A blue chip stock is a huge company with an excellent reputation. These are typically large, well-established, and financially sound companies that have operated for many years and that have dependable earnings, often paying dividends to investors. A blue chip stock typically has a market capitalization in the billions, is generally the market leader or among the top three companies in its sector, and is more often than not a household name. For all of these reasons, blue chip stocks are among the most popular to buy among investors.

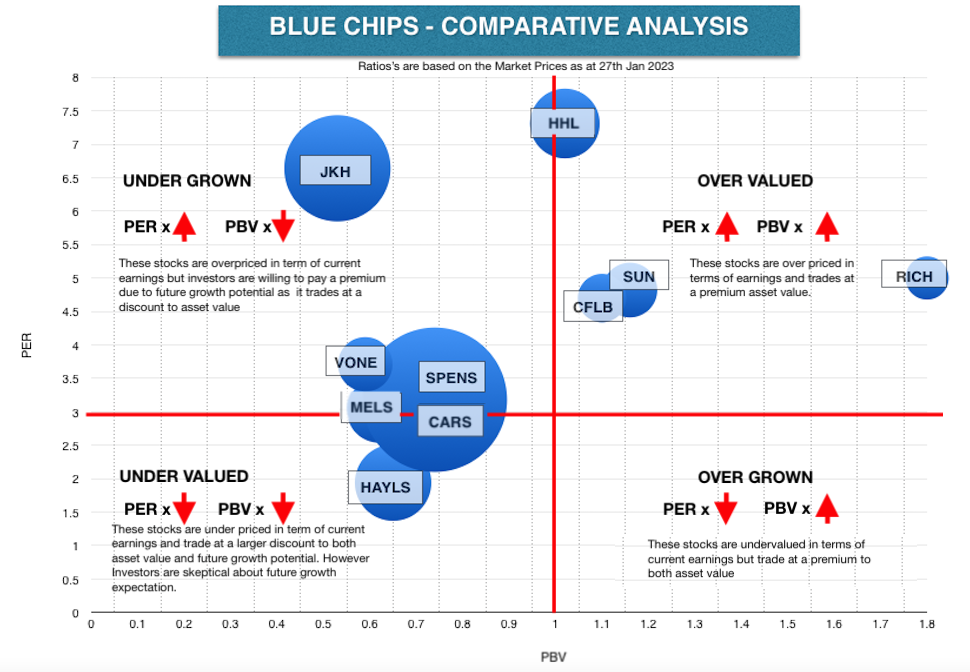

High PE Ratio

A high PE ratio means that a stock is expensive and its price may fall in the future. A low PE ratio means that a stock is cheap and its price may rise in the future. The PE ratio, therefore, is very useful in making investment decisions.

Low PE Ratio

Low P/E. Companies with a low Price Earnings Ratio are often considered to be value stocks. It means they are undervalued because their stock prices trade lower relative to their fundamentals. This mispricing will be a great bargain and will prompt investors to buy the stock before the market corrects it.

High P/B Ratio

A high P/B ratio suggests a stock could be overvalued, while a lower P/B ratio could mean the stock is undervalued. As with most ratios, the P/B ratio varies by industry. A company should be compared with similarly structured companies in similar industries; otherwise, the comparison results could be misleading.

Low P/B Ratio

The price-to-book (P/B) ratio considers how a stock is priced relative to the book value of its assets. If the P/B is under 1.0, then the market is thought to be underpricing the stock since the accounting value of its assets, if sold, would be greater than the market price of the shares.

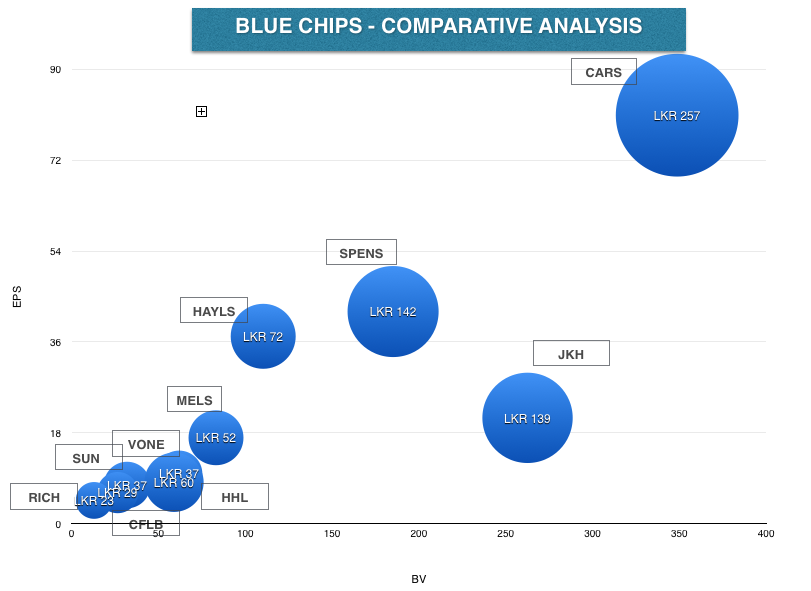

Blue Chip Companies of Sri Lanka and relevant Ratios

Earnings Vs Book Value

What Is a Good Price-to-Earnings Ratio?

The question of what is a good or bad price-to-earnings ratio will necessarily depend on the industry in which the company is operating. Some industries will have higher average price-to-earnings ratios, while others will have lower ratios. For example, in January 2021, publicly traded broadcasting companies had an average trailing P/E ratio of only about 12, compared to more than 60 for software companies.

If you want to get a general idea of whether a particular P/E ratio is high or low, you can compare it to the average P/E of the competitors within its industry.

Is It Better to Have a Higher or Lower P/E Ratio?

Many investors will say that it is better to buy shares in companies with a lower P/E because this means you are paying less for every dollar of earnings that you receive. In that sense, a lower P/E is like a lower price tag, making it attractive to investors looking for a bargain. In practice, however, it is important to understand the reasons behind a company’s P/E. For instance, if a company has a low P/E because its business model is fundamentally in decline, then the apparent bargain might be an illusion.

What Does a P/E Ratio of 15 Mean?

Simply put, a P/E ratio of 15 would mean that the current market value of the company is equal to 15 times its annual earnings. Put literally, if you were to hypothetically buy 100% of the company’s shares, it would take 15 years for you to earn back your initial investment through the company’s ongoing profits assuming the company never grew in the future.

Why Is the P/E Ratio Important?

The P/E ratio helps investors determine whether the stock of a company is overvalued or undervalued compared to its earnings. The ratio is a measurement of what the market is willing to pay for the current operations as well as the prospective growth of the company. If a company is trading at a high P/E ratio, the market thinks highly of its growth potential and is willing to potentially overspend today based on future earnings.

A Low Price-to-Book (P/B) Ratio

A P/B ratio with lower values, particularly those below one, could be a signal to investors that a stock may be undervalued. In other words, the stock price is trading at a lower price relative to the value of the company's assets.

Conversely, market participants might believe that the company's asset value is overstated. If the company has overvalued assets, investors would likely avoid the company's shares because there is a chance that asset value will face a downward correction by the market, leaving investors with negative returns.

A low P/B ratio could also mean the company is earning a very poor (even negative) return on its assets (ROA). If the company has poor earnings performance, there is a chance that new management or new business conditions will prompt a turnaround in prospects and give strong positive returns. Even if this does not happen, a company trading at less than book value can be broken up for its asset value, earning shareholders a profit.

For value investors, the P/B ratio is a tried and true method for finding low-priced stocks that the market has neglected. Value investors, including Warren Buffet, search for opportunities where they believe the market has wrongly valued or priced a stock. A P/B ratio of less than one could be an indicator of an undervalued company that the market has misunderstood.

A High Price-to-Book (P/B) Ratio

A P/B ratio that's greater than one suggests that the stock price is trading at a premium to the company's book value. For example, if a company has a price-to-book value of three, it means that its stock is trading at three times its book value. As a result, the stock price could be overvalued relative to its assets.

A high share price versus asset value could also mean the company is earning a high ROA. However, the high stock price could indicate that most of the goods news regarding the company has already been priced into the stock. As a result, any additional good news might not lead to a higher stock price.

P/B provides a valuable reality check for investors seeking growth at a reasonable price. P/B is often looked at in conjunction with return on equity (ROE), a reliable growth indicator. ROE represents a company's profit or net income as compared to shareholders' equity, which is assets minus debt. ROE is important because it shows how much profit is being generated with the company's assets.

Large discrepancies between P/B and ROE are often a red flag. Overvalued growth stocks can have a combination of low ROE and high P/B ratios. If a company's ROE is growing, its P/B ratio should be doing the same.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.