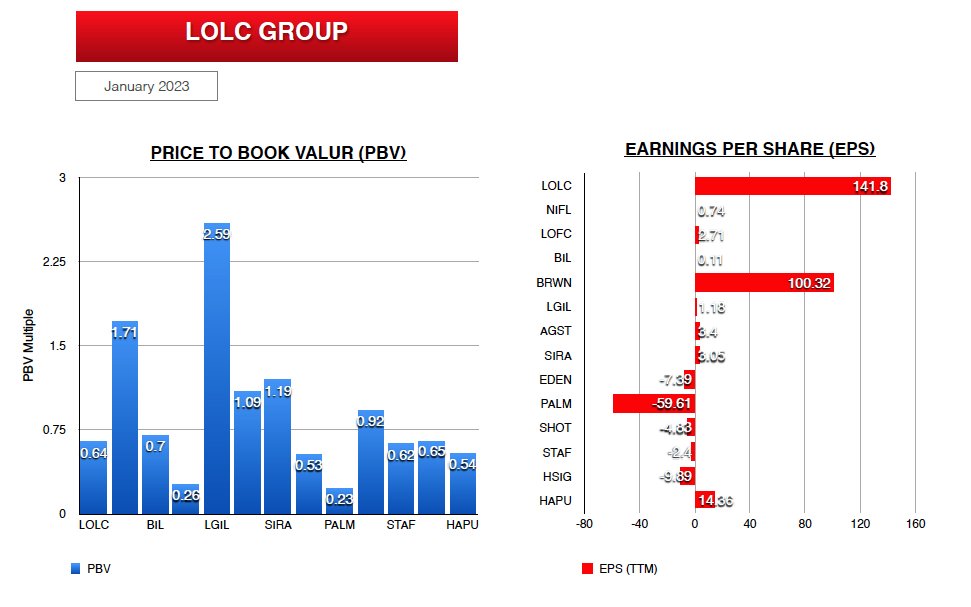

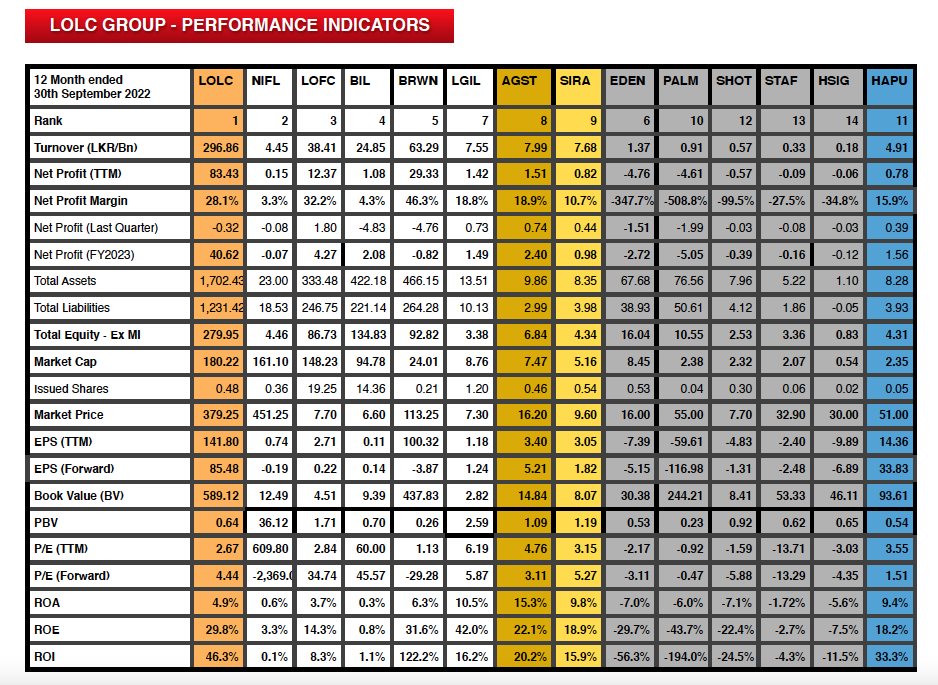

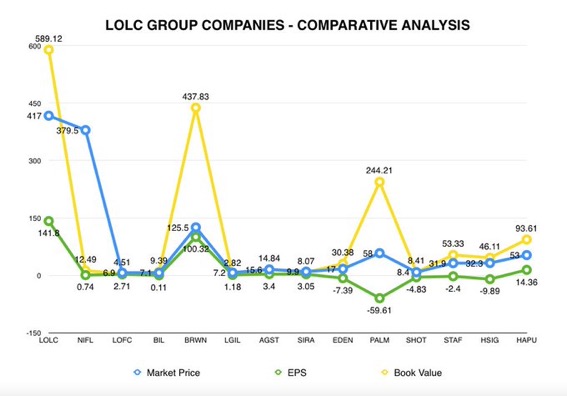

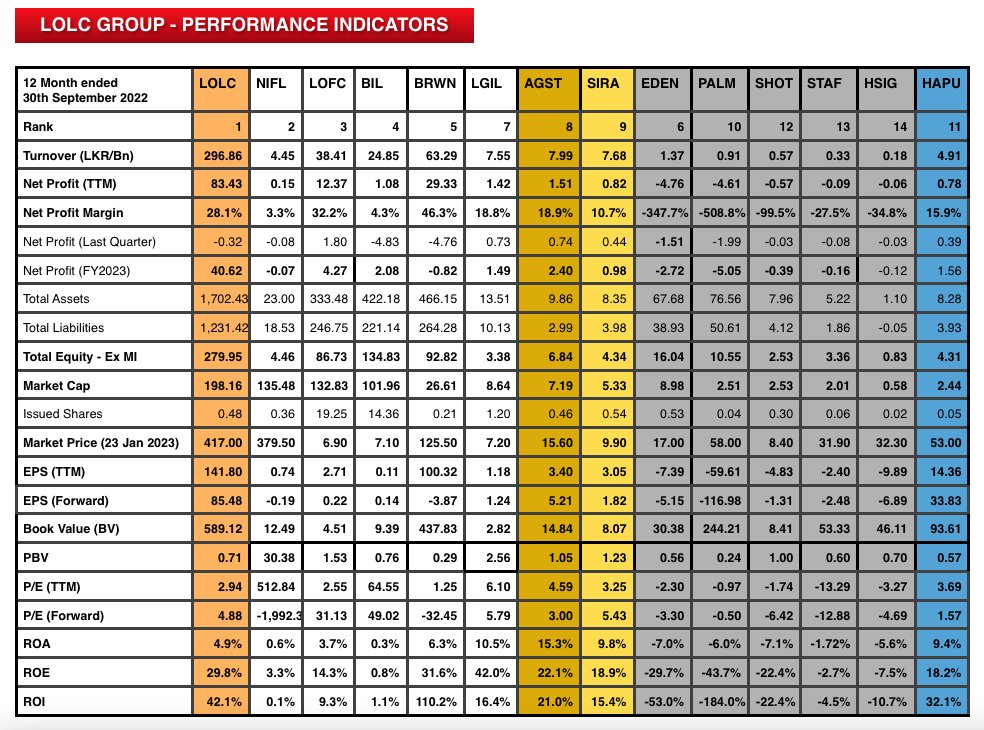

- LOLC group lacklustre performance clearly reflects the negative Earnings per share (EPS/ttm) of its group companies despite efforts to restructure.

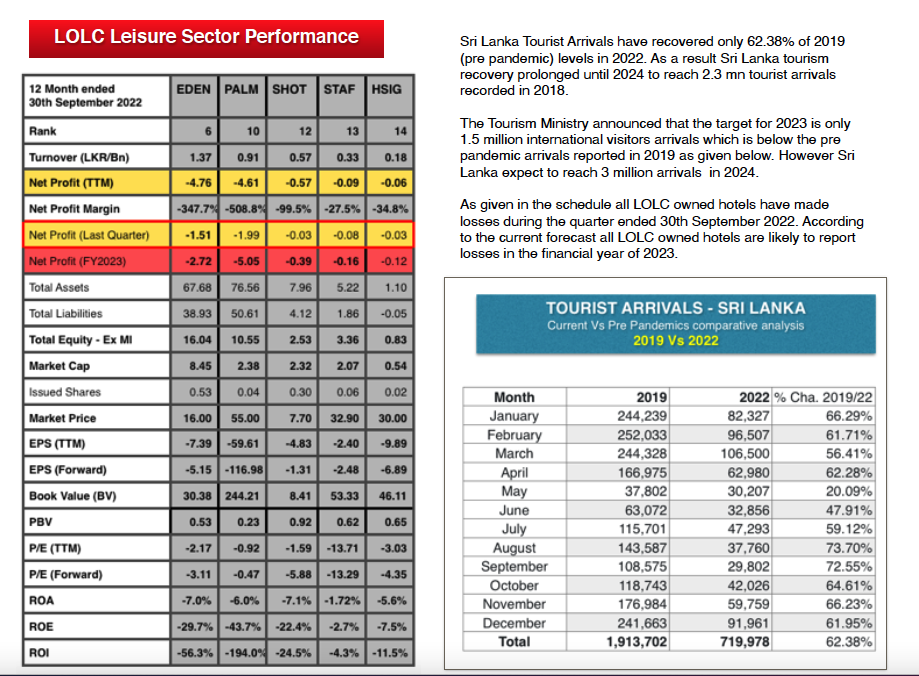

- LOLC owned hotels are likely to continue its losses in to FY 2023 causing financial concerns to the group.

- LOLC Financial sector performance is likely to have significant impact on the banking sector of Sri Lanka

- Attachments

LOLC Group Performance.pdf

LOLC Group Performance.pdf - You don't have permission to download attachments.

- (644 Kb) Downloaded 9 times

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home