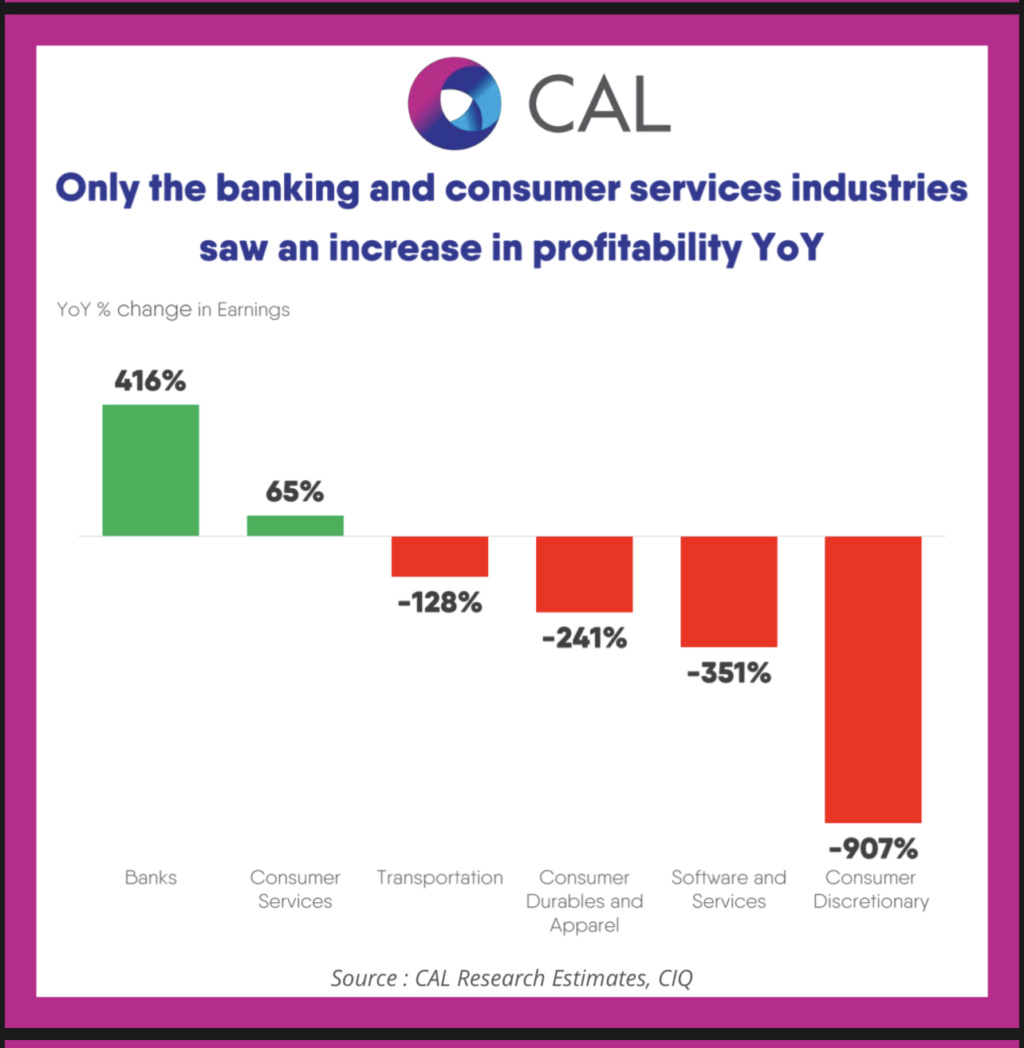

Considering the key positive developments in the Sri Lankan banking industry, there are indeed some lucrative investment potentials.

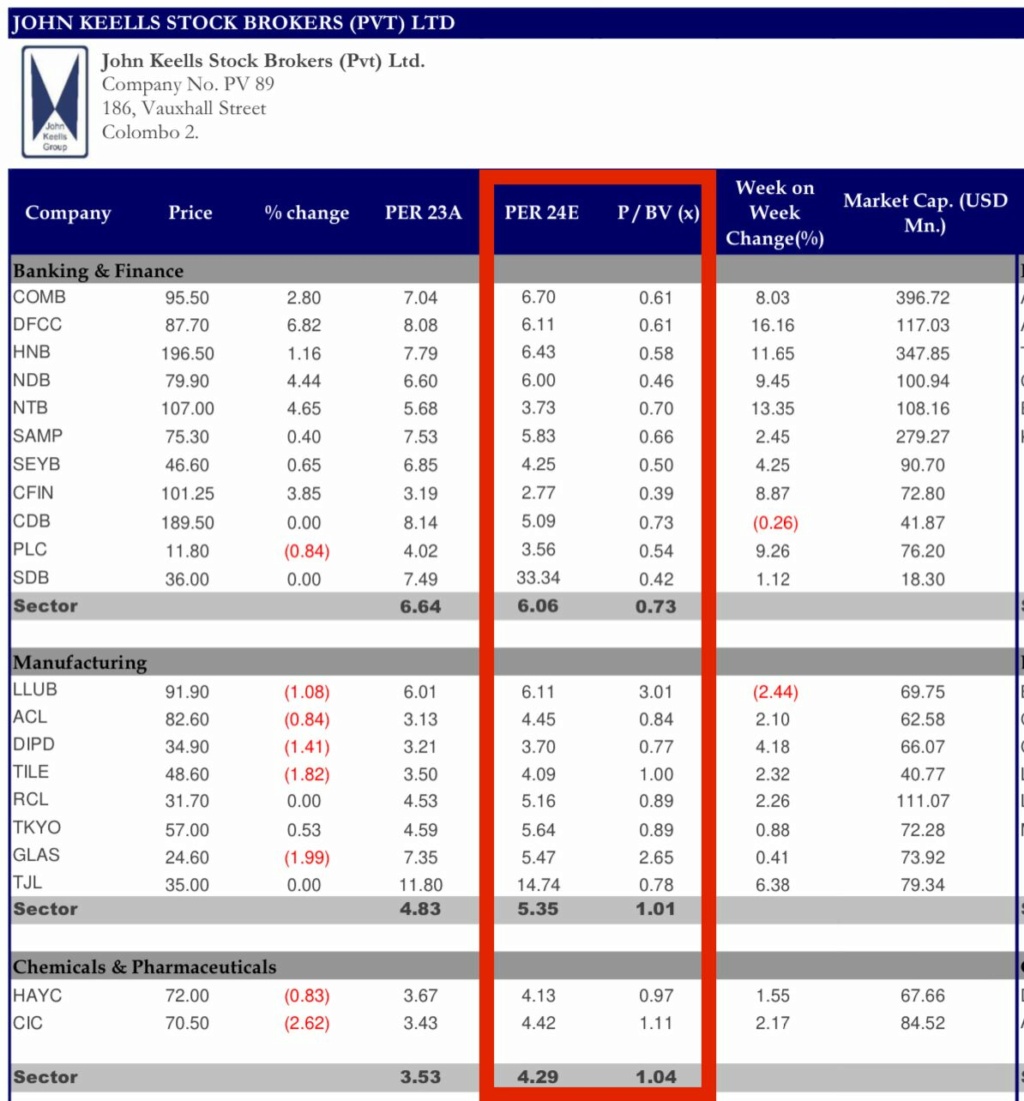

Significantly oversold share prices of Banks since 2019~2020 opening a large share price upside potential.

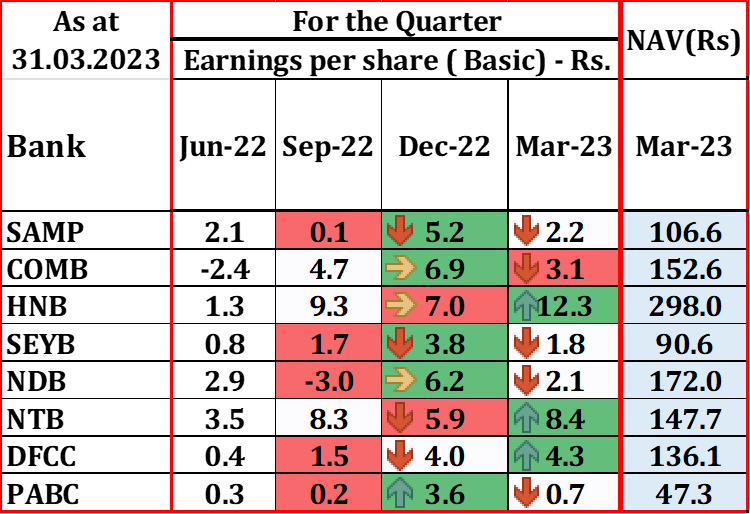

Significant Gains from Treasury Bonds: The gains from investing in Government securities, especially Treasury Bonds, at a yield rate above 27%~28%, suggest attractive returns for investors. This could positively impact banks that have capitalized on this opportunity, such as Nations Trust Bank (NTB) and DFCC Bank as per market sources. High returns from these securities could boost banks' profitability and shareholder value significantly.

Absence of impairment charges: The large/partial provisions made to cover possible haircuts due to default in SLSB and SLDB indicates an improvement in the overall credit quality of these assets after the DDO. Lower provisioning requirements enhance the banks' financial performance and strengthen their balance sheets.

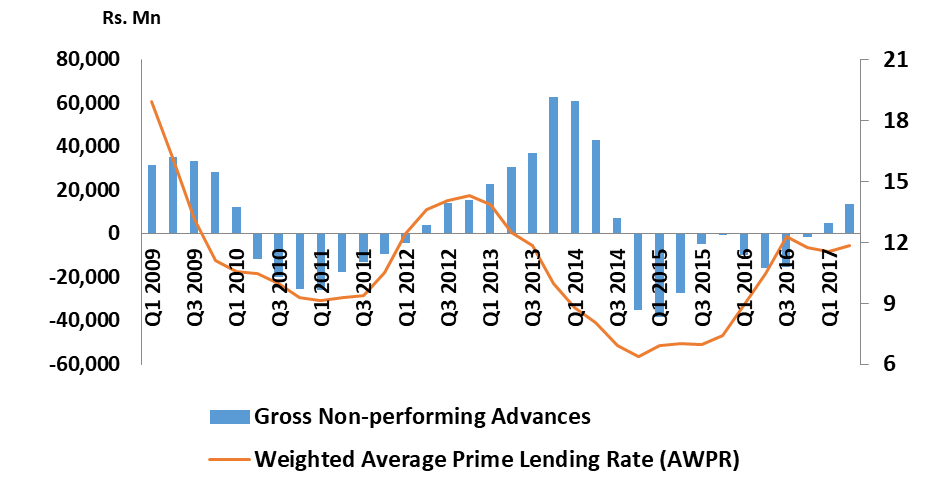

NPA Reduction and Recovery: The reduction in Non-Performing Assets (NPA) during a low-interest-rate cycle (NPA and AWPLR has a positive correlation) and the significant reversals in provisions made on loan book, especially from the recovery in the tourism sector, are positive signs to improve asset quality. It suggests that the banks are effectively managing their asset quality and risk exposures.

Estimated Loan Growth: Anticipated loan growth from 4Q23 due to relaxation in imports targeting the X-mas season where importers are compelled to enhance working capital requirements due to USD/LKR depreciation from Rs 200~Rs 340, and low-interest-rate pressure set by the Central Bank of Sri Lanka (CBSL) can boost banks' lending activities. This may lead to increased interest income due to volume growth leading to potential revenue growth for banks.

Removal of "Country Default Status": The removal of "country default status” continuously highlighted by the President of Sri Lanka and the state Minister of Finance could lead to credit rating improvements for the country. This can have a positive impact on banks' borrowing costs and enable them to access international funding at more favorable terms.

Low-Cost Funding Lines: The potential to borrow low-cost funding lines with a country rating upgrade, where recently DFCC Bank secured with its accreditation by the Green Climate Fund (GCF), can provide a competitive advantage for DFCC Bank to offer more attractive interest rates and potentially gain market share from competitors.

Announcement Policy Interest Rate Cuts in 2H23: If the announced policy interest rate cuts are implemented by CBSL, it can further push interest rates towards further to lower levels. Lower interest rates can stimulate economic activity and increase demand for credit, benefiting the banking industry.

As investors, conduct thorough research on individual banks, their financial health, risk management practices, and competitive positioning prior to decision making. Stay up-to-date with the latest economic and market developments to make well-timed investment choices.

Good Luck

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home