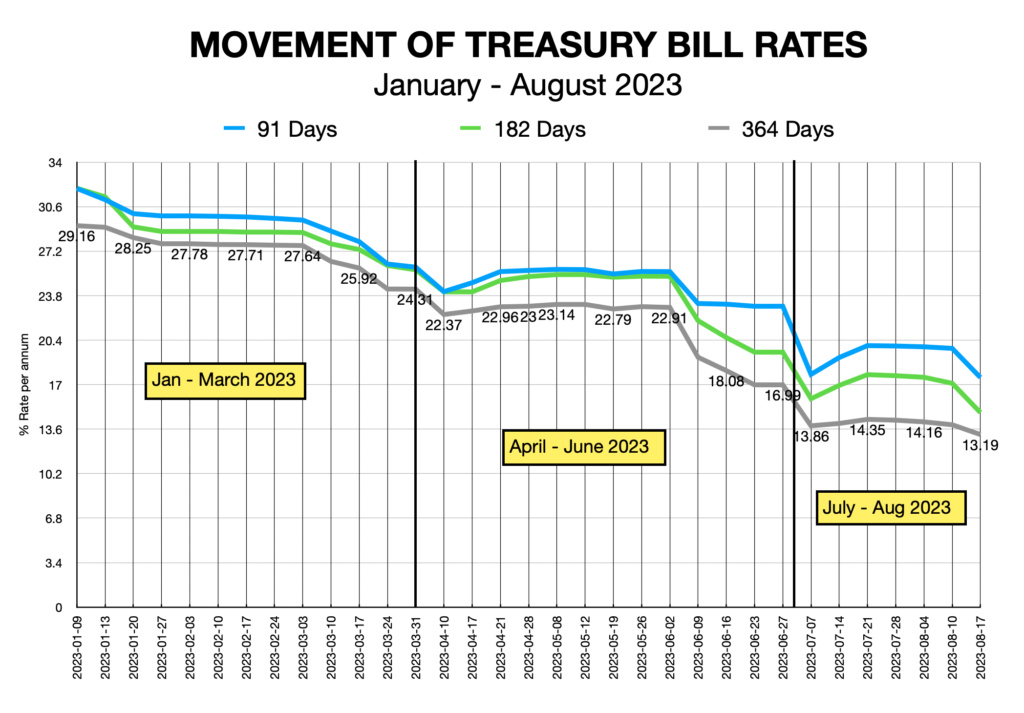

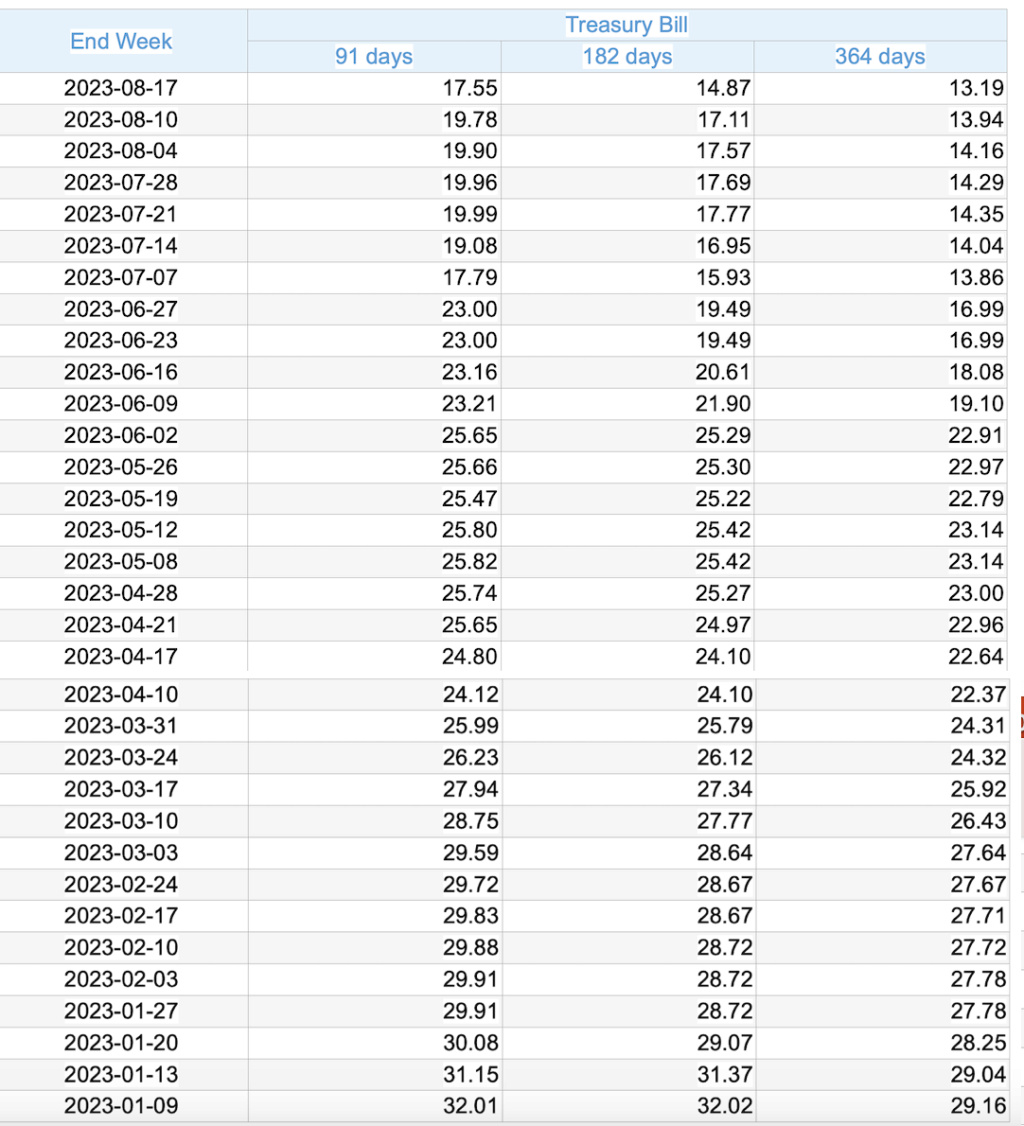

As given above Government Treasury Bill Rates have fallen from high of 32% p.a to 18% from January to August 2023. How much more can TB Rates fall? How will it impact Banks and Treasury Bond Companies like CALT/CFVF/FCT? Can they maintain the same earnings growth in coming Quarters?

Future Outlook does not look all that promising. Why?

TB rates went upto 32% p.a due to economic crisis. These Bond Companies only make profits when TB/Interest Rates come down from the High. TB rates have already fallen from 32% to 18%. As a result these companies made a super profits which is hard to sustain in the future.

If these Companies are to make same Profits next quarter interest rates will have to fall from 18% to 2% p.a. This is very unlikely to happen. Therefore the profits made by these companies are not sustainable. Valuing these companies on the straight line earnings is improper and incorrect.

Profits of these Bond companies are cyclical. Eg: Like Tsunami or Covid 19 Pandemic which cannot be predicted with any certainty.

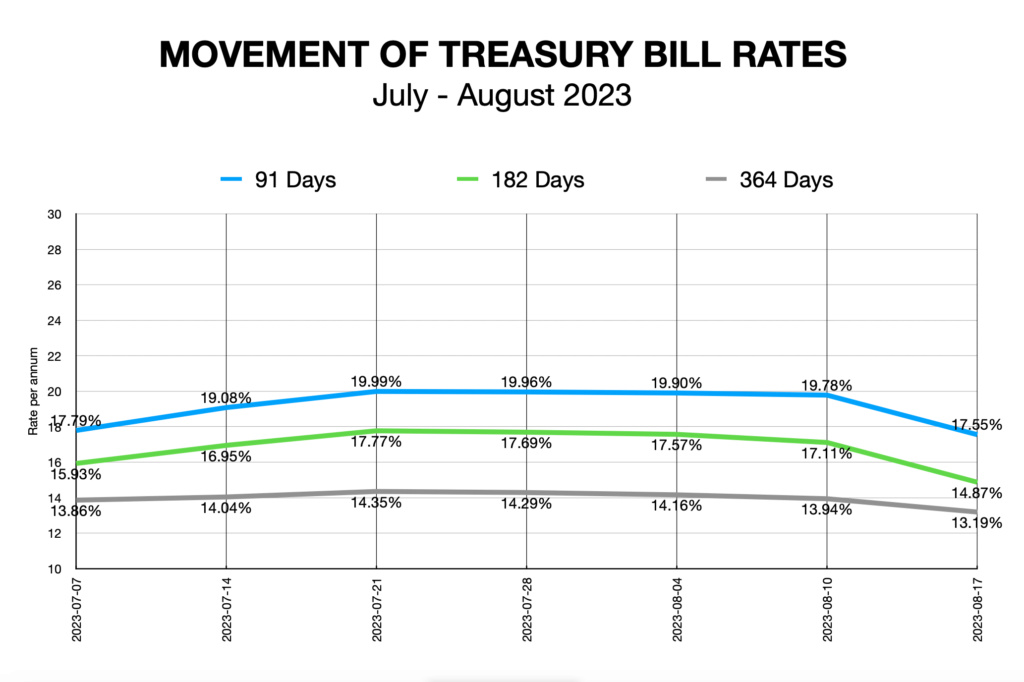

September Quarter Forecast

Find Above, Treasury Bill (TB) Movement of the July - Aug 2023 quarter to-date. Hardly any significant fall so far, therefore next quarter Earnings of the bond companies expected to be lower.

https://www.cbsl.lk/eResearch/Modules/RD/SearchPages/Indicators_GovernmentSecurities.aspx

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home