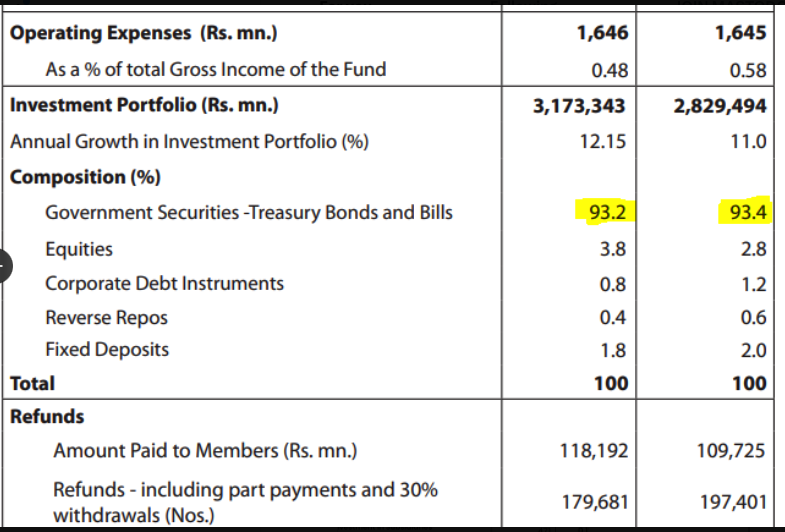

EPF PORTFOLIO

Total write off in the event of 20% hair cut as proposed by Domestic Debt Restructuring (DDR)

LKR 3,173,343mn X 93% X 20% = LKR 589 Billion

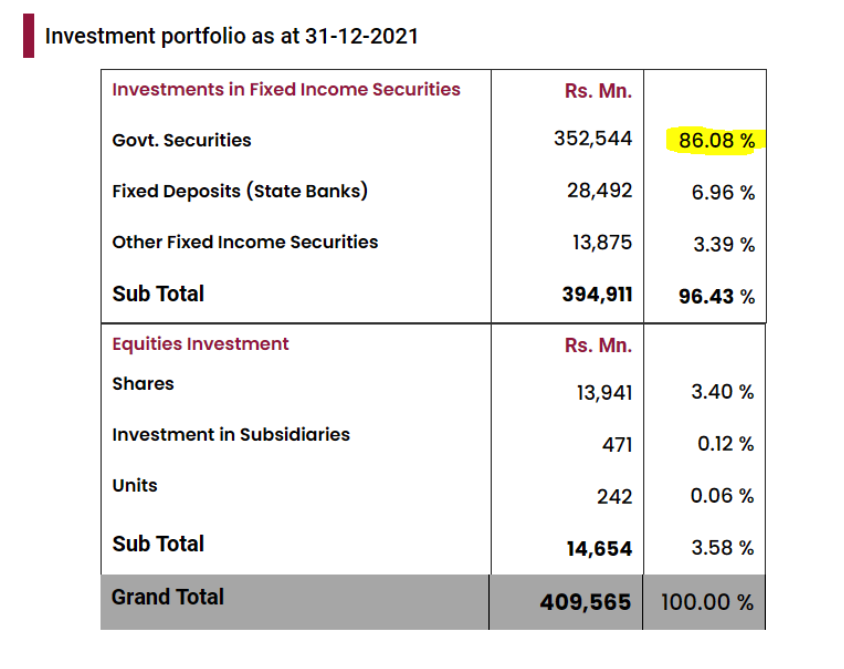

ETF PORTFOLIO

Total write off in the event of 20% hair cut as proposed by Domestic Debt Restructuring (DDR)

LKR 352,544mn X 20% = LK 70 Billion

NBFIs are heavily exposed to sovereign risk through their investments in government bonds. Pension funds are one of the largest holders of local currency government debt. The EPF holds around 29 percent of total domestic local currency government debt, with 94 percent of its investments in government debt. Similarly, the ETF invested 80 percent of its portfolio in government debt by 2021. In addition, insurance companies are also highly exposed to government debt.

Exposures of insurance companies to government debt accounted for 43½ percent of their assets

IMF restructuring scenario serves purely illustrative purposes. There are many alternative ways of restructuring Sri Lanka’s debt that would also achieve the debt restructuring targets. The authorities have indicated their objective to take each creditor’s specific needs into account when designing the restructuring operation, while also stressing the importance of fair burden sharing across creditors. The perimeter of restructuring is based on preliminary considerations shared by the authorities and their financial advisors, taking into account the need to safeguard domestic financial stability.

Accordingly, under the IMF illustrative restructuring scenario:

T-bills held by the Central Bank are exchanged into longer term debt instruments; a select pool of the remaining domestic debt is assumed to be reprofiled to reduce gross financing need, while limiting the impact on the financial sector. For external private debt, a principal reduction is assumed, with amortization beyond the program period, implying a large NPV reduction. For official bilateral debt, similar debt relief in NPV terms is assumed, implemented through a long maturity extension – with amortization payments starting in 2033.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home