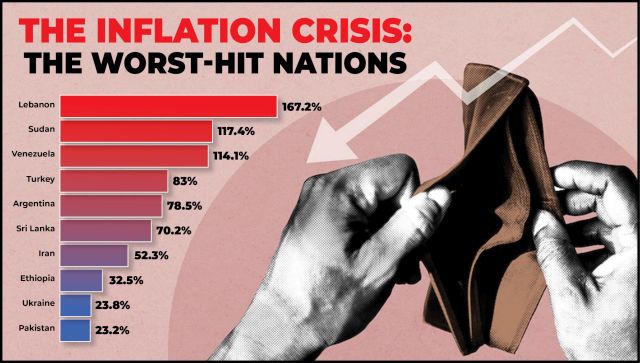

A global inflation crisis is plaguing the world, triggered by the war in Ukraine, the threat of energy shortage in Europe, supply-chain bottlenecks, and other geopolitical tensions. A global recession is looming and yet there are no signs of the prices of commodities coming down. Some say the worst is yet to come.

In India, if you are complaining about higher prices, maybe you should pause. Rising inflation in countries around the world will leave you shocked – with numbers going from double to triple digits. We take a look at some of the worst-hit nations.

Lebanon

At 167.2 per cent, Lebanon is posting the highest inflation rate in the world currently. The country faces the worst economic crisis in more than three decades and inflation is expected to average 178 per cent in 2022, up from about 155 per cent last year, Fitch Solutions predicted last month.

Inflation in Lebanon is expected to average 178.0 per cent in 2022 up from 154.8 per cent in 2021. AFP

Inflation in the West Asian nation is as much a result of high global commodity prices as a crisis of confidence in the economy. Following its default on Eurobonds in 2020 because of fiscal deterioration and low reserves, the country’s currency has been in a free fall, which means that the actual price of imports has soared. Political turmoil has added to economic instability, thereby denting the credibility of the country’s institutions.

Sudan

Sudan is facing 117.4 per cent inflation and it has declined from 125.4 per cent in July. Inflation in the country has been in three figures for more than two years.

This is primarily driven by rapid currency depreciation and political instability. Fiscal mismanagement, including extensive government borrowing and high prices of imported commodities, have contributed to the country’s high-inflation era.

The inflation rate has seen a downward trend since the second half of last year. Last May, annual inflation growth slowed to 192 per cent, down from 220.7 per cent in the previous month. Yet inflation rates in Sudan are still at the highest levels in the world, according to the Union of Arab Chambers.

Venezuela

Venezuela’s year-on-year inflation figure is 114.1 per cent, the highest in Latin America, according to Reuters.

The country’s problems with inflation started in 2016. Financial mismanagement, price caps on goods, and the inability to reform meant that the country’s economy went on a tailspin. What started as inflation, veered into hyperinflation in a few years. Sanctions on the regime of President Nicolas Maduro haven’t helped either.

High prices coupled with the de facto dollarisation of the economy have severely widened pay gaps between public and private-sector employees, reports Reuters.

Graphic: Pranay Bhardwaj

Argentina

Argentina recorded an annual inflation rate of 78.5 per cent in August, the highest in 30 years.

Its inflation saga is almost the same as any other country currently facing a similar crisis – political turmoil fueled by price spikes and a currency rout.

Fiscal mismanagement, including the inability to rein in spending and high debt levels, has led to investors moving out of the country, thereby leading to sharp currency depreciation. Replacements of two finance ministers in quick succession a few months ago have added to the uncertainty.

Turkey

Inflation in Turkey has soared to 83 per cent, which is the highest in 24 years. The biggest rise in prices is seen in the transport, food, and housing sectors.

Official data released on 3 October shows consumer prices have risen 83.45 per cent in Turkey from a year earlier, further hitting households already facing high energy, food and housing costs. Experts say the real rate of inflation is much higher than official statistics, at an eye-watering 186 per cent. AP

Independent experts from the Inflation Research Group estimate the annual rate is 186.27 per cent, according to a report by BBC.

The rise in prices comes after a series of interest rate cuts by the central bank. To fight inflation, the strategy is to raise interest rates but Turkey has gone the other way. This led to a fall in the value of the country’s currency, costing it more to import goods, the report says.

Sri Lanka

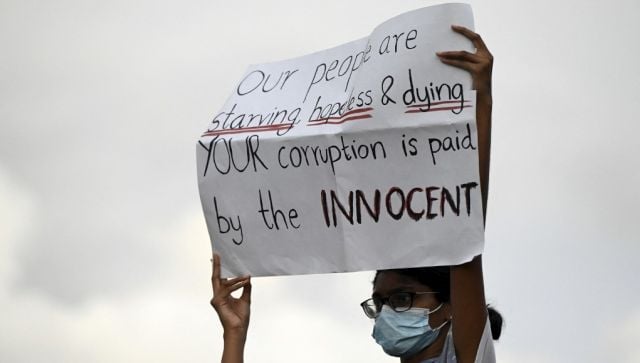

As the island nation struggles with its worst economic crisis, inflation surged to 70.2 per cent in August from 66.7 per cent a month ago. According to official data, food prices have risen by 84.6 per cent, compared to 82.5 per cent in July.

Based on the inflation forecasts, Sri Lanka’s central bank said last month that prices could peak in September before starting to ease thereafter if global commodities prices remained stable.

In mid-April, the nation declared its international debt default due to the forex crisis. The country owes $51 billion in foreign debt, of which $28 billion must be paid by 2027, reports news agency PTI.

Sri Lanka is facing its worst economic crisis ever. In August, inflation surged to 70.2 per cent. AFP

Sri Lanka’s inflation problems have many origins. First, rapid government spending over the past five years, including on projects that have not brought in large returns. This led to a rise in debt and deficit levels. Second, the drop in agricultural production due to new laws on fertilizer use pushed food prices. Finally, with tourism hit during the pandemic, the country’s foreign reserves went dry, meaning it had to ration fuel and buying more externally was not possible.

Iran

Iran’s inflation is at 52.3 per cent. The country’s economy has been battered over the years because of sanctions from the West on its nuclear programme. This has not only choked the flow of key imports but also the outflow of oil to garner revenues for the country. In such a scenario, rising global commodity prices, including food, have added to price pressures on the domestic economy with fiscal imbalances contributing to high inflation. Removal of import food subsidies has also aided inflation domestically.

Ethiopia

In May, inflation rose to 37.2 per cent, one of the highest levels in recent years, in Ethiopia. Since then it has eased to 32.5 per cent in August.

The combined effects of the COVID-19 pandemic, conflicts in various parts of Ethiopia, high global oil prices, as well as climate change-induced drought conditions in various parts of the country have largely frustrated the government’s efforts to stem the galloping costs of living in the country, reports Xinhua news agency.

Ukraine

The war with Russia has devastated the economy of Ukraine. Prices rose for seven straight months as consumer prices rose 23.8 per cent in August.

The rising prices of staples such as eggs and sugar remain a concern. The war has left the economy in a shamble affecting both supply and transportation costs.

Pakistan

After rising to the highest level of 27.3 per cent in August, Pakistan’s inflation is now at 23.2 per cent. The neighbouring nation has reasons to worry.

About 5.7 million Pakistani flood survivors will face a serious food crisis in the next three months, the United Nations warned.

Internally displaced flood-affected people arrive to collect drinking water at Kotri in Jamshoro district of Sindh province. Pakistan’s economy is already in the doldrums and the floods have added to its woes. AFP

There are several other problems plaguing the economy – global commodity prices, especially crude oil and natural gas have added to the import bill. The high debt, including external debt, along with the pressures of the pandemic has meant that the country has to run to the IMF again for a bailout. Third, the currency has depreciated sharply this year due to widening fiscal and external balances and dollar strength.

The big economies

Even the world’s most advanced nations are facing an inflation crisis. The United States is experiencing 40-year-high inflation and is on the verge of recession.

The pound has been tumbling and the troubles of the UK economy continue with no end in sight. AP

In Germany, inflation is at its highest level in more than a quarter century. This is driven by energy prices which are 43.9 per cent higher compared with September 2021, reports Mint. The country that relied heavily on Russian gas now is facing the heat amid the war in Ukraine.

The value of the pound has tumbled, making it more expensive for the United Kingdom to import food and fuel. The country is struggling with surging prices which are a result of the pandemic and the trade disruptions because of Russia’s war in Ukraine.

https://www.firstpost.com/explainers/global-inflation-crisis-worst-hit-nations-lebanon-sudan-turkey-sri-lanka-pakistan-11386831.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.