https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/wei/WEI_20221202_e.pdf

Sri Lankan banks' access to foreign-currency funding is constrained by the sovereign default. Any local-currency debt restructuring would elevate funding and liquidity stress, given the predominance of local-currency funding, at 74% of the total, and large holdings of local currency-denominated government securities. A restructuring could necessitate recapitalisation by the government, though further regulatory forbearance measures could keep banks compliant with regulatory minimums on a reported basis, however, underlying capital positions could stay weak.

https://www.fitchratings.com/research/sovereigns/fitch-downgrades-sri-lanka-long-term-local-currency-idr-to-cc-affirms-rd-foreign-currency-idr-01-12-2022

Importance of making adequate Impairments, maintaining adequate Liquidity and Capital buffers for the soundness of the Banking System;

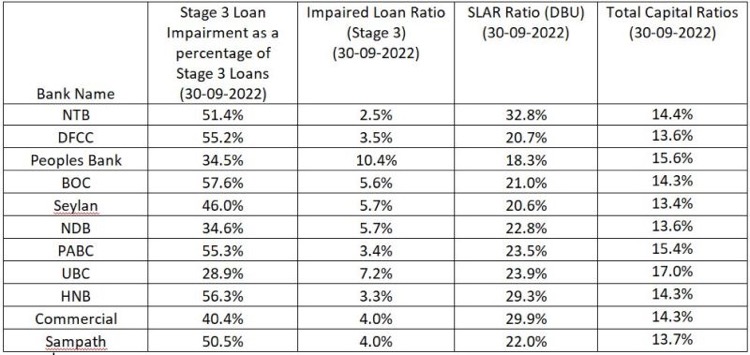

During theses challenging times it is necessary for banks to make adequate impairment provisioning since in doing so banks will not do overstatement of their assets as well as they will create a reserve buffer to cover problematic loans and advances. When looking at the Stage 3 impairment cover ratio against the stage 3 loans (As at 30-09-2022) some of the banks have make adequate provisioning by covering more than 50% of the stage 3 loans.However, in some cases the provisioning are relatively low compared to the industry averages /as well as provisioning made by similar size of banks.Any way under these challenging conditions it is prudent to make adequate provisioning without waiting for the last moment by exposing to unexpected shocks.

Also, for the soundness of the banking system maintaining an adequate liquidity is a must. However, some of the banks are still facing liquidity issues and which has created an unhealthy competition for capturing deposits and same has been now highlighted by the regulator and the regulator has requested from the banks to seek the CBSL assistance for liquidity issues rather than competing with each others for deposits by offering very high rates. Liquidity position of the industry is evident from the below table since as per the same some of the banks are just above the statutory requirement.

However, banks will get some sort of a relief on liquidity issues since now the CBSL has temporally deferred maintaining SLAR separately for DBU and Off Shore Banking unit by allowing banks to maintain SLAR (20% or more) on consolidated basis (Covering DBU and Off Shore Banking Units).

Also, for the soundness of a bank/banking system maintaining an adequate capital buffers are also compulsory and as per the table some of the banks are around 0.5% -1.0% above the statutory requirement which is applicable for them (Regulatory figures are 12.5%,12.0% and 14.0% based on the size of the bank).

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home