But what do you mean by TBs & jargons like coupons, YTM, etc? Is it actually risk free?.

What is a T Bond?

TBs are issued by @CBSL on behalf of the Govt of Sri Lanka, for funding expenditure.

Since the issuer is Govt, they are part of Govt. Securities (GSec).

As the Govt. can print money to repay, they are "technically" credit risk free. More on this later.

Face Value (FV)

This is the amount that will be paid on maturity. Also called nominal or par value.

It's the base amount on which periodic "coupons" are calculated (explained next).

FV remains constant throughout the life of TB.

All trades and investments are based on FV.

Coupon Rate (CR)

The annualised rate at which coupons (interest payments) are paid.

TBs have a fixed CR, while the frequency is semi-annual (once every six months).

Coupon = (FV * CR) /2

E.g.

Rs. 10 Mn FV TB with a 18% p.a. coupon, will pay 900,000, every six months.

Maturity Date

Date on which TB will mature and FV is paid.

Term to Maturity (TTM)

Length of the time period until the TB matures.

Simply,

TTM = Maturity Date - Today

TBs have a fixed maturity date.

TTM could range from 1+ to 30 years.

Yield to Maturity (YTM)

Overall yield earned by investor who buys the TB today and holds it up to maturity date.

It's the Internal rate of return (IRR) of the investment.

Focus should be on YTM (not on coupon rate) when you compare returns of one TB against another.

Are TBs risk free?

As long as Govt. has the capacity to print and repay, they can be considered "credit risk" free.

But, there have been few instances where TBs were part of a restructuring process during an @IMFNews program.

This is known as Domestic Debt Restructuring.

TBs also have other risks:

• Price risk: market prices could fall (if you plan to sell before maturity)

• reinvestment risk: reinvestment of coupons occur at lower rates than expected (overall return falls)

• Liquidity risk: difficulty in selling at a decent price/pace

How can I buy a TB?

Only Primary Dealers can buy directly from CBSL.

PDs are appointed by CBSL to deal in GSecs.

We have bank PDs as well as stand-alone PDs.

They do a decent job at providing investment opportunities.

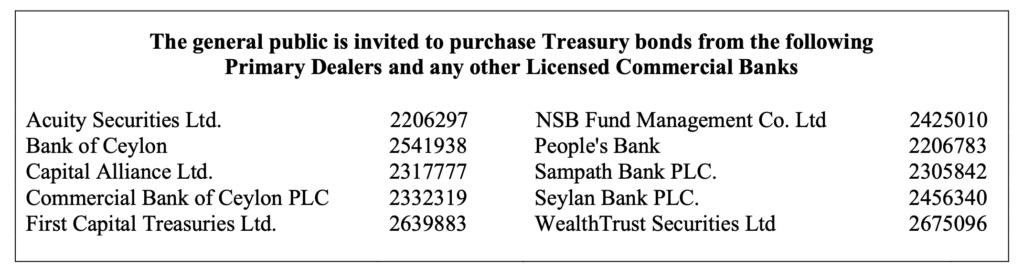

Below is a list of PDs published by CBSL.

You can buy TBs in two ways:

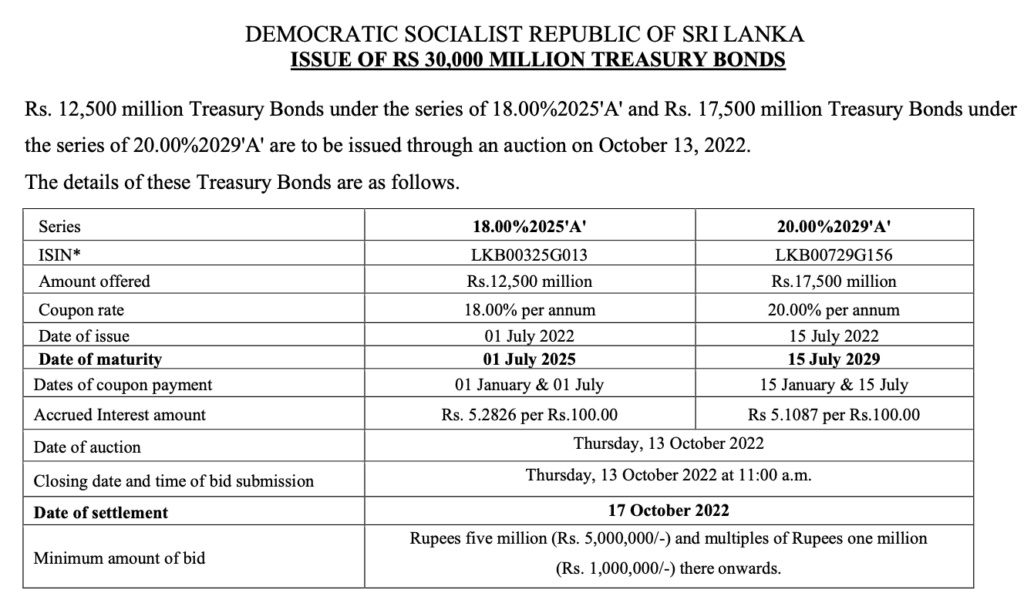

A. Bid at TB auction through a PD (min Rs. 5Mn). You can submit a bid at "any" YTM, but whether that's accepted or not depends on CBSL. Ref. TB auction notice.

B. Buy a TB from PD's ex-stock (min ~ Rs. 1 Mn, but YTM would be much lower than A.

• TBs are issued by Govt.

• They are "credit risk" free, but not free from all risks

• Term ranges from 1+ to 30 years

• You receive semi-annual coupons + FV at maturity

• YTM is more important the coupon rate

• You can get TBs from PDs in two ways (bid or buy)

Higher Treasury Bill rates alter the equity investment landscape

There are various reasons why increasing TB interest/yield rates can have an impact on equity markets. One is that it could affect future earnings growth for companies.

Higher interest rates tend to negatively affect earnings and stock prices (with the exception of the financial sector). Higher interest rates also mean future discounted valuations are lower as the discount rate used for future cash flow is higher.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home