Wonder of Asia

Bond Trading Companies (Primary Dealerships) owned by few individuals make huge profits from Treasury Bills Sales whilst over 2 million EPF members undergo Domestic Debt Restructuring (DDR) and loss of value for their life time savings with no mercy from justice system.

In the implementation of DDR, the government has excluded the country’s financial sector, mainly represented by banks and non-bank financial institutions since they are already subject to an effective tax rate of over 50 per cent. As such, it is clear that DDR will have no impact on the banking sector and its depositors. However, there is an impact on the EPF and the ETF.

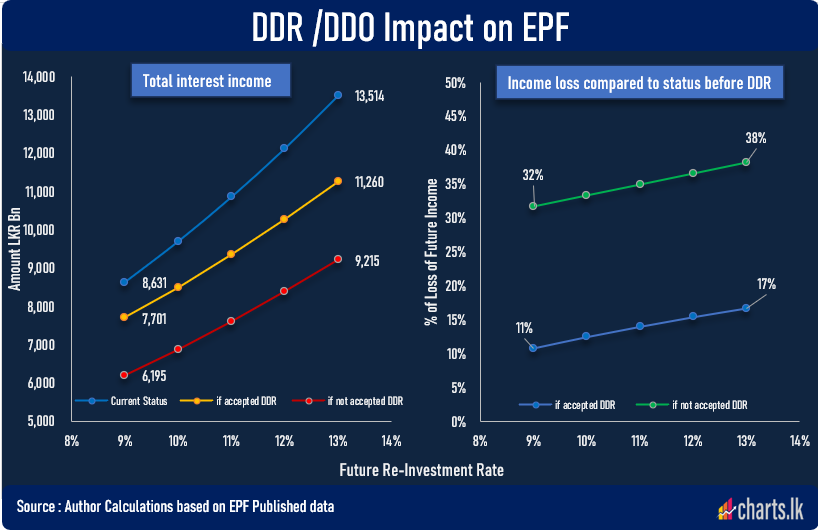

The loss to the EPF would vary based on future interest rate behaviors. The opportunity loss would be realized over the period of time on EPF, where the fund will only be able to transfer lower income to the members under DDR compared with the current status. The higher future interest rates will increase the opportunity loss to the fund.

Total income under the current portfolio is estimated as LKR 8.631T at a 9% re-investment rate, which will fall to LKR 7.7T if DDR is accepted and will fall further to 6.195 T if the DDR is not accepted.

Total income loss would be 11% compared with the current status if DDR is accepted at a 9% reinvestment rate. It would be 32% if EPF rejects the DDR proposal.

Supreme Court rejects petition against alleged EPF and ETF cuts

Aug 09, Colombo: The Supreme Court today ruled to dismiss the fundamental rights petition submitted by the Inter-Company Employees’ Union requesting an order preventing the curtailment of the loans taken by the government from the Employees’ Provident Fund (EPF)and the Employees’ Trust Fund (ETF) in the domestic debt optimization process.

After a lengthy consideration, the Supreme Court bench comprising justices S. Thurairaja, Kumuduni Wickramasinghe and Mahinda Samayawardena announced the court’s decision.

When the petition was called for consideration, Deputy Solicitor General Kanishka de Silva, who appeared for the respondents, told the court that they would raise preliminary objections requesting to dismiss the petition without hearing.

http://www.colombopage.com/

Exceptional Profits Reported By Bond Trading Companies

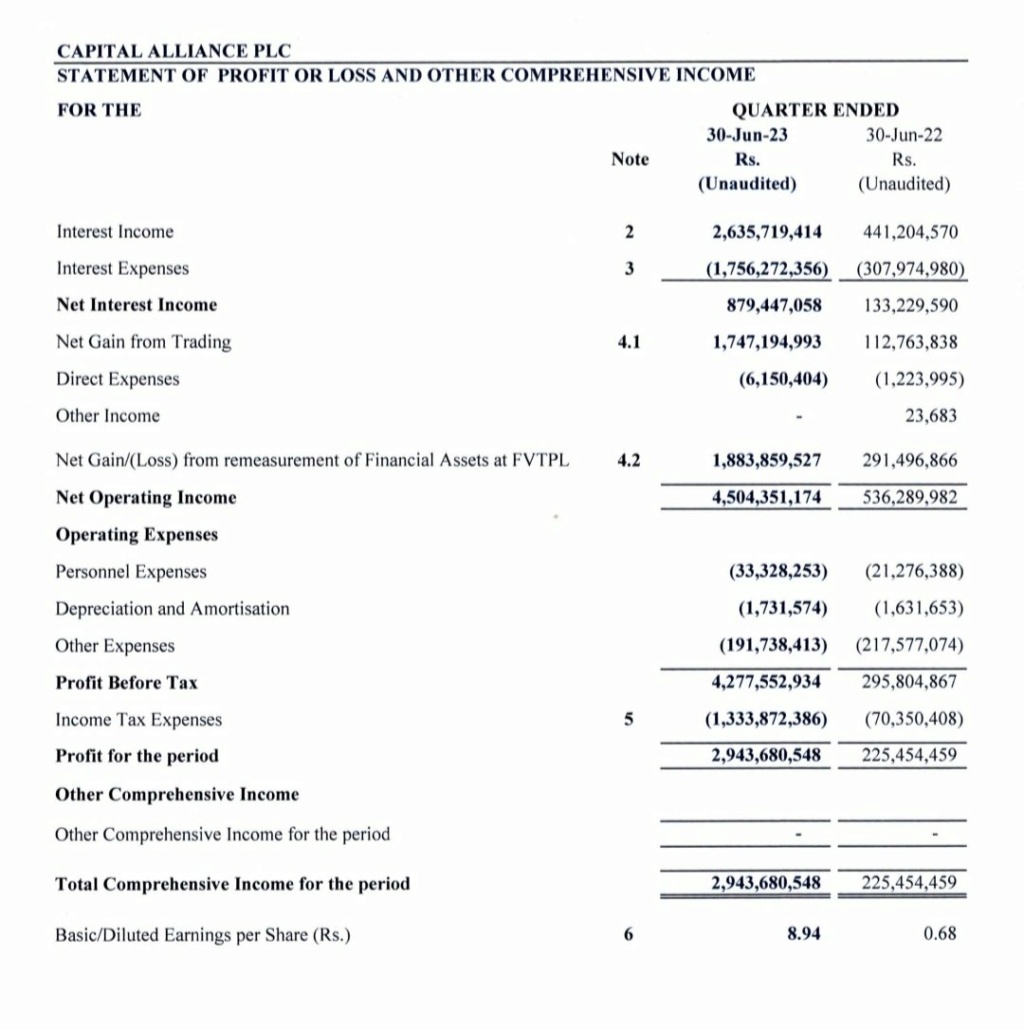

Capital Alliance PLC #CALT reported exceptional earnings (2.94 bn PAT) in June Q as expected. Q EPS (8.94) has exceeded last year annual EPS. Simply exceptional.

https://twitter.com/nandasiri_amila/status/1691081057628807168?s=20

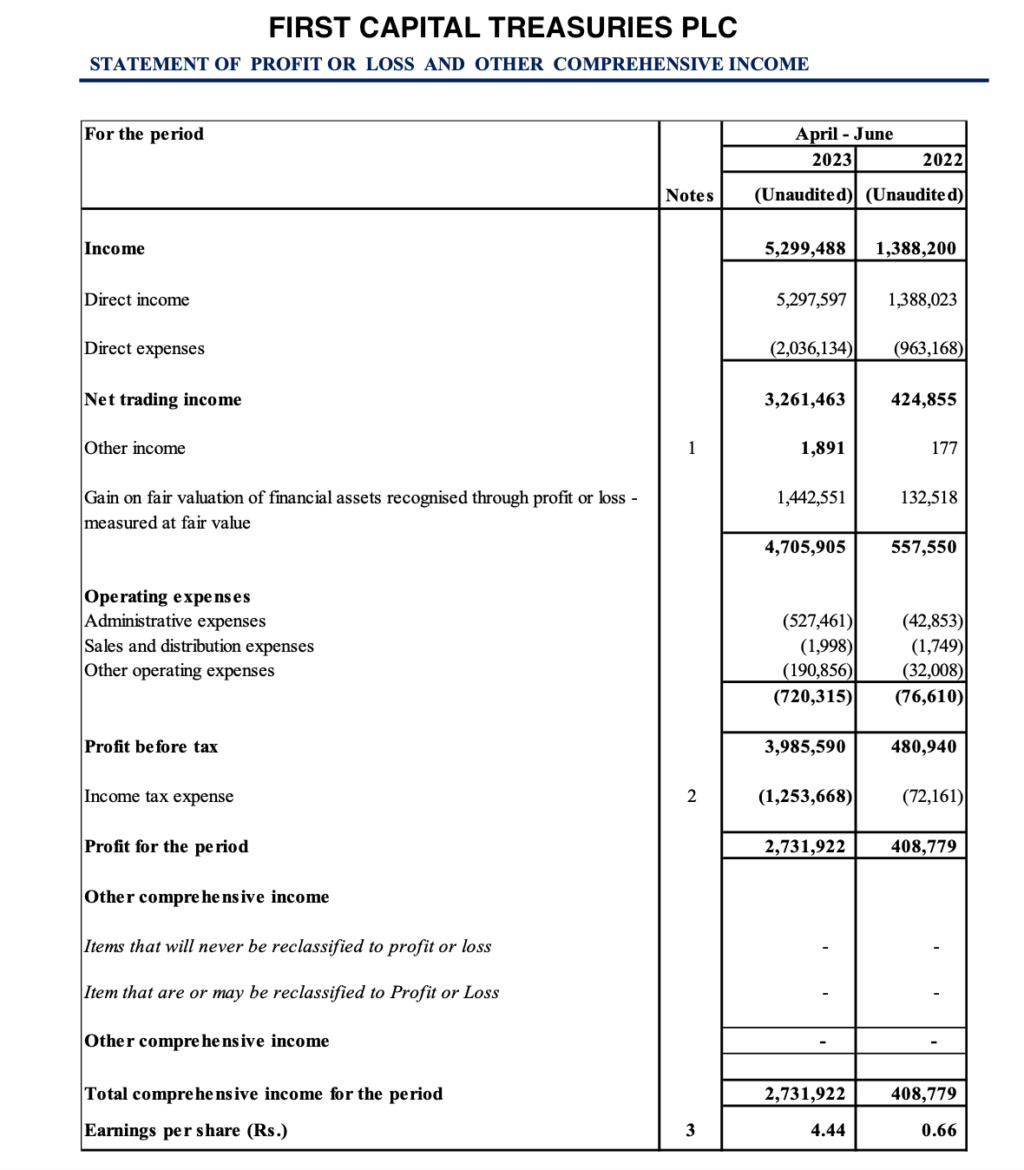

First Capital Treasuries PLC #FCT reported exceptional earnings (2.7 bn PAT) in June Q as expected. Q EPS (4.44) has exceeded last year annual EPS. Simply exceptional.

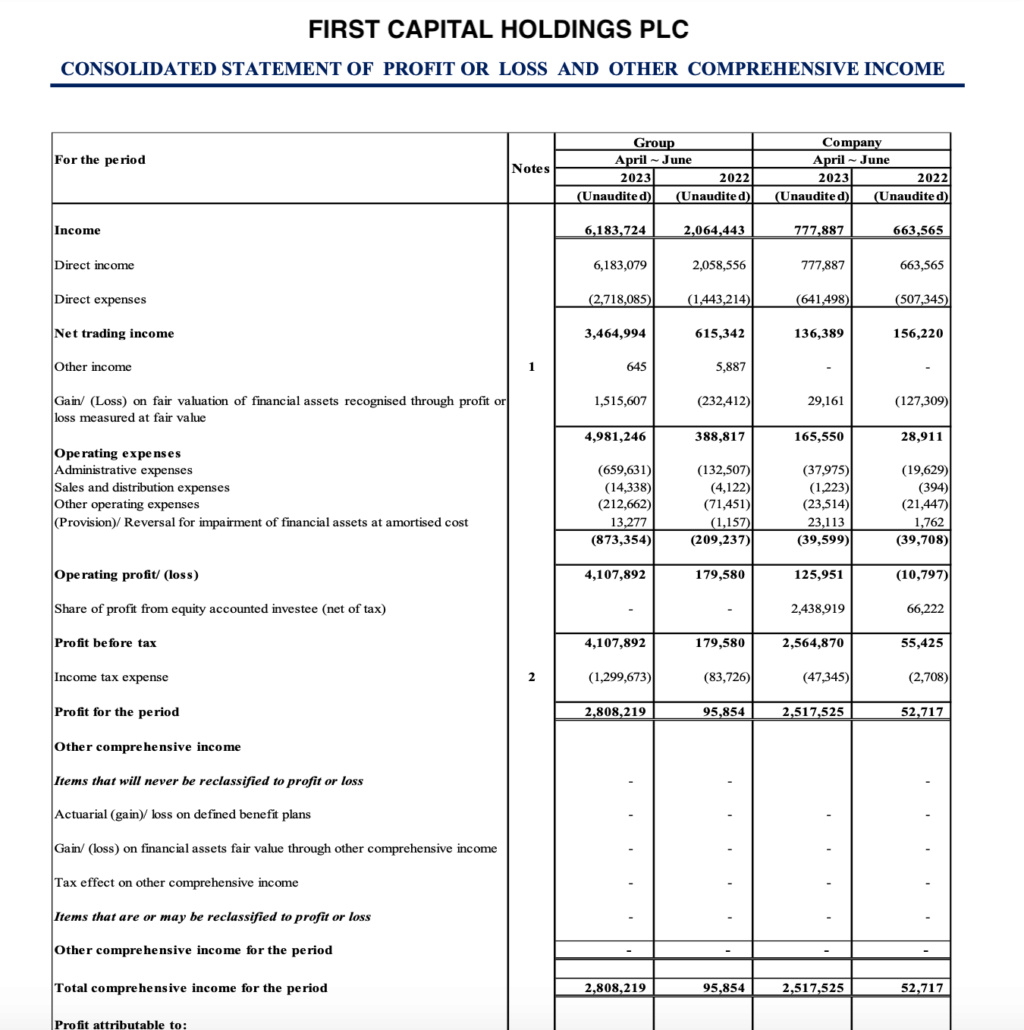

First Capital Holdings PLC #CFVF reported exceptional earnings (2.81 bn PAT) in June Q as expected. Q EPS (6.22) has exceeded last year annual EPS. Simply exceptional.

https://cdn.cse.lk/cmt/upload_report_file/698_1692100940698.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.