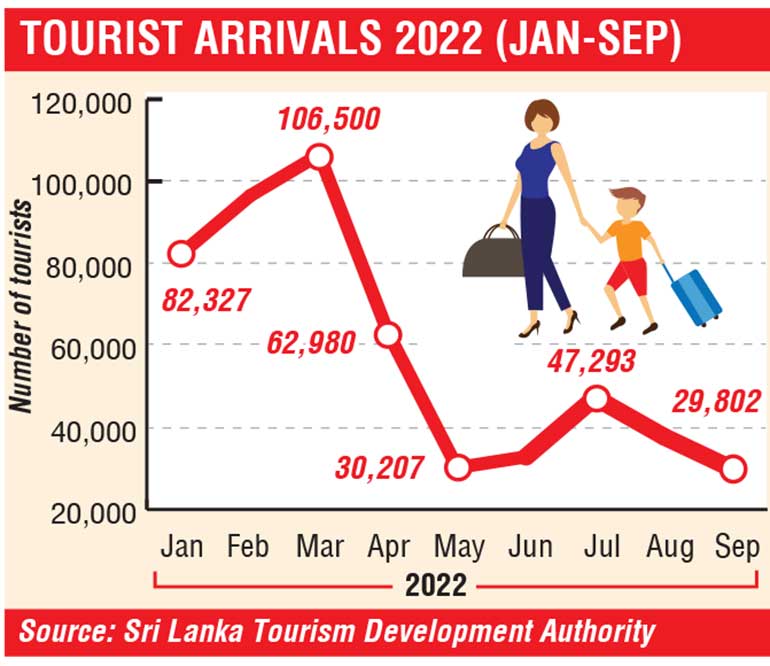

- September arrivals totalled 29,802

- India, UK and Australia emerge as top three traffic generators

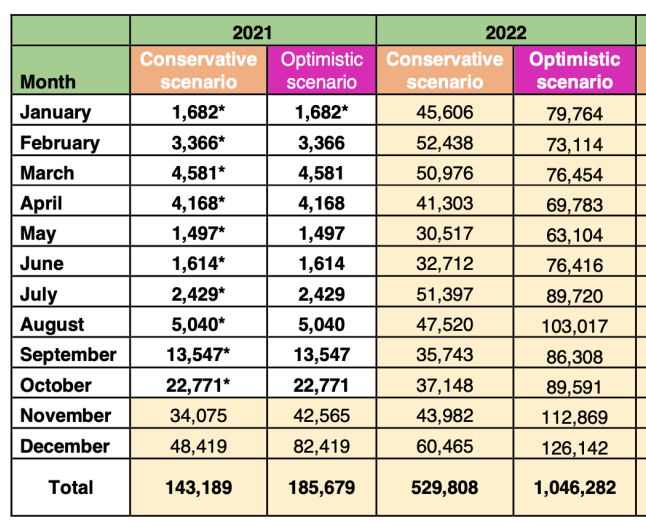

- January-September tourist arrivals reach 526,232

Sri Lanka witnessed its lowest monthly tourist arrivals in September, with the number of international visitors entering recorded at 29,802.

The arrivals for the month are even lower than that of May, which saw 30,207 tourists entering the country.

In May, the political and economic crisis in the country escalated, severely crippling the tourism sector that was well on its way towards revival from the impact of the COVID-19 pandemic.

The low rate of tourist arrivals in September brings the total number of visitors that entered the country from January 01 to September 30 to 526,232. The weekly tourist arrival averaged 7,450, whereas the daily arrivals averaged 993 for the month of September.

India, the UK and Australia emerged as the top three source markets in September, accounting for 6,493, 2,872 and 2,309 arrivals, respectively.

For the January-September period, India, the UK and Russian Federation were the top three tourist traffic generators for the country, bringing in 86,625, 68,527 and 51,300 international visitors, respectively.

Although the recent months have seen lower tourist arrivals to the country, the industry stakeholders have expressed confidence in the numbers picking up towards the latter part of the year, leading to the winter season.

Although the travel advisories issued against the island nation, due to the political and economic crisis, too have been reversed, Sri Lanka is still to fall under the ‘green’ category of the travel traffic light system, which indicates travellers to exercise ‘normal’ precautions. Sri Lanka aims to attract a total of one million tourists and generate an income of US $ 1.7 billion for this year.

https://www.dailymirror.lk/business-news/Tourist-arrivals-drop-to-lowest-in-September/273-246085

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

Sri Lanka’s tourist arrivals fell by 21% in September in comparison to August suffering the lowest inflow for the year so far, dealing a fresh setback to triple-crises-hit industry’s hope for a robust revival in the upcoming winter season.

Sri Lanka’s tourist arrivals fell by 21% in September in comparison to August suffering the lowest inflow for the year so far, dealing a fresh setback to triple-crises-hit industry’s hope for a robust revival in the upcoming winter season.