- Imminent Banking Crisis

- Unaffordable Borrowing rates

- Volatile Exchange Rates

- High Government Taxes

- Continuation of Import Restrictions

- High Cost of Living

- Possibilty of Stock Market Closure

- Sale of Strategic Government Assets

- IMF Deadline already missed

The After Effects of IMF

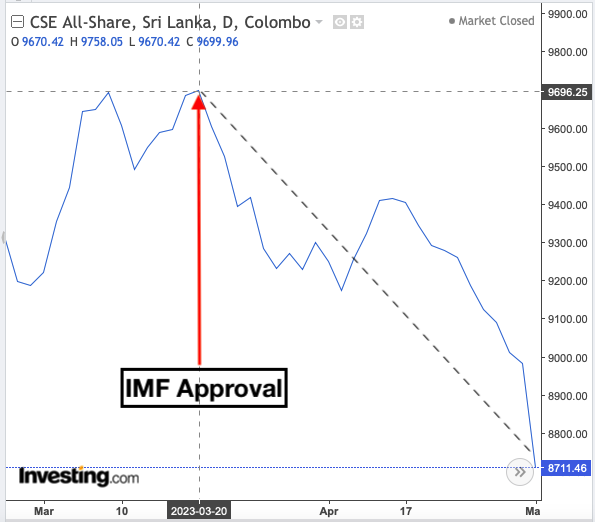

Colombo Stock market all share index (ASPI) has fallen near 10% or 1000 points since the approval of IMF bail out package in March 2023. This decline was further fuelled by the statement made by the President to close the stock market in the event of further crisis.

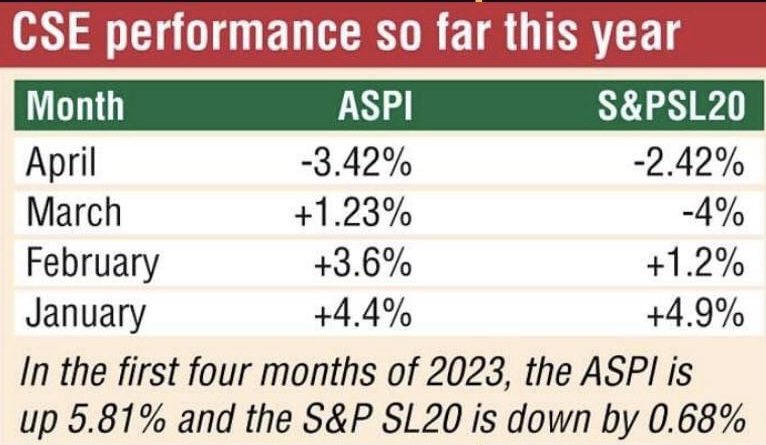

ASPI remain positive with 5.81% gain for the year 2023 despite 3.42% fall in April 23. Market is yet to absorb the consequences of Domestic Debt Restructuring (DDR) and negative impact of IMF reforms. Market sentiments likely to remain negative in coming months.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home