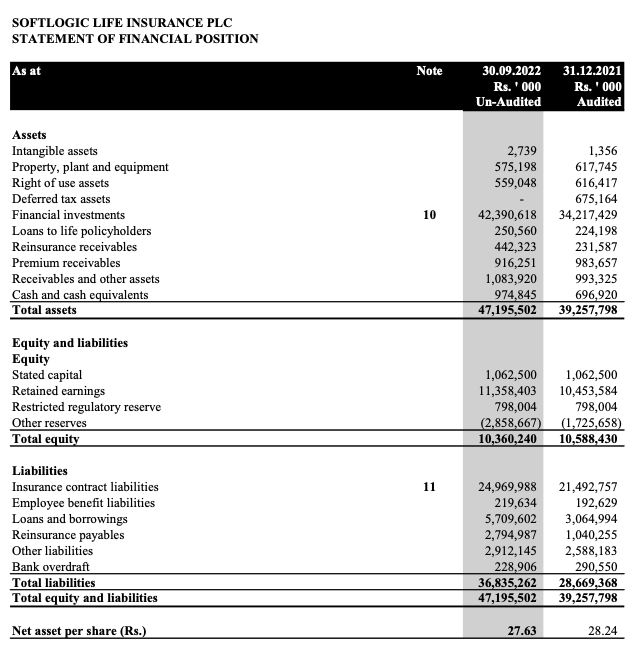

- Net Asset Value (NAVPS) per share declined to LKR 27/= in Sep 2022.

- Price to Book Value (PBV) is more than 2X (Market Price LKR 55/=)

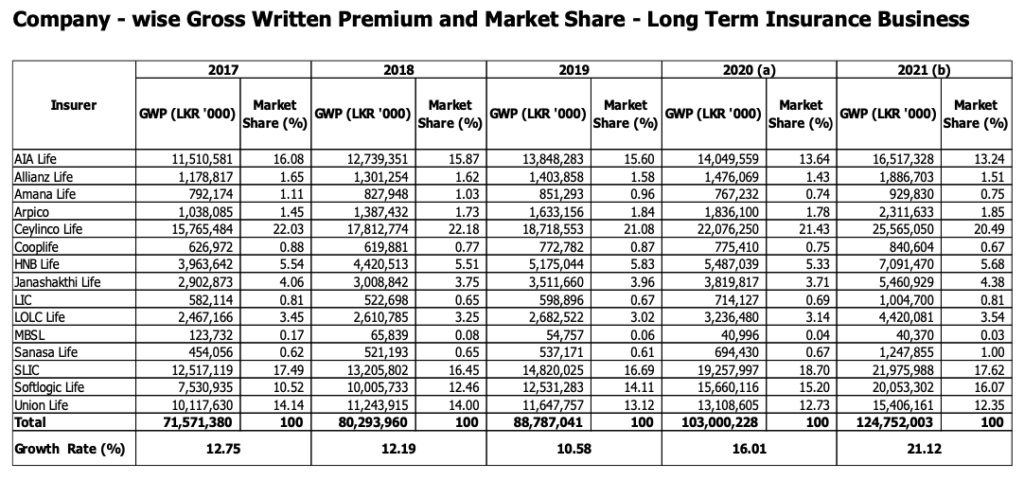

- Maintains a market share of over 16.07% in the life insurance sector.

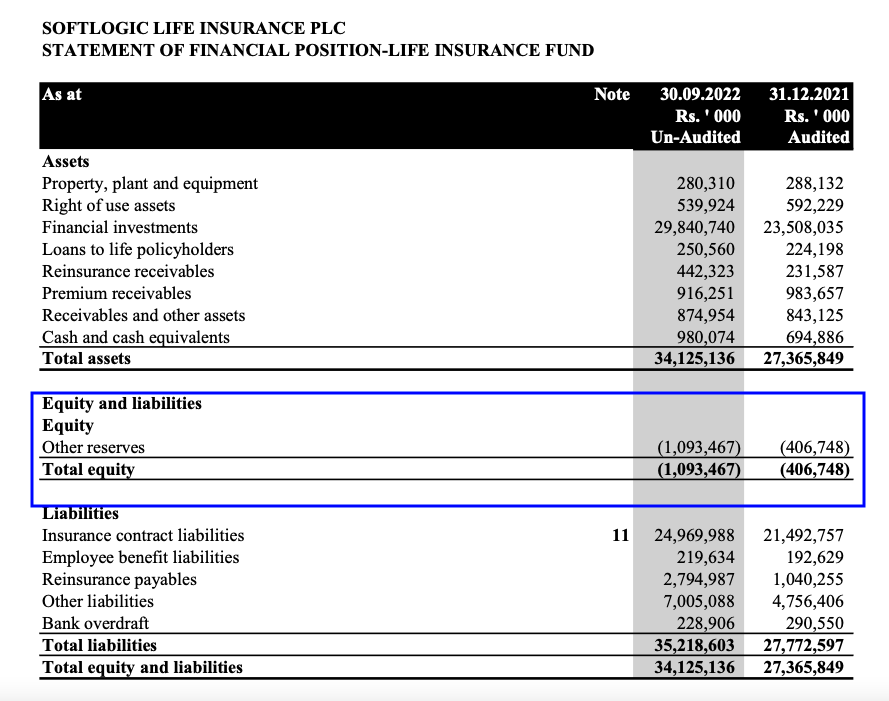

- Life Insurance Fund losses exceed LKR 1bn as at Sep 2022.

- Invested more than LKR 3bn in International Sovereign bonds (ISB's) which will undergo debt restructuring.

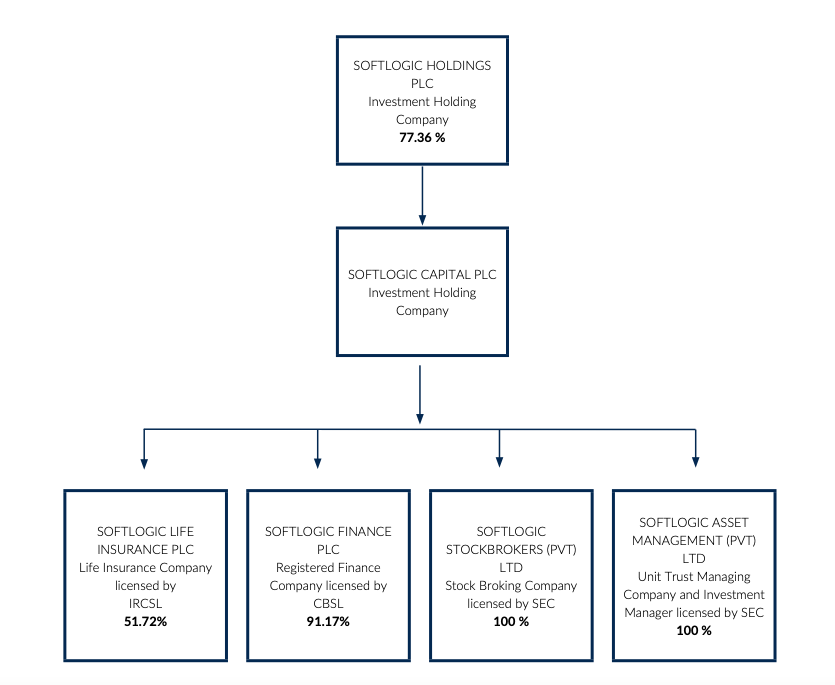

- Life Funds of AAIC managed by Softlogic Group subsidiary Softlogic Asset Management (pvt) Ltd.

- Softlogic Capital PLC (SCAP) owns majority shareholdings of AAIC and Softlogic Asset Management Company.

- Majority shareholders of AAIC to invest LKR 1.2bn in Commercial Paper of Softlogic Holdings (SHL)

- Pending Tax litigation is a cause for concern.

Life Insurance fund at risk

Softlogic Asset Management (Pvt) Ltd (http://softlogicinvest.lk/) is the investment management arm of the Softlogic Group which manages the funds of Softlogic Life Insurance PLC.

As seen in the below diagram, both Softlogic Insurance PLC (AAIC) and Softlogic Asset Management (Pvt) Ltd are controlled by Softlogic Capital PLC (SCAP).

Softlogic Capital PLC recently made an announcement through the CSE regarding investment of LKR 1.2bn commercial papers of Softlogic Holdings PLC (SHL).

Life Insurance holders funds are at risk of inefficient management due to conflict of interest and the current financial status of the Softlogic Holdings PLC.

Valuation

Net Asset Value (NAVPS) per share declined to LKR 27/= in Sep 2022 and Price to Book Value (PBV) is more than 2X (Market Price LKR 55/=)

https://cdn.cse.lk/cmt/upload_report_file/364_1668395042310.pdf

Pending Tax litigation against AAIC is a cause for concern

The Commissioner General of Inland Revenue issued it's determination on the appeal filed by the Company relating to the assessment raised for the Y/A 2014/15, 2015/16, 2016/17 and 2017/18 amounting to Rs. 681.7 Million along with penalty, in favor of the Commissioner General of Inland Revenue. The Company is in the process of hearing the appeals with Tax Appeals Commission.

The Company has been issued with an assessment under the Income Tax act by the Department of Inland Revenue in relation to the year of assessment 2018, amounting to Rs. 533.4 Million including penalty and interest. The Company has filed an appeal to the Commissioner General of Inland Revenue and awaiting the CGIR

LKR 3.2bn invested in international Sovereign Bonds

https://cdn.cse.lk/cmt/upload_report_file/364_1668395042310.pdf

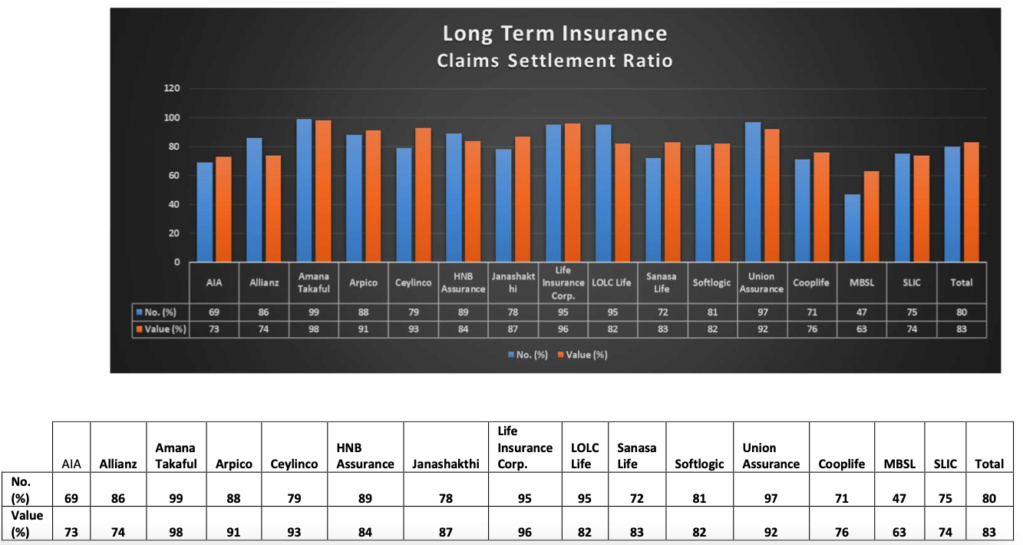

Maintains a healthy market share in the Insurance Sector

Company - wise Gross Written Premium and Market Share - Life Insurance Business

SLIC Life and Softlogic Life secured second and third positions in the market by recording GWP of LKR 21,976 million (2020: LKR 19,258 million) and LKR 20,053 million (2020: LKR 15,660 million) respectively, with market shares of 17.62% (2020: 18.70%) and 16.07% (2020: 15.20%). Even though the market share has contracted compared to the previous year, SLIC Life has managed to grow its GWP by 14.11%, largely boosted by new policies issued for one existing non-participating product with an investment plan.

Softlogic Life further strengthened its strong growth momentum by capturing its highest market share over the last five years, amounting to 16.07%. Further, the company maintained its double-digit growth by recording a growth rate of 28.05% (2020: 24.97%) because of the execution and exceptional performance of the multi-channel strategy and expansion of the digital distribution channel, digitization of internal processes, etc.

https://ircsl.gov.lk/wp-content/uploads/2022/10/Statistical-Review-2021-19.10.2022.pdf

- Attachments

Softlogic Life Insurance.pdf

Softlogic Life Insurance.pdf - December 2022

- You don't have permission to download attachments.

- (847 Kb) Downloaded 3 times

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home