Major issues facing financial systems include inflation at multi-decade highs, continuing deterioration of the economic outlooks in many regions, and persistent geopolitical risks, as we discuss in our latest GlobalFinancial Stability Report.

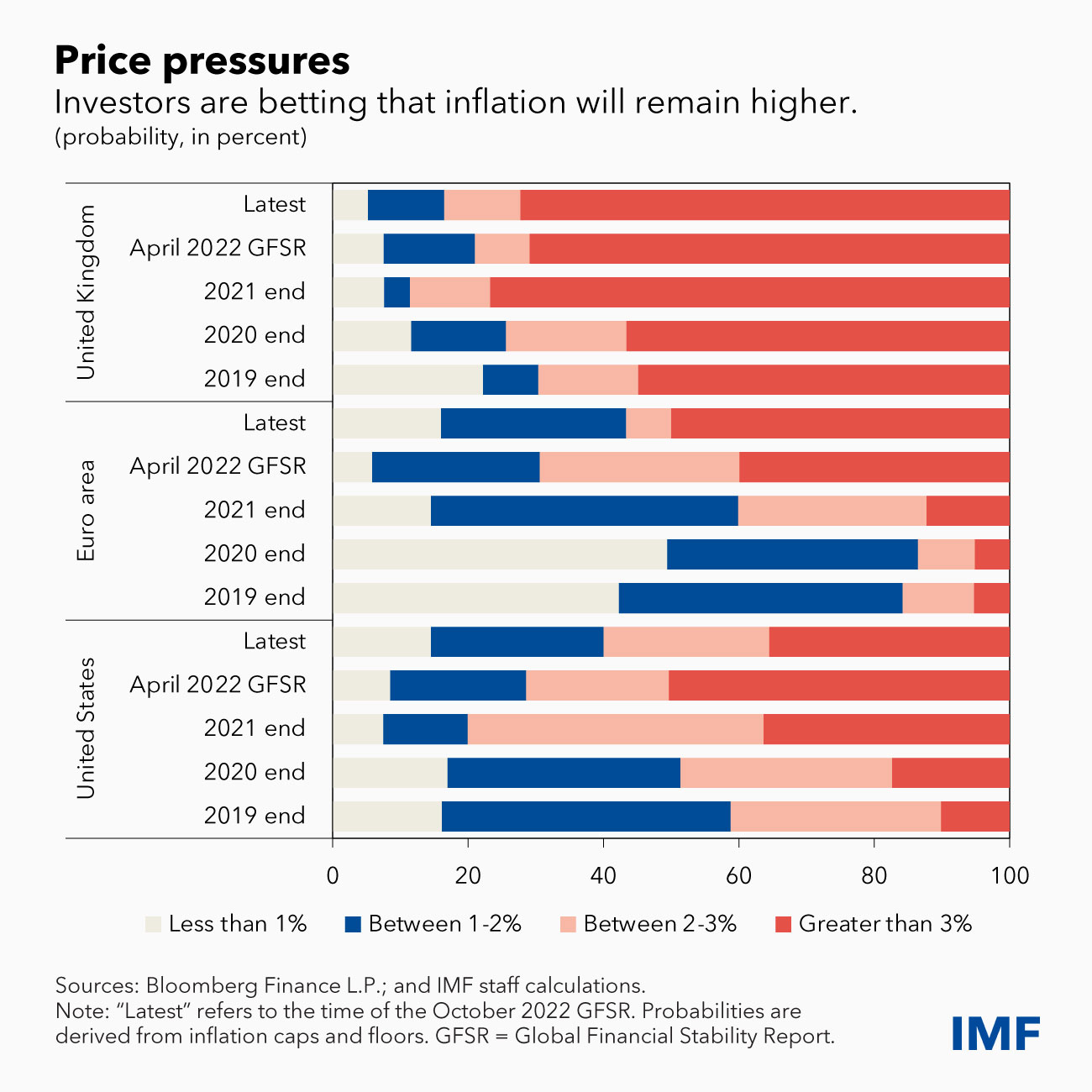

To avoid inflationary pressures from becoming entrenched, central banks confronting stubbornly high inflation have had to accelerate monetary policy tightening. What’s more, those in advanced and emerging economies alike also face magnified risks and vulnerabilities across different sectors and regions.

Financial vulnerabilities are elevated for governments, many with mounting debt, as well as nonbank financial institutions such as insurers, pension funds, hedge funds and mutual funds. Rising rates have added to stresses for entities with stretched balance sheets.

At the same time, the ease and speed with which assets can be traded at a given price has deteriorated across some key asset classes due to volatile interest rates and asset prices. This poor market liquidity, together with pre-existing vulnerabilities, could amplify any rapid, disorderly repricing of risk, were it to occur in the coming months.

Global markets are showing strains as investors have recently become more risk-averse amid heightened economic and policy uncertainty. Financial asset prices have fallen as monetary policy has tightened, the economic outlook has deteriorated, recession fears have grown, borrowing in hard currency has become more expensive, and stress in some nonbank financial institutions has accelerated. Bond yields are rising broadly across credit ratings, with borrowing costs for many countries and companies already rising to the highest levels in a decade or more.

Property concerns

The faltering property sector in many countries raises concerns about risks that could broaden and spill over into banks and the macroeconomy. Risks to housing markets are growing because of rising mortgage rates and tightening lending standards, with many more potential borrowers now being squeezed out of markets. Stretched housing valuations could adjust sharply in some market segments.

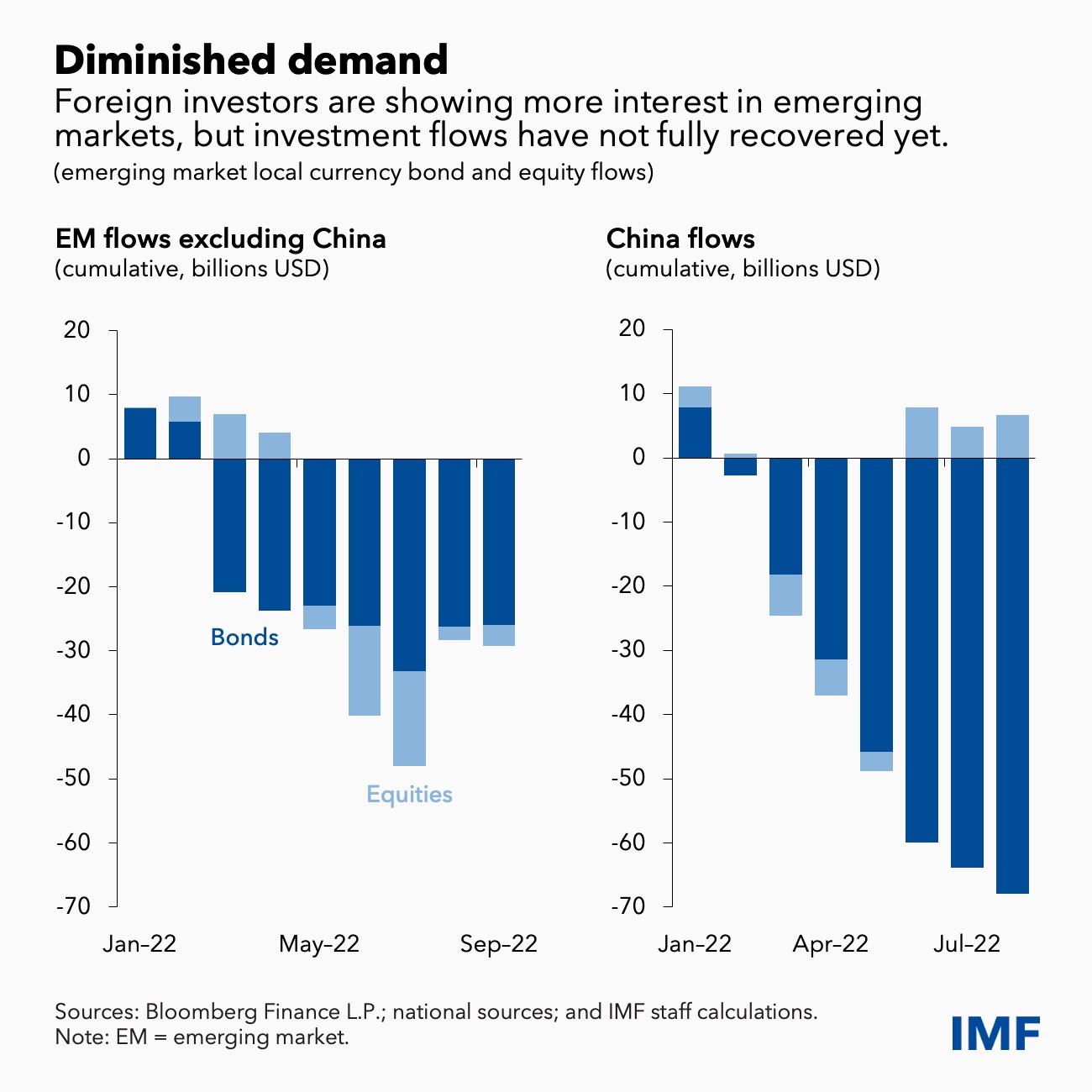

Emerging markets are confronting a multitude of risks, including high external borrowing costs, stubbornly high inflation and volatile commodity markets. They also face heightened uncertainty about the global economy, and policy tightening in advanced economies.

Strains are particularly severe in frontier markets —generally smaller developing economies—where challenges are driven by a combination of tightening financial conditions, deteriorating fundamentals, and high exposure to commodity price volatility.

Investors have so far continued to differentiate across emerging economies. While many frontier markets are at risk of sovereign default, many of the largest emerging markets are more resilient to external vulnerabilities to date. Having said that, after the stabilization of outflows in the first half of the year, foreign investors are again pulling back.

Emerging and frontier market bond issuance in US dollars and other major currencies has slowed to the weakest pace since 2015. Without improved access to foreign funding, many frontier market issuers will have to seek alternative sources and/or debt reprofiling and restructurings.

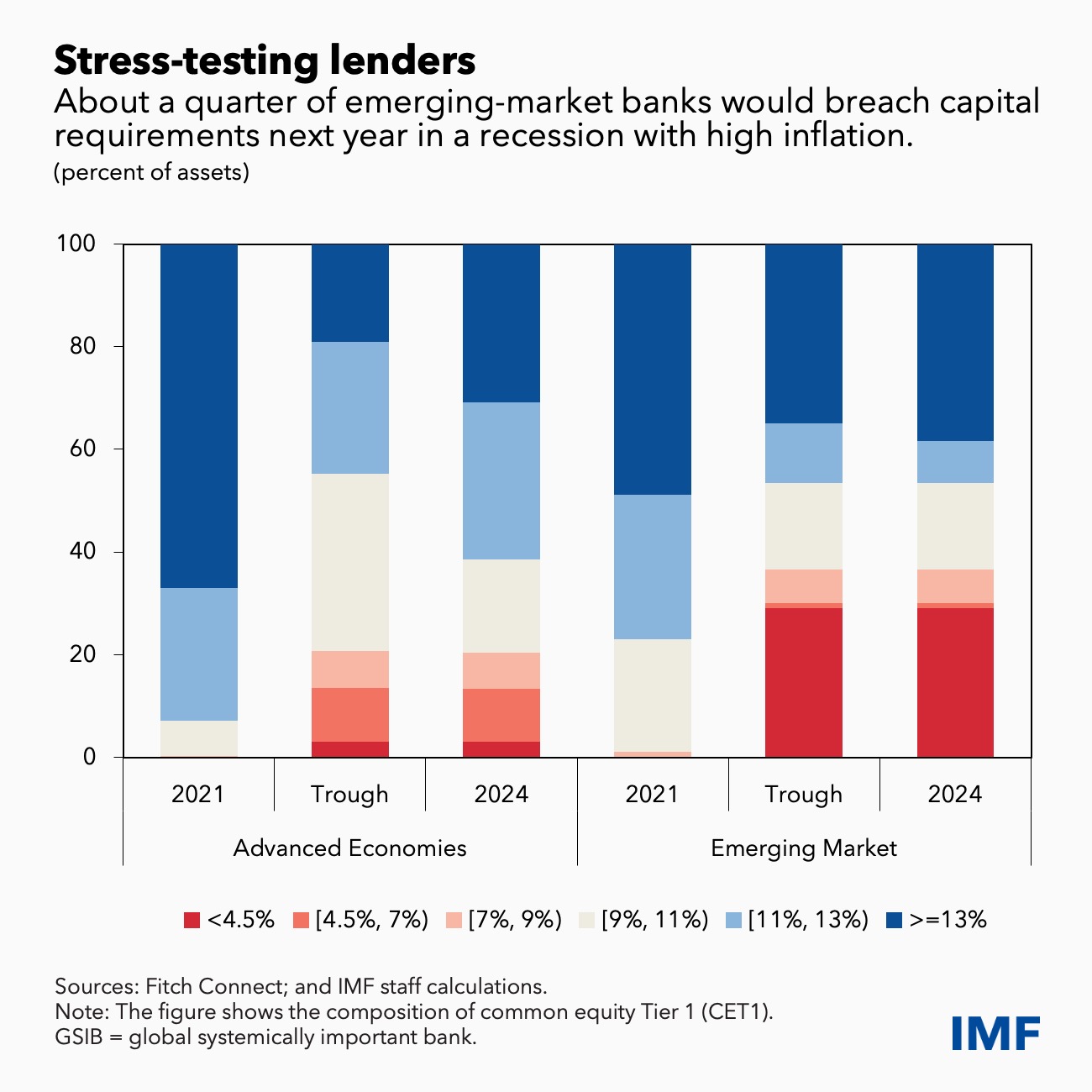

The global banking sector has been bolstered by high levels of capital and ample liquidity buffers. However, the IMF’s Global Bank Stress Test warns these buffers may not be enough for some banks. In the event a sharp tightening of financial conditions causes a global recession next year amid high inflation, 29 percent of emerging-market banks (by assets) would breach capital requirements. Most banks in advanced economies would fare much better, the stress test indicates.

The challenging macroeconomic environment is also putting pressure on the global corporate sector. Credit spreads have widened substantially, and high costs are eroding corporate profits. For small firms, bankruptcies have already started to increase because of higher borrowing costs and diminished fiscal support.

Policy recommendations

Central banks must act resolutely to bring inflation back to target and avoid a de-anchoring of inflation expectations, which would damage their credibility. Clear communication about policy decisions, commitment to price stability, and the need for further tightening will be crucial to preserve credibility and avoid market volatility.

Exchange rate flexibility helps countries adjust to the differential pace of monetary policy tightening across countries. In cases where exchange rate movements impede the central bank’s monetary transmission mechanism and/or generate broader financial stability risks, foreign exchange intervention can be deployed. Such interventions should be part of an integrated approach to addressing vulnerabilities as laid out in the IMF’s Integrated Policy Framework .

Emerging and frontier markets should reduce debt risk through early engagement with creditors, multilateral cooperation, and international support. For those in distress, bilateral and private sector creditors should coordinate on preemptive restructuring to avoid costly defaults and prolonged loss of market access. Where applicable, the Group of Twenty Common Framework should be used.

Policymakers face an unusually challenging financial stability environment. Though no globally systemic event has materialized so far, they should contain further buildup of vulnerabilities by adjusting selected macroprudential tools to tackle any pockets of risk. In this highly uncertain environment, striking a balance between containing these potential threats and avoiding a disorderly tightening of financial conditions will be critical.

—This blog is based on Chapter 1 of the October 2022 Global Financial Stability Report, “Financial Stability in the New High-Inflation Environment.”

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home