Low inflation first, interest rate later: CBSL

https://www.ft.lk/top-story/Low-inflation-first-interest-rate-later-CBSL/26-740752

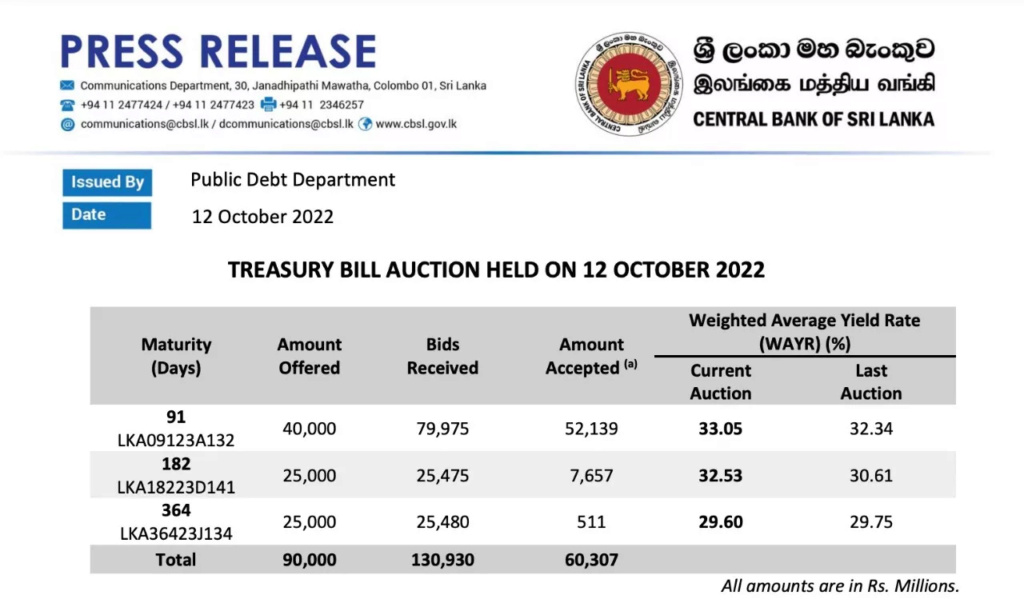

The CBSL Governors statement is a clear indication that TB rates will be further increased during next 3 months to curtail inflation. Analyst expects rates to reach high of 40% by December 2022 whilst some investors fear Sri Lanka's interest rate would reach as high as 70% as in Argentina subsequent to IMF supervision.

Argentina continues rate rises

https://www.centralbanking.com/central-banks/monetary-policy/monetary-policy-decisions/7953115/argentina-continues-raising-interest-rates

Seasonal demand for goods and services and resultant demand pull inflation of key food and services from November to January 2023 is likely to be curtailed through further increase in interest rates by CBSL. Further due to expected rise in crude oil prices and strengthening of the US dollar with Fed planning to raise rates, there is a possibility of Sri Lankan rupee may further depreciating against the US Dollar.

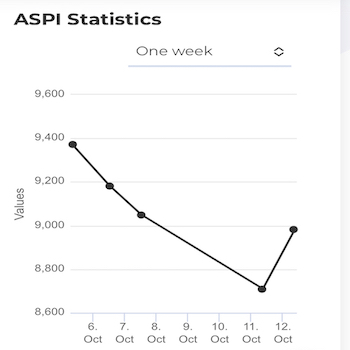

In these circumstances stock market is likely remain stagnant and depressed until December 2022.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home