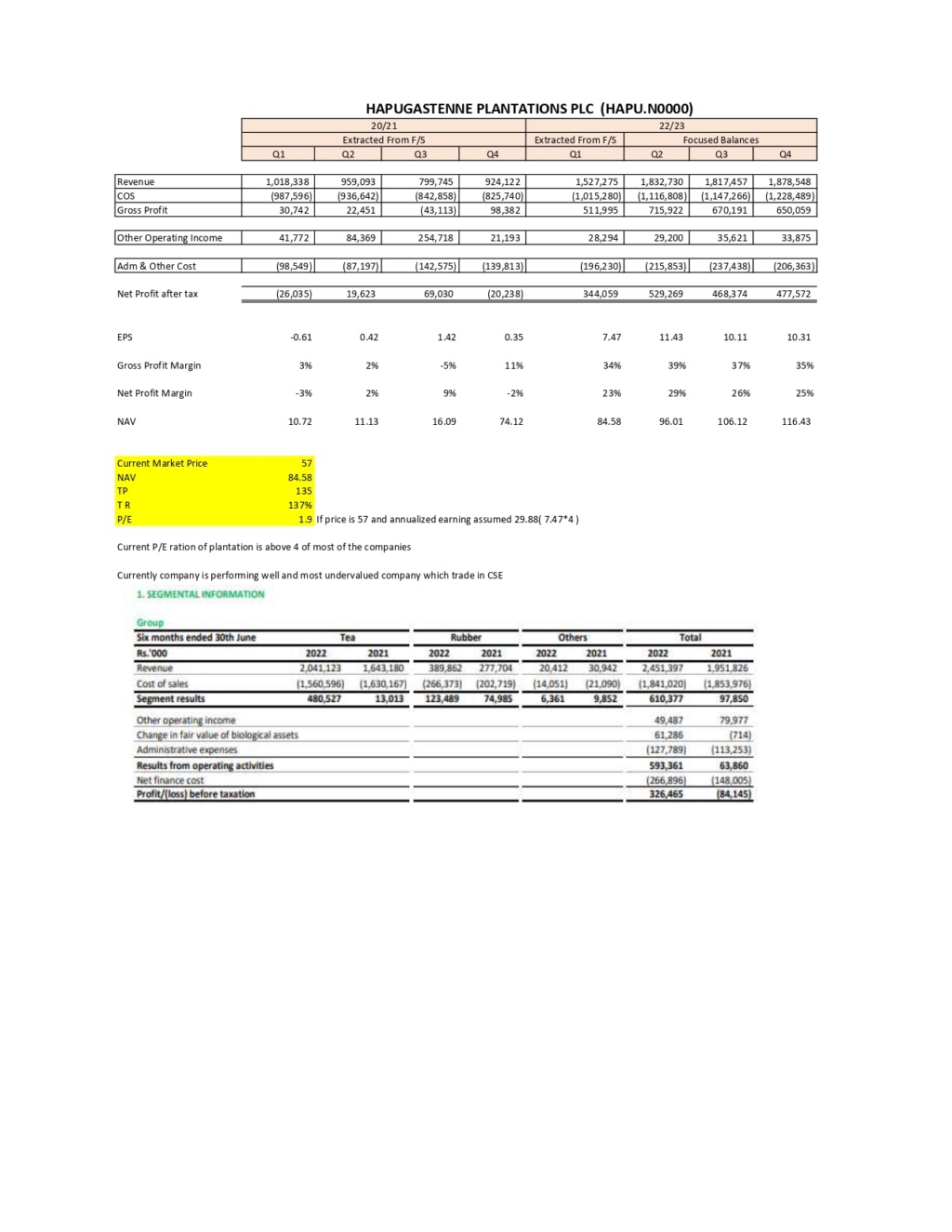

They produce Both Tea and Rubber which stabilize their future earnings.

Current Market Price = 60

NAV = 84.5

EPS for 1st quarter = 7.52

Estimated EPS Annualized = Rs 30 (7.52*4)

P/E = 60/30 = 2

According to sectors P/E, Most of the plantation company trade above 3time PE.This should trade above Rs.120

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home