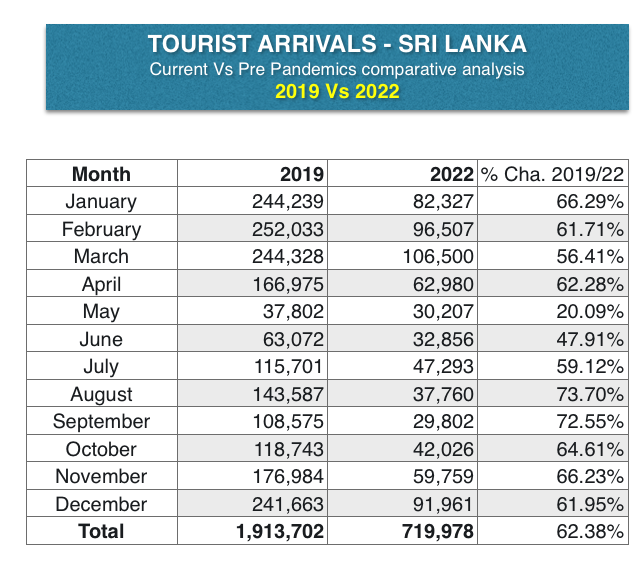

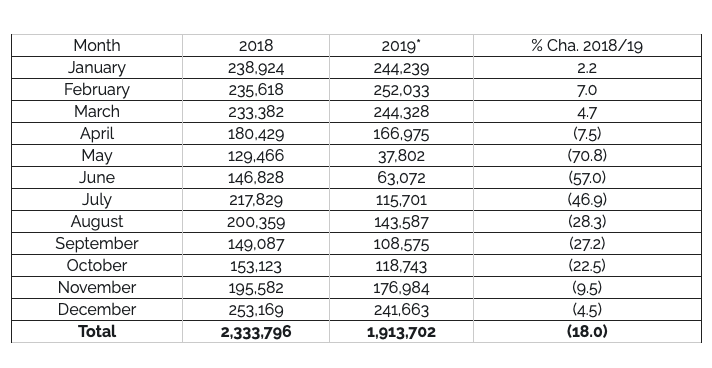

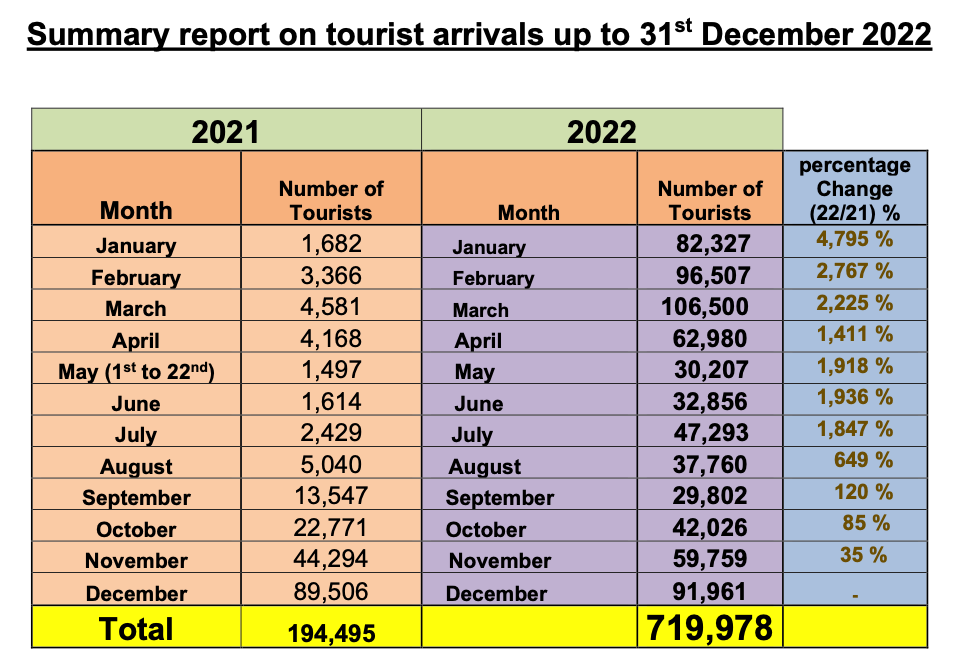

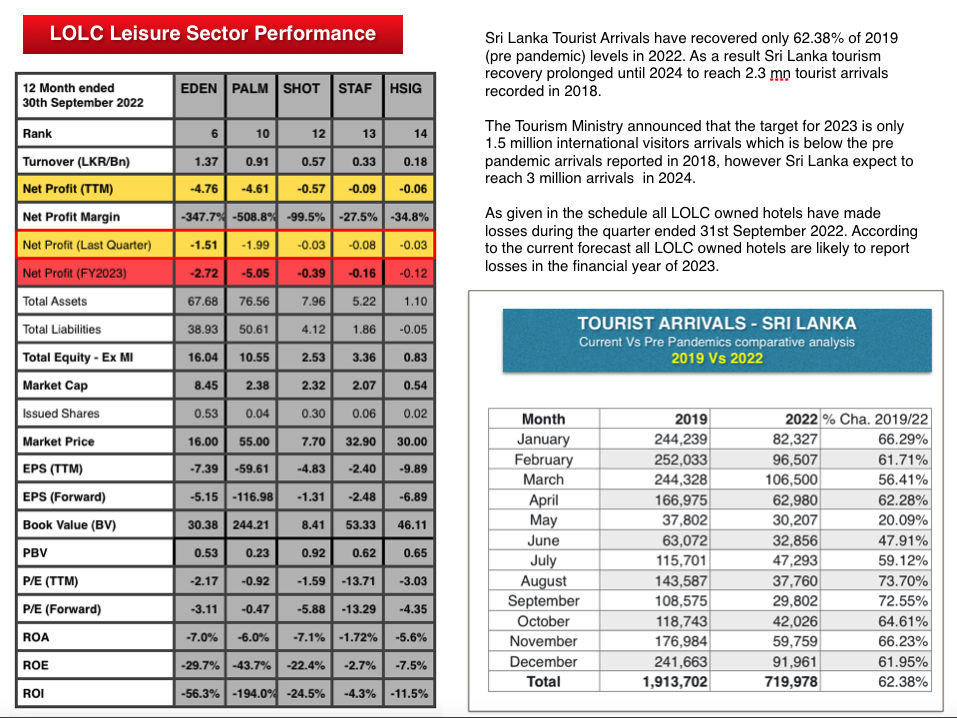

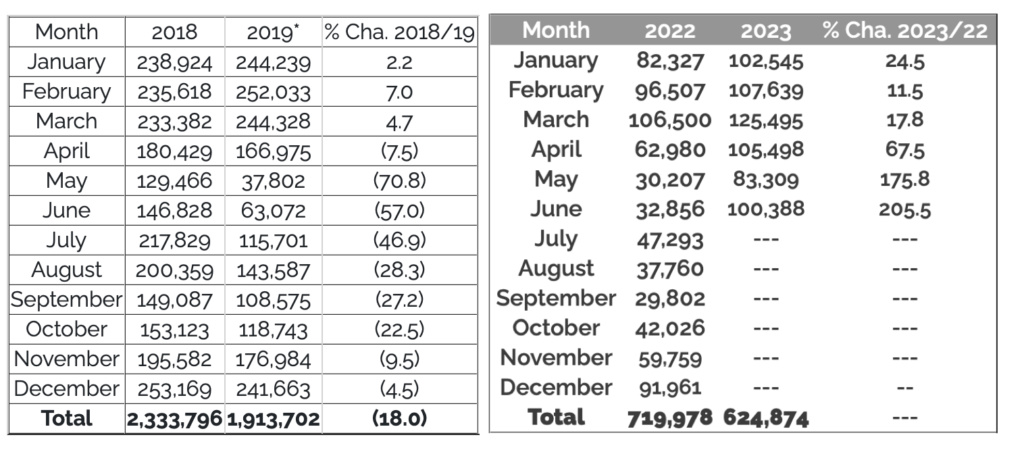

Sri Lanka Tourist Arrivals have recovered only 62.38% of 2019 (pre pandemic) levels in 2022. As a result Sri Lanka tourism recovery prolonged until 2024 to reach 2.3 mn tourist arrivals recorded in 2018.

The Tourism Ministry announced this week an ambitious target of luring 1.5 million international visitors in 2023 and double of that (3 million) in 2024.

https://sltda.gov.lk/en/monthly-tourist-arrivals-reports-2019

SL aims to lure 1.5mn tourists in 2023, 3mn in 2024

The Tourism Ministry announced this week an ambitious target of luring 1.5 million international visitors to the country and fetching an income amounting to US $ 5 billion in 2023.

Tourism Minister Harin Fernando said that the aim is to double the arrivals to three billion in 2024, after which he is upbeat the hard-hit sector will achieve higher growth levels. Addressing a media briefing this week, Fernando said he is confident Sri Lanka would achieve the revised target set for the year 2022. The ministry revised the arrival target from 1000,000 to 800,000 for this year.

For the first 11 months of the year, Sri Lanka welcomed 628,071 visitors. The island nation would need to lure 171,929 tourists in December to achieve the target.

Since the Covid-19 pandemic, arrivals to the island nation crossed 100,000 only in March 2022. From the following month, the arrival numbers remained at the levels of 20,000 to 40,000.

Only in November, tourist arrivals to the country crossed the 50,000 mark for the first time since the eruption of the political and economic crisis in the country.

According to the minister, the 800,000 target will be realised with an increase in tourist arrivals expected from the UK, Germany, France and Russia for the remaining winter season.

https://www.dailymirror.lk/business-news/SL-aims-to-lure-1-5mn-tourists-in-2023-3mn-in-2024/273-249771

The outlook and road to recovery

The easing of travel restrictions, a major hurdle to air transport and international traffic in particular, increases the demand for air travel. Most countries in all regions have plans to lift many, if not all, health measures, relax travel restrictions, and reopen borders as they return to normality. A large proportion of the world’s major aviation markets with originating passenger traffic have reached vaccination rates of 80%. In many cases, vaccines serve as a passport to travel in the current context.

Geopolitical conflicts

The conflict between Russia and Ukraine further damaged the global economy disrupting trade and driving a slowdown in 2022. It not only triggered a rise in energy prices affecting the cost of travel but also a humanitarian crisis resulting in millions of refugees and a global food crisis. There are risks of worldwide spillovers to other commodity markets adding to inflation pressures.

Economic downturn

The risk for an economic downturn due to rising interest rates aimed at curbing inflation is ever present. Coupled with the significant increase in jet fuel prices, this could weaken and even delay the aviation industry recovery in the short-term by increasing the cost of travel. The IMF expects inflation to remain in 2022, projected to reach 6.6% in advanced economies and 9.5% in emerging markets and developing economies[1]. Central banks continue to increase interest rates in order to tame inflation—this will potentially contract or slow the growth of economic output.

Supply chain bottlenecks and labour shortage

Supply chain disruption affecting a large range of commodities and services triggered a rapid rise in the price of oil and gas—including jet fuel—as well as a broader transportation crisis. The shortage of shipping containers, clogged seaports and cross-border shipment disruptions have a direct impact on the health of the global economy. The air transport sector is especially affected by labour shortages across all players in the aviation ecosystem.

Despite the downside risks, the industry remains confident that the potential for a recovery to 2019 levels within two or three years is possible assuming a short-lived recession in 2023. There is no doubt that many people remain eager to resume travelling and the 2022 early Northern Hemisphere summer volumes are a testament to that. With the combination of vacation deprivation and an upsurge in confidence in air travel provided by increased vaccination rates and safety measures, the relaxation of travel restrictions will help boost the propensity for air travel and fuel the industry’s recovery.

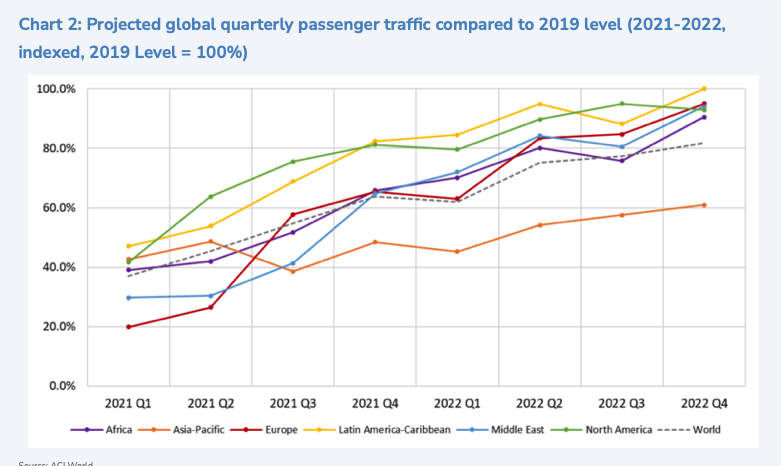

Projected global quarterly passenger traffic compared to 2019 level (2021-2022, indexed, 2019 Level = 100%)

Based on the points above, the 2022 Q3 and Q4 projections are as follows:

World

Global passenger traffic in the year 2022 is expected to be 6.8 billion, representing a loss of 33.1% compared to the projected baseline, which is 74.4% of 2019 traffic.

Full recovery to 2019 levels at the global level is forecast for 2024.

Africa

The region is expected to reach close to 79.3% of its 2019 level in the year 2022. Due to its dependence on international traffic,Africa will remain part of the highly impacted regions and is expected to make a full recovery to 2019 levels only in mid- to late 2024.

Asia-Pacific

While some countries in Asia-Pacific have reopened to vaccinated travelers, the international passenger market is not expected to see significant improvement before the second half of 2022. The region is expected to have the slowest recovery, reaching only 54.5% of 2019 levels in 2022.

Full year recovery to 2019 levels is expected by the end of 2024 but could slip into 2025 if some countries lag to lift the remaining COVID-19 restrictions.

Europe

With the significant improvement in the first half of the year 2022, the region in the year 2022 will mark 82.5% of its 2019 level. Despite some risks of a slowdown during the fall and winter seasons, Europe full-year recovery to 2019 levels is expected in 2024.

Latin America-Caribbean

The region is expected to continue seeing a positive uptick in 2022. The increase in leisure travel is forecast to bring the region to 91.9% compared to 2019. Full-year recovery for the region is expected in late 2023.

The Middle East

With the region’s high dependence on international travel and connectivity, both of which are improving in Europe and Asia-Pacific except China, the region will continue to boost its recovery in 2022. The region is expected to reach 82.7% of 2019 levels by year end and fully recover only in the first half of 2024.

North America

The strong performance is expected to continue in 2022, helping the region to reach 89.6% of its 2019 level by year end.

North America should be the first region to reach full-year recovery to 2019 levels as early as in 2023.

https://aci.aero/2022/10/06/the-impact-of-covid-19-on-airports-and-the-path-to-recovery/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home