Hotel Rooms

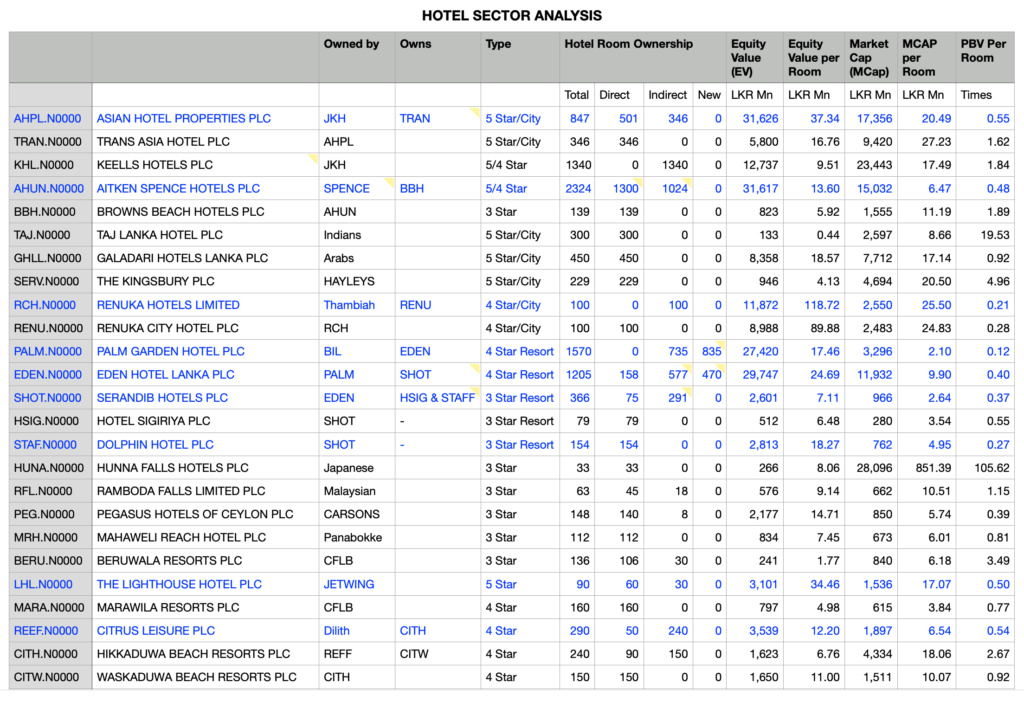

Above analysis takes into consideration the number of hotel rooms directly and indirectly controlled by each hotel entity. This include Hotel rooms under construction as well, which is stated separately.

Equity Value Per Room (EQ per Room)

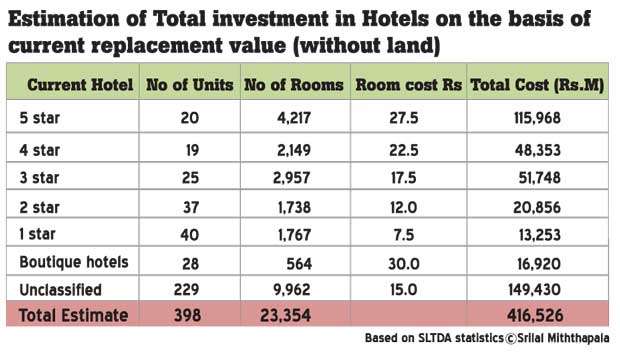

Equity Value or Shareholder Value per room is derived by dividing total shareholders funds (NAV)/BV) inclusive of minority interest by the available number of rooms directly and indirectly controlled by the each hotel. Higher EQ Value per Room indicates the revenue earning capability of each room. Cost of the replacement value per each type of star class hotel room are given in the table 2.

Market Capitalisation Per Room

Market Value or Market Capitalisation per room is determined by dividing the total Market Capitalisation of the respective share by the number of hotel rooms directly and indirectly controlled by the each hotel. This will indicate how investors have perceived the value of the each hotel room from the perspective of stock market.

Price To Book Value (PBV) Per Hotel Room

Price to Book Value of each hotel room is determined by dividing the Market Capitalisation per Room by the Equity Value Per Room. Lower this indicator the more likely be an attractive investment opportunity.

City Hotels

Accordingly AHPL and RENUK seems the most attractive city hotel from the perspective of the valuation.

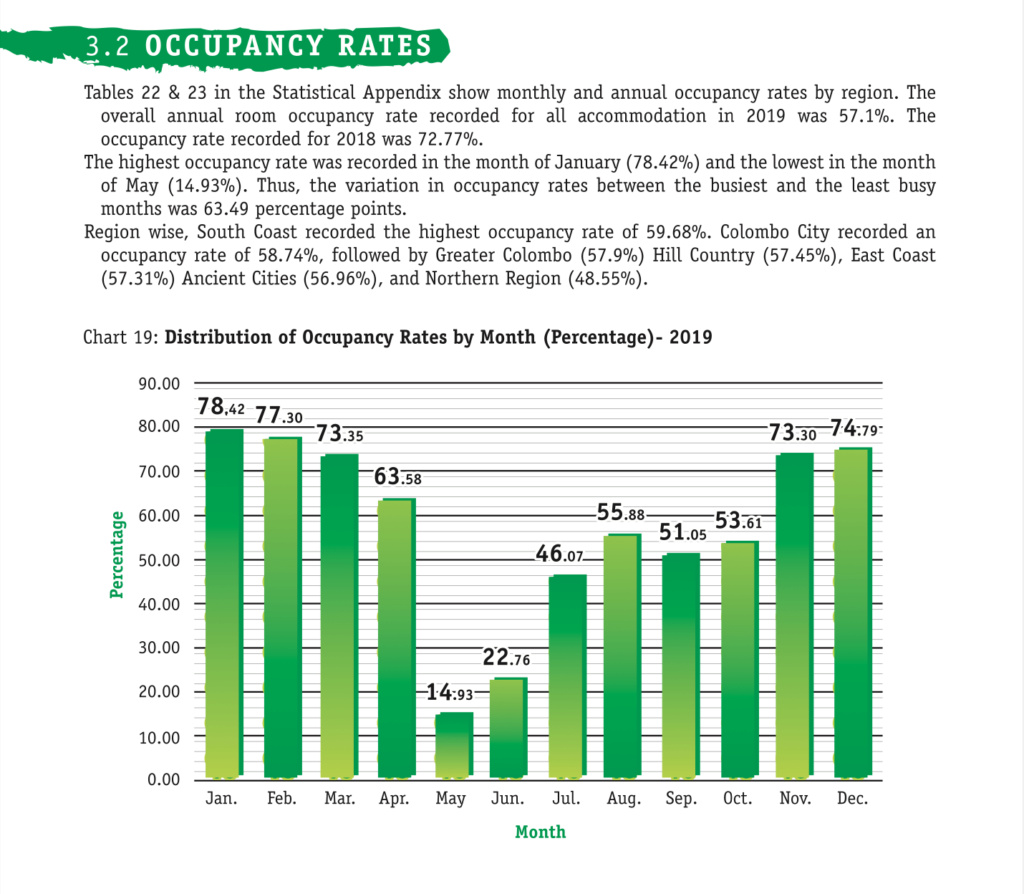

The total room inventory recorded up to December 2019 was 40,365. Classified tourist hotels (1-5 star) had the highest inventory of 14,093 rooms while Guest houses had 11,661 rooms. Tourist hotels had an inventory of 9,636 rooms.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home