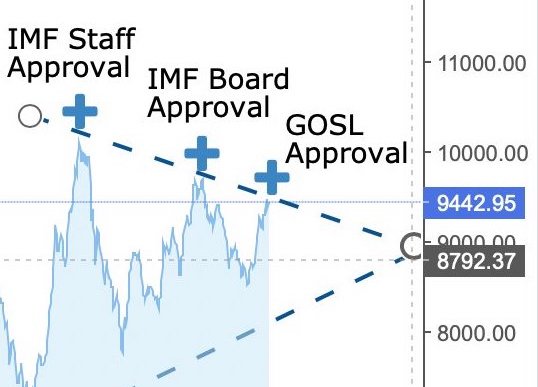

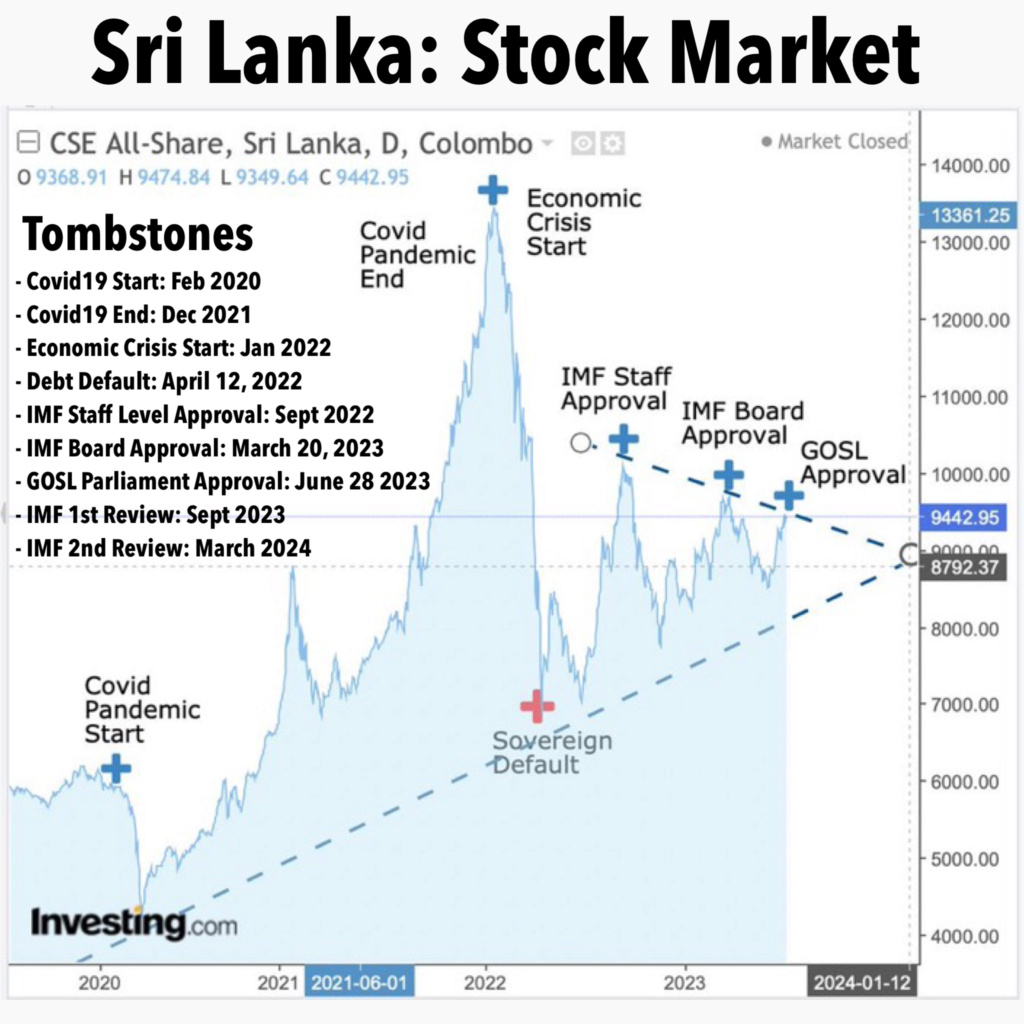

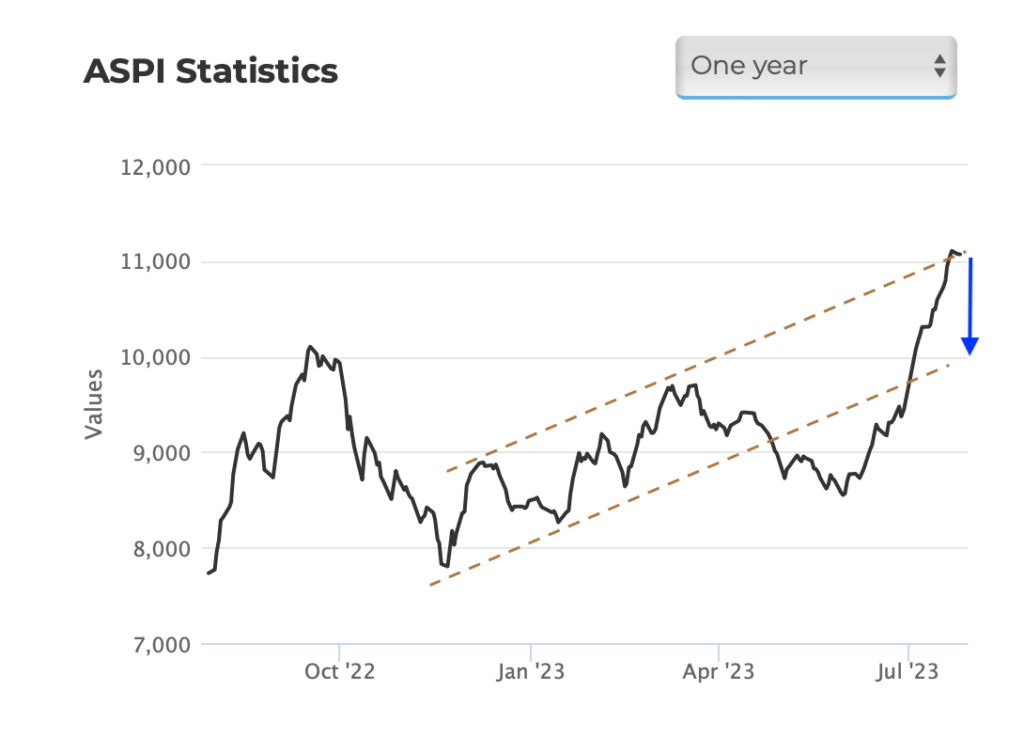

Stock Market investors have yet another opportunity to exit Colombo Stock market after the Covid 19 pandemic which caused economic crisis and sovereign debt default in Sri Lanka prior to the implementation of the IMF proposals and resultant market impact.

Tombstones

- Covid19 Start: February 2020

- Covid19 End: December 2021

- Economic Crisis Start: January 2022

- Debt Default: April 12, 2022

- IMF Staff Level Approval: September 2022

- IMF Board Approval: March 20, 2023

- GOSL Parliament Approval: June 28 2023

- IMF 1st Review: September 2023

- IMF 2nd Review: March 2024

How Stock market reacted to IMF Programme

From September 2021 to Present

The Staff Report prepared by a staff team of the IMF for the Executive Board’s consideration on March 20, 2023, following discussions that ended on September 1, 2022, with the officials of Sri Lanka on economic developments and policies underpinning the IMF arrangement under the Extended Fund Facility. Based on information available at the time of these discussions, the staff report was completed on March 6, 2023.

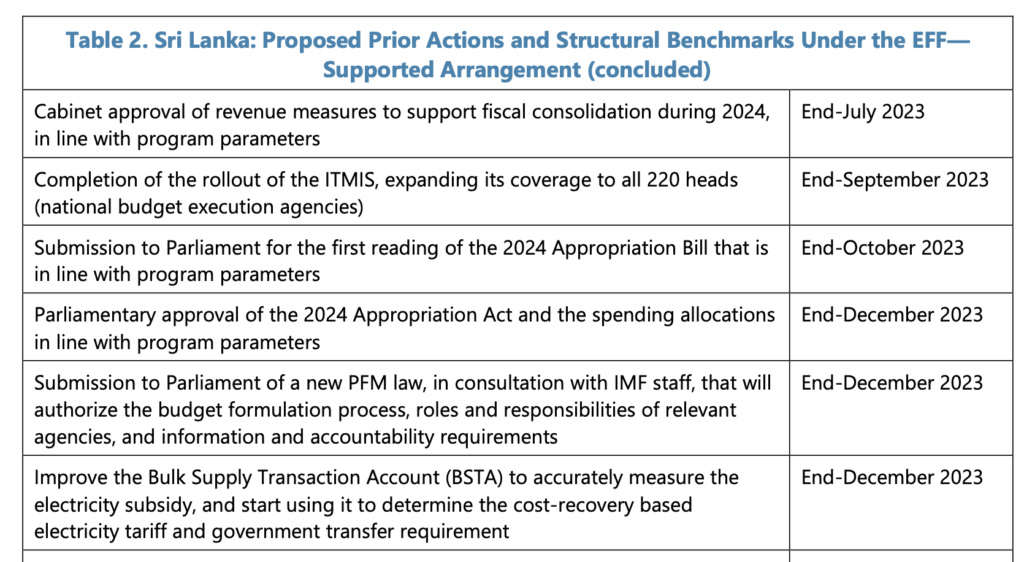

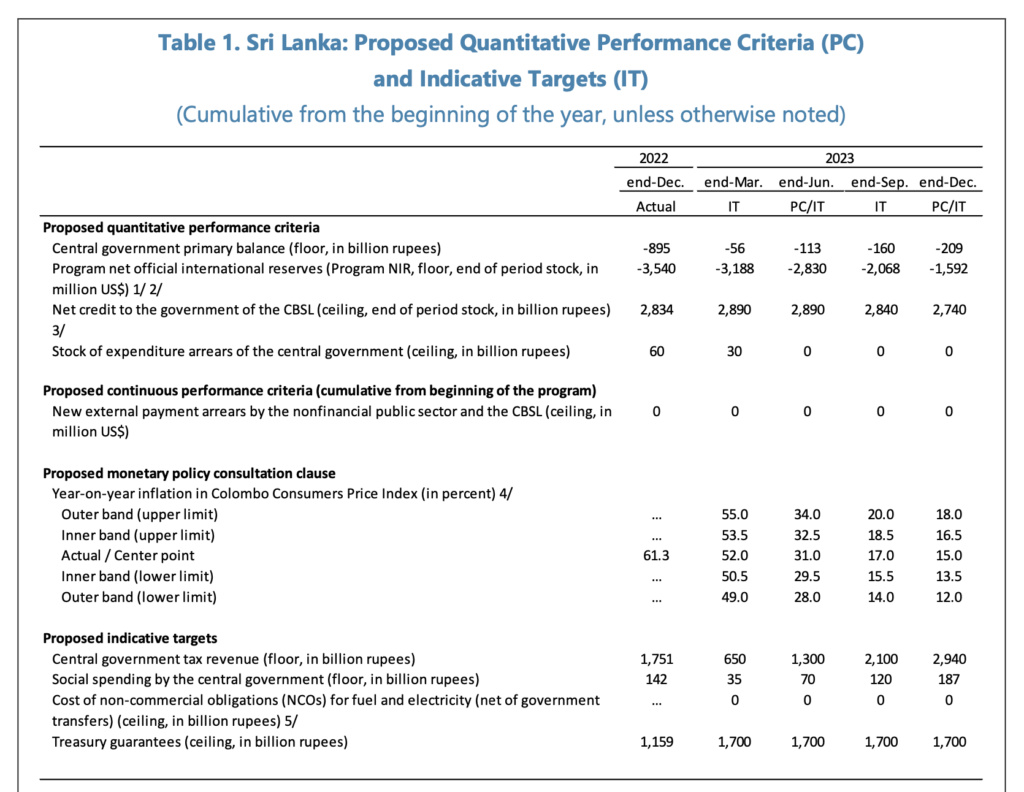

IMF program will be subject to semiannual reviews with performance criteria, the MPCC bands, and indicative targets set out in Table 1 attached to this MEFP and Technical Memorandum of Understanding (TMU).

Completion of the first and second reviews will require observance of the quantitative performance criteria for end-June 2023 and end-December 2023, respectively, as well as continuous performance criteria, as specified in Table 1 attached to this MEFP.

The reviews will also assess progress toward observance of the structural benchmarks specified in Table 2 attached to this MEFP. The first two reviews of the program will take place on or after September 1, 2023 and March 1, 2024, respectively. We request the use of IMF financing for budget support and, in this respect, will finalize a Memorandum of Understanding between the CBSL and the Ministry of Finance on responsibilities for servicing financial obligations to the IMF.

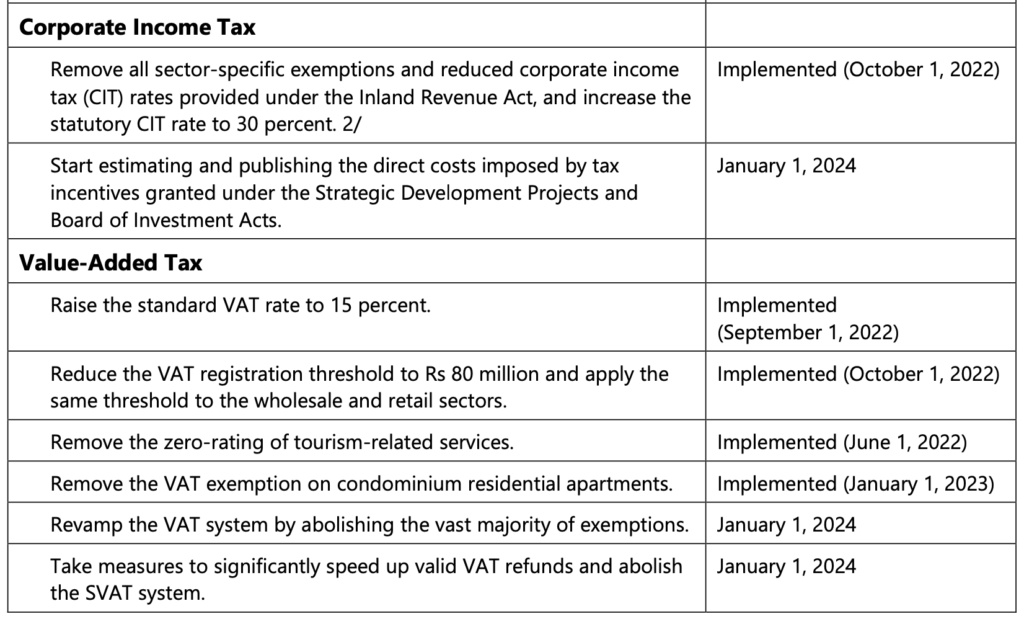

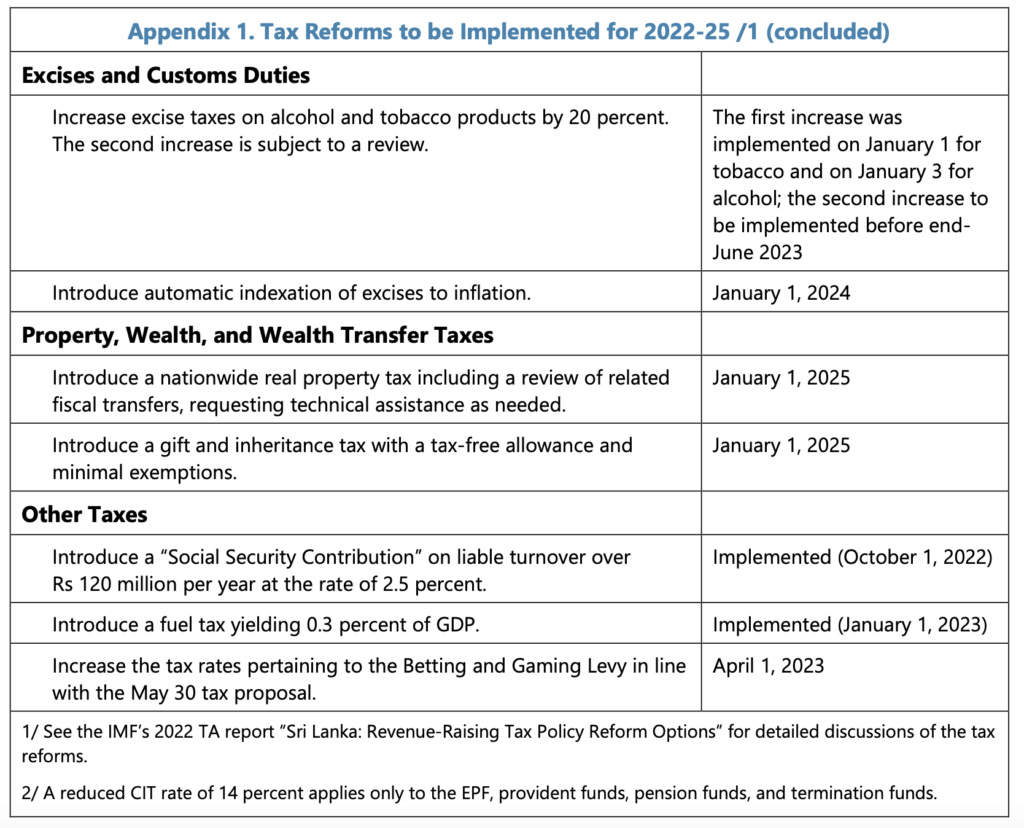

IMF: Future Implications

Sri Lanka: Proposed Quantitative Performance Criteria and Indicative Targets

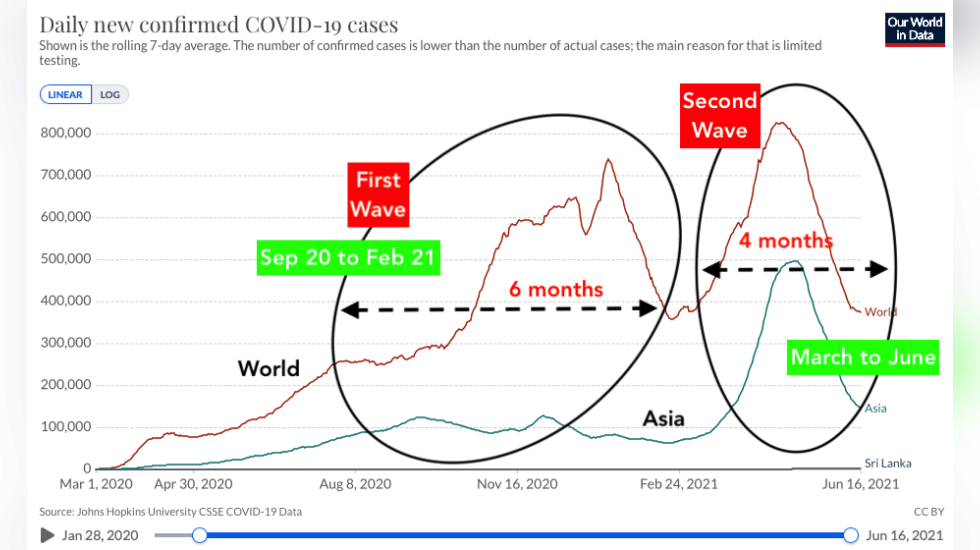

How Covid19 affected Sri Lanka

From: February 2020 to December 2021

The COVID-19 pandemic in Sri Lanka is part of the ongoing worldwide pandemic of coronavirus disease 2019 (COVID-19) caused by the severe acute respiratory syndrome coronavirus 2 (SARS-CoV virus. The first case of the virus in Sri Lanka was confirmed on 27 January 2020, after a 44-year-old Chinese woman from Hubei, China, was admitted to the Infectious Disease Hospital in Angoda, Sri Lanka. As of 1 September 2021, a total of 462,767 COVID-19 cases had been recorded in the country, 386,509 patients had recovered from the disease, and 10,140 patients had died.

The first reported case involving a Sri Lankan outside the country was reported in Italy on 3 March 2020. As of 23 March 2020, forty-five quarantine centres had been built in the country by the Sri Lanka Army as a preventative measure in an attempt to stop the spread of the pandemic. Nearly 3,500 people were placed under quarantine in 45 quarantine centres, including 31 foreigners from 14 countries. As of 25 March 2020, Sri Lankan authorities tracked down over 14,000 people who had come into contact with identified patients, and ordered those people to self-quarantine. As of 16 April 2020, Sri Lanka was named the 16th highest-risk country for contracting the virus.[9] In April 2020, Sri Lanka's response to the pandemic was ranked as the 9th best in the world.

Although Sri Lanka was successful in handling the first wave of the pandemic, the government's failure to handle the second and the third waves of the pandemic have caused a spike in COVID-19 deaths since November 2020. There was a sudden increase in COVID-19 cases after the relaxation of health restrictions during the Sinhala and Tamil New Year in April 2021. The highly contagious Delta variant has been responsible for the considerably high fatality rate in the country since August 2021. As of August 2021, Sri Lanka became the country with the fourth-largest number of daily deaths in the world by population just behind Georgia, Tunisia, and Malaysia. Government negligence in implementing a lockdown, negligent behaviour of the general public, and teachers' protests have all contributed to the record spike of COVID-19 cases and deaths in the country.

On 20 August 2021, government imposed a ten-day lockdown island-wide to curb the spread of COVID-19 cases.[ The decision to lockdown the country came following the immense pressure from the health authorities and the political parties who demanded complete lockdown after Sri Lanka surpassed 1,000 deaths over the course of eight days.It is believed that the COVID-19 cases in the country are underreported by the officials and allegations regarding the manipulation of details regarding the COVID-19 pandemic in the country were also raised.

Some businesses imposed a voluntary lockdown for a period of 10 to 14 days during the early parts of August when the government refused to impose a lockdown due to the worsening situation of the economy. The Central Bank of Sri Lanka raised interest rates in August 2021, and Sri Lanka became the first nation in Asia to tighten the monetary policy during the pandemic era. On 27 August 2021, the government extended the lockdown to 6 September 2021 as the daily death toll surpassed 200 for the first time since the pandemic began.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home