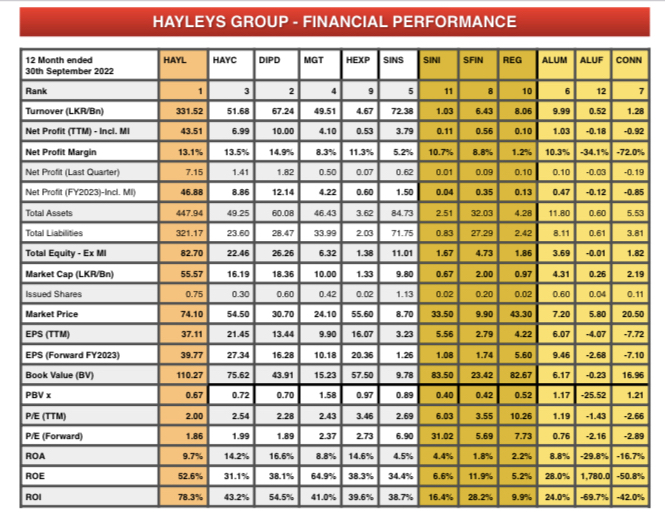

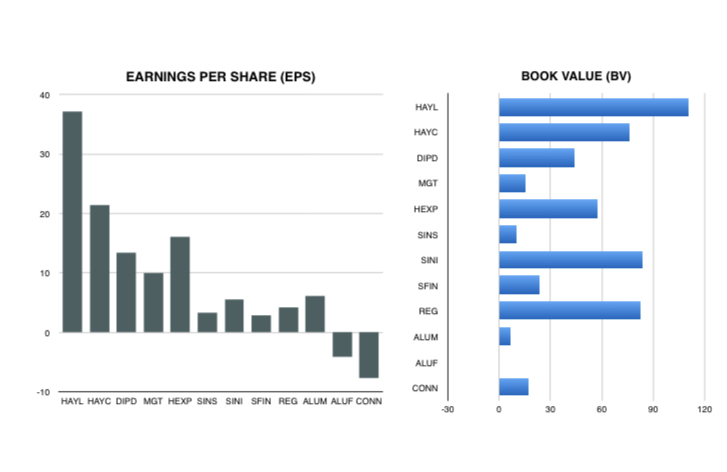

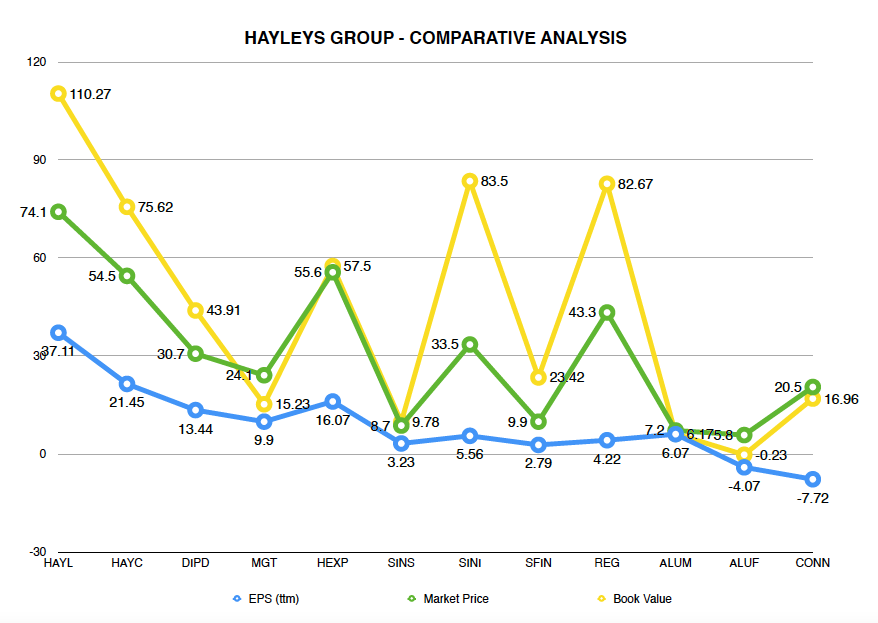

Hayleys PLC (HAYL) reported a Net Profit of LKR 7.15bn (EPS of LKR 5.40 per share) for the quarter ended 30th September 2022. Earnings per share (EPS) for last 12 months/TTM is LKR 37.11 per share whilst forecast EPS for the year ended 31st March 2023 expected be LKR 39.77 per share.

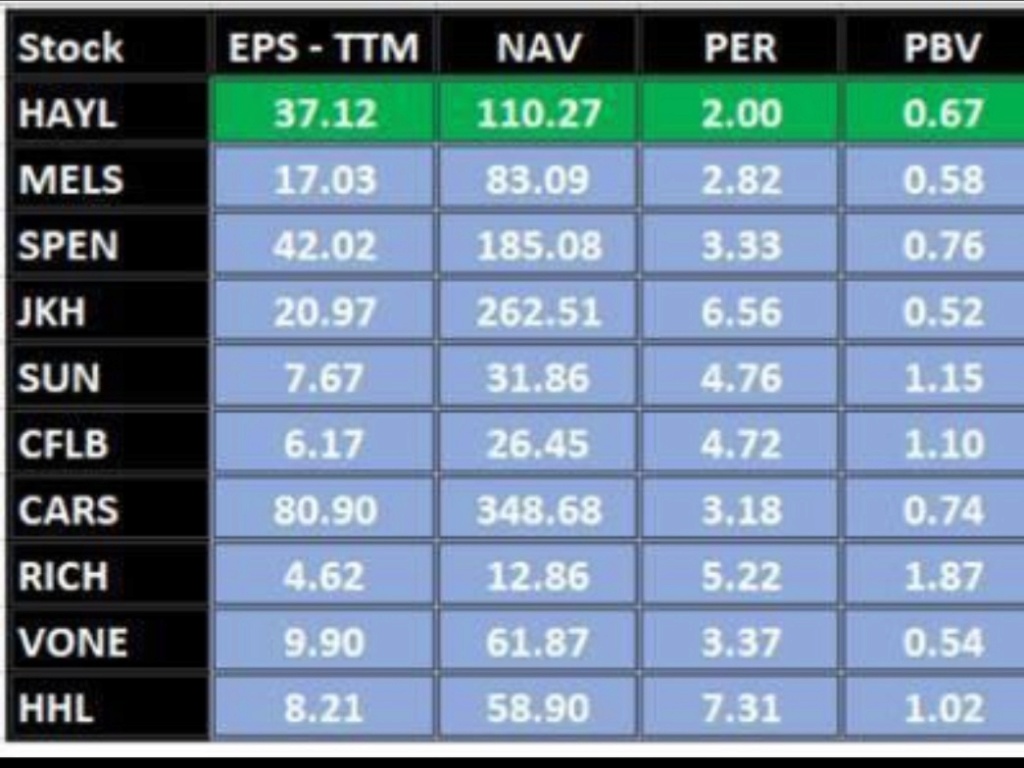

Hayleys PLC share is currently trading at a price of LKR 74.10 per share or Price to Earnings Ratio (PER) multiple of 2X (TTM) and 1.86X (Forward Earnings) basis respectively which is attractive in terms of value.

The Book Value (BV) or Net Asset Value (NAV) of Hayleys PLC is LKR 110.27 per share and at current market price Price of LKR 74.10 per share, the Price to Book Value (PBV) is 0.63X. Accordingly share is trading at 33% discount to the current book value.

Further we expect Earnings for 2H 2022/23 to grow at a moderate 15% from corresponding quarter although actual result of HAYL during 1H 2022/23 indicate growth in excess of 40%.

At the expected growth rate of 15% p.a Hayleys PLC Price to Earnings Growth (PEG) Ratio is below 1.

Download Report: https://easyupload.io/thf4r0

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home