;

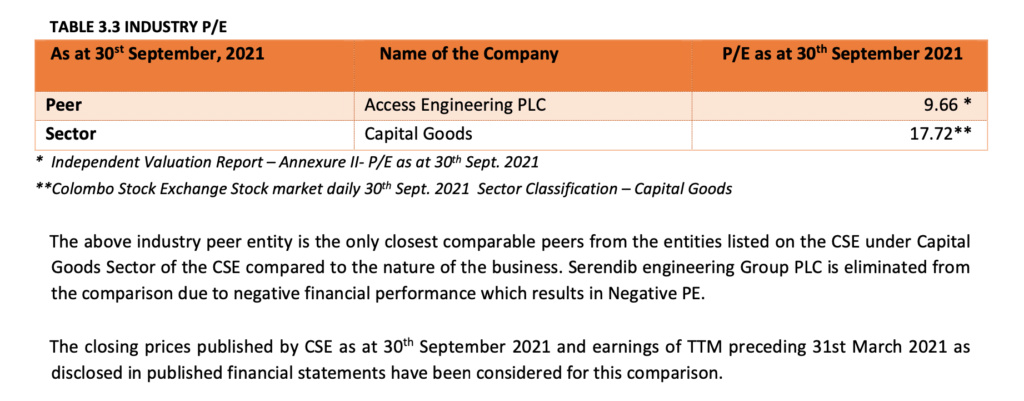

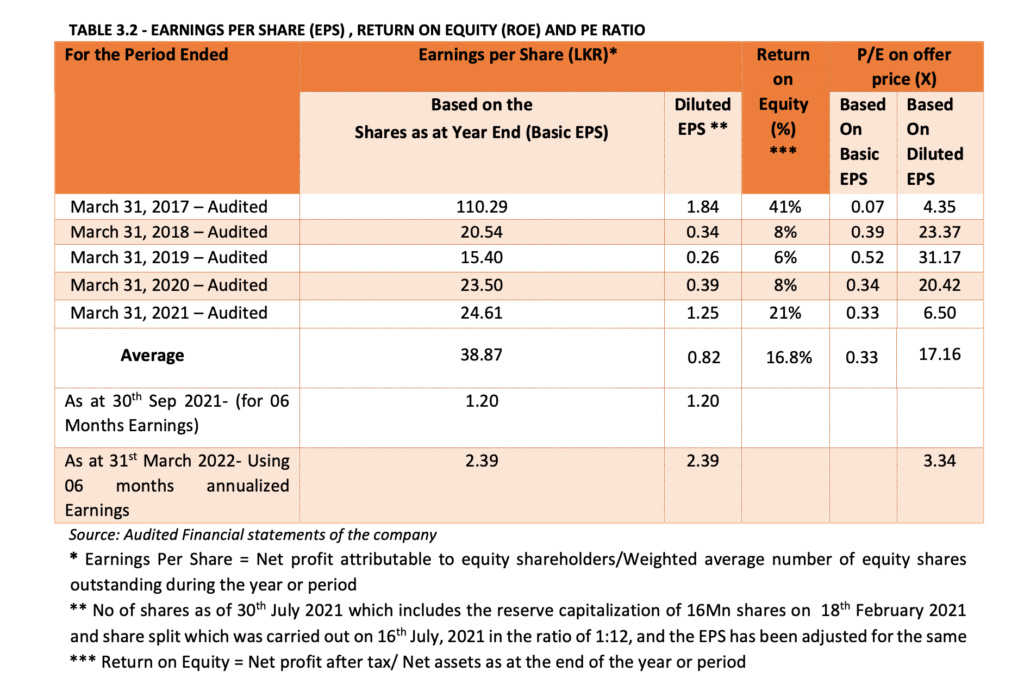

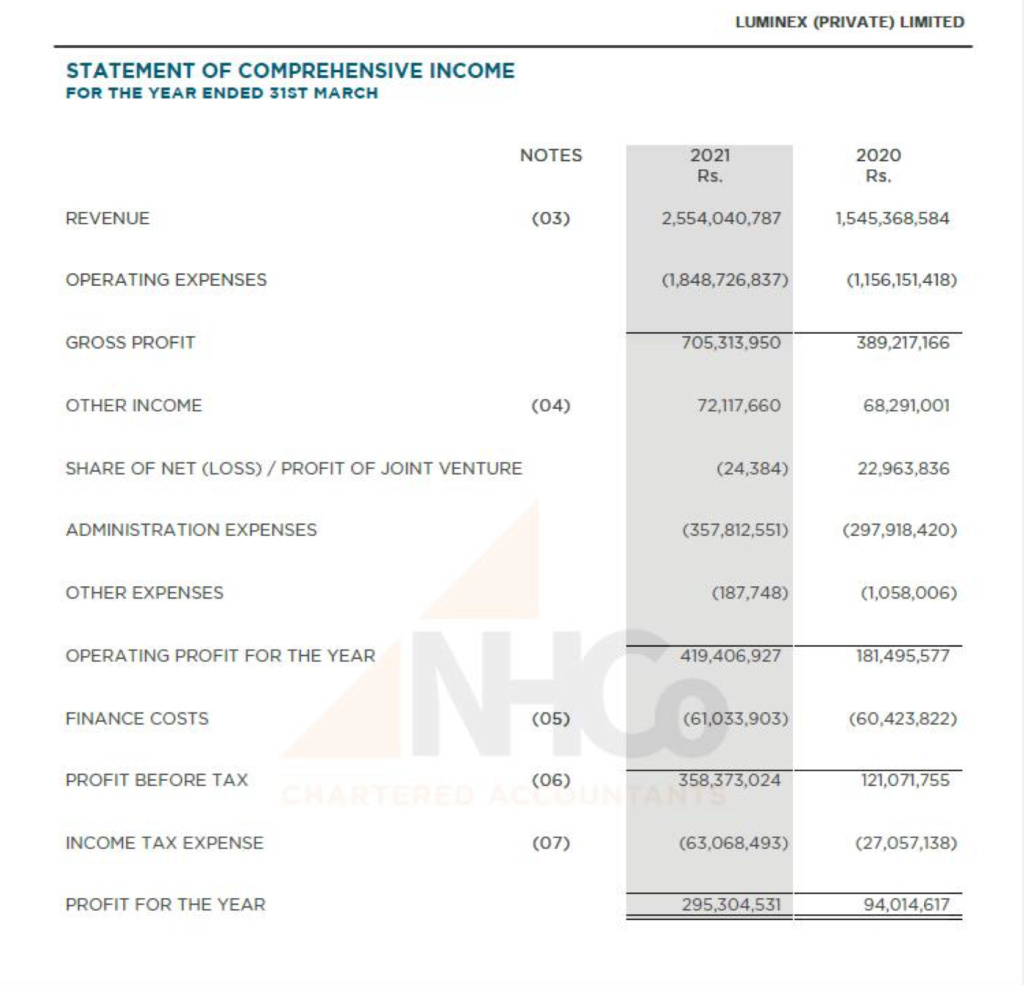

Price Earnings Ratio (P/E)

The P/E in relation to the Ordinary Voting Share Issue Price of LKR 8.00

• Based on the basic EPS of LKR 24.61 for the year ended 31st March 2021, the P/E is 0.33 times.

• Based on the diluted EPS of LKR 1.25 for the year ended 31st March 2021, the P/E is 6.50 times.

• Based on the average EPS of LKR 38.87, the P/E is 0.21 times

• Based on the annualized diluted EPS of LKR 2.39 for the six (06) months ended 30th September 2021, the

P/E is 3.34 times.

• The P/E range of the industry peer is as given below;

Return on Investment (ROI)

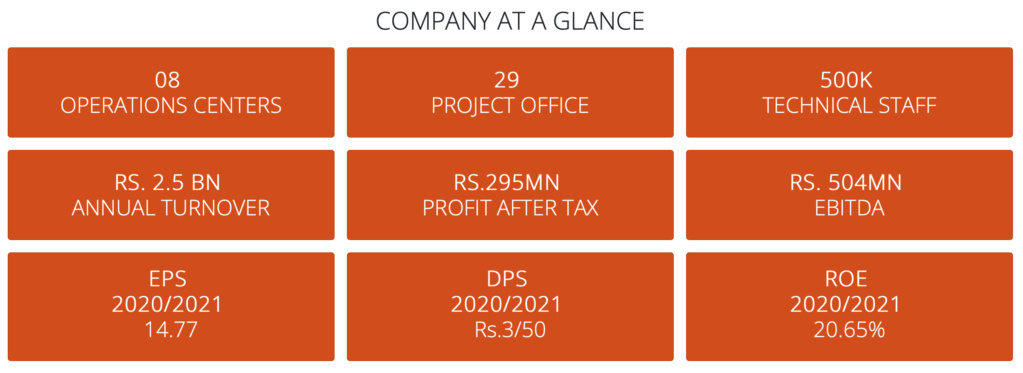

Luminex was incorporated as a Limited Liability Company on 12/02/1986 under the Companies Act No. 17 of 1982 and re-registered on 19/2/2009 under the Companies Act No. 07 of 2007. The legal form of the company was changed from Private Limited to a Limited Company under provisions of the Companies Act No. 07 of 2007 on 06/08/ 2021.

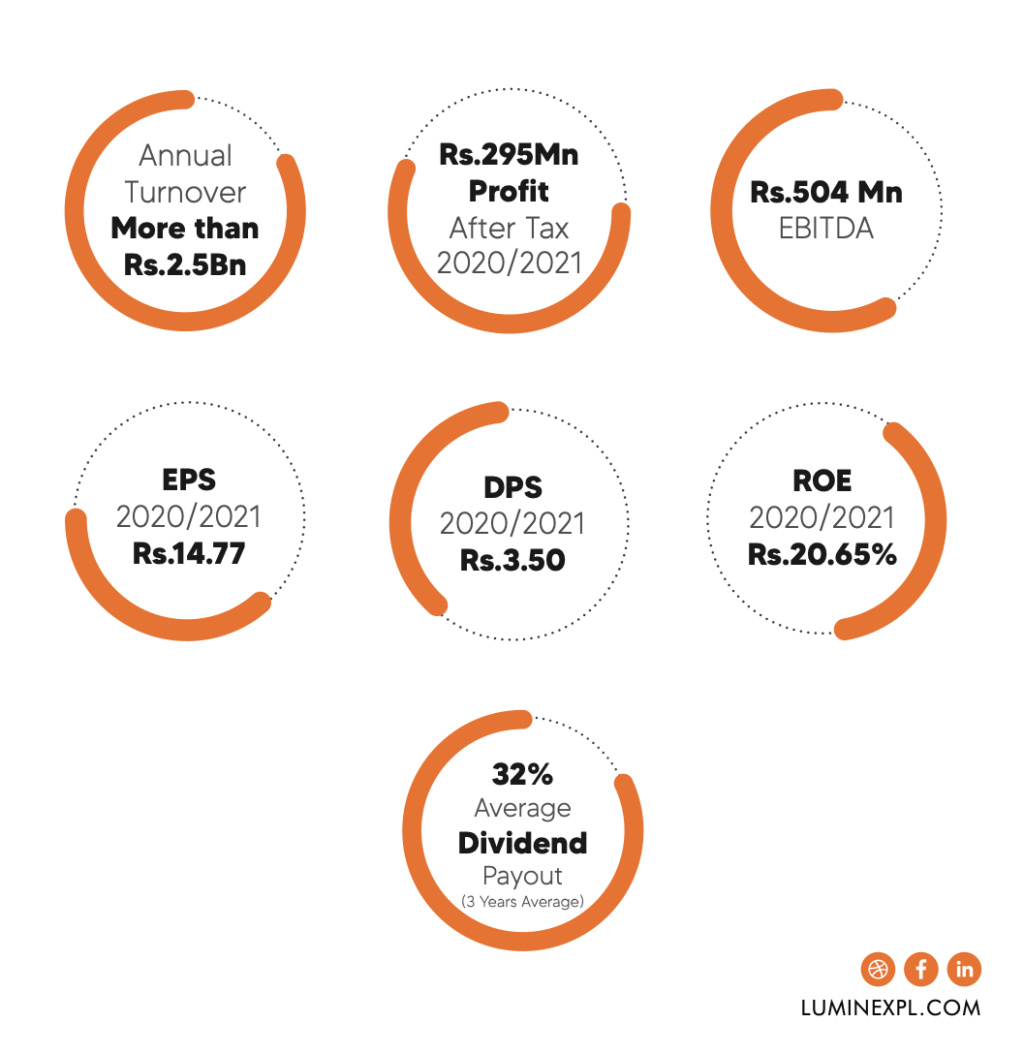

The Company is a successful engineering company specializing in the fields of Telecommunication, MEP and Civil engineering. Having been incorporated in 1986, the company has developed expertise in the fields of electrical and telecommunication engineering by keeping abreast with the emerging trends in the relevant fields during the last three decades. This has enabled the company to be a pioneering partner in many telecommunication and engineering projects in Sri Lanka, for which it has been recognized with accolades and awards. The company has built its reputation based on its ability to deliver high quality products and services, personalized customer service and innovation.

- Revenue Growth

Luminex expects to grow business volumes in all key industry segments. Continuing investment by Telecom companies upgrading their infrastructure to meet the data driven demand including direct fiber optic connectivity is expected to drive the revenue growth in the Telecom sector while continued government focus and investment in infrastructures development with an increased focus on water purification and distribution is expected to drive revenue growth in the EMP and Civil engineering sectors.

- Diversification of Revenue

The company intends to follow a path of diversifying the revenue sources in order to have a balanced mix of revenue generated from the three key operating industry segments. As such MEP and Civil engineering segments are expected to grow at higher rate compared to the Telecom segment, increasing their percentage share of the company’s total revenue.

- International Expansion

The company sees international expansion as an important and inevitable part of its future. As a start the company expects to have a fully operational presence in Telecom and Electrical engineering in the middle east in the foreseeable future. The company is currently in the final stages of negotiations with partners and potential customers to commence operation.

Telecommunication

More than 10Bn Revenue (During last 10 years)

Strong technical

staff force 400+

Total Projects in hand more than Rs.2.5Bn

Past experience: 25+ Years Latest Technological Equipment

Electrical

Close to 1Bn Revenue (During last 10 years)

Strong technical

staff force 50+

Total Projects in hand more than Rs.650Mn

Past experience: 35+ Years

Civil

More than 1Bn Revenue (During last 10 years)

Strong technical

staff force 50+

Total Projects in hand more than Rs.200Mn

Past experience: 10+ Years

Water

More than 400mn Revenue (Since 2018)

Strong technical

staff force 50+

Total Projects in hand more than Rs.1Bn

Started in 2018

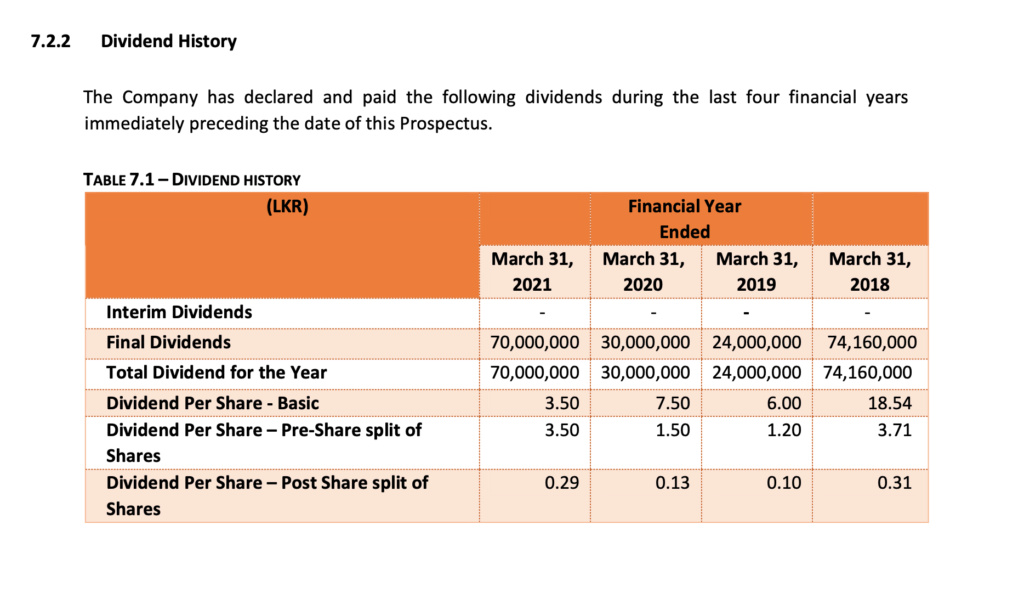

Dividends History

Link to Download Prospectus & Application

http://www.luminexpl.com/ipo

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home