- Corporate Tax Impact on Earnings

Increased Tax implication expected to have full impact in September Quarter. GOSL expected to levy more taxes on banks as per IMF recent review. In this context taxes on Treasury Bill Gains are likely to be included in the budget.

Taxation of banks in Sri Lanka remains at a very high level totalling around 60% to 70% of its profits before tax, including the consumption taxes.

- NPL Impact on Earnings

Non Performing Loans have to be provided in full as per the CBSL regulations for provisioning, Banking Sector average NPL's have exceeded 12%. No adequate provisions were made since the lifting of the moratorium in December 2022.

Net Asset Values (after NPL adjustment) indicate that most banking sector shares are currently trading at a premium.

- Interest Rate impact on Earnings

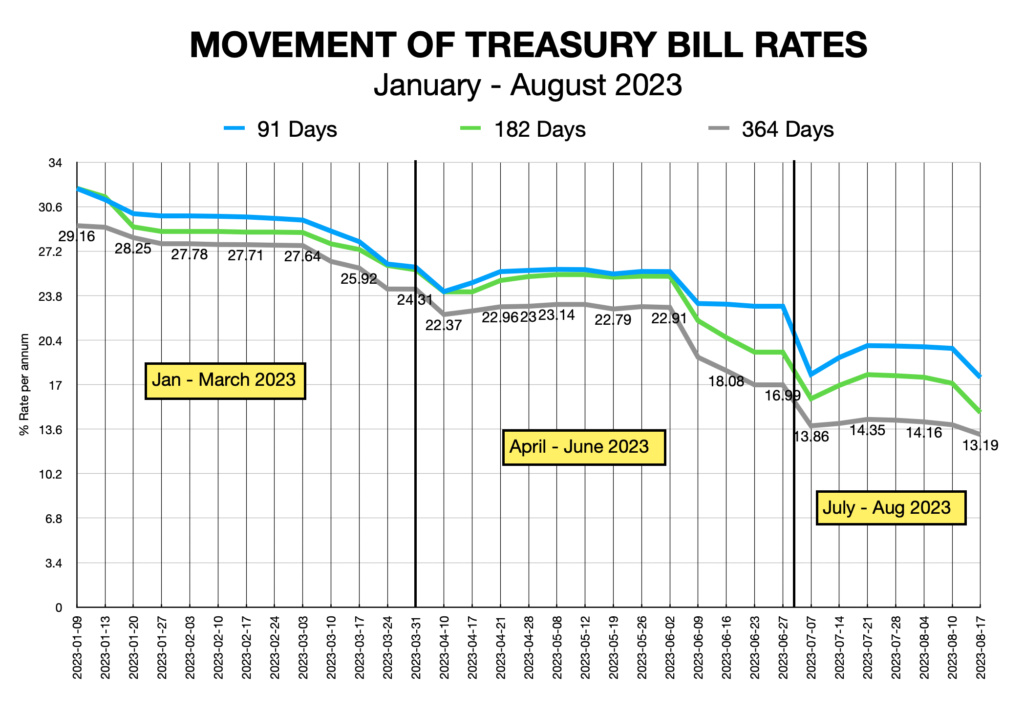

Banks have been making its profits mainly from the high interest derived from Treasury Bills which has now fallen below 18% p.a. Further as a result of lower interest rates, Bank interest spreads have affected significantly. Under current circumstances falling interest rates are unlikely to fuel any meaningful increase of credit growth.

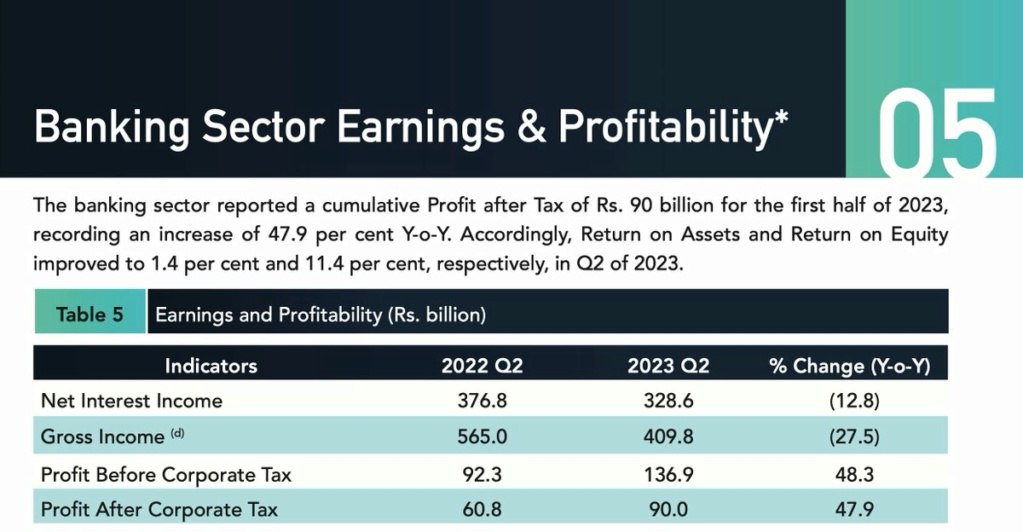

The Banking Sector Net Interest Income reported a decline of 12.8 % YoY for the Q2 of 2023,whilst Gross Income reported a decline of 27.5% YoY. Increased Corporate taxes are yet to have the full impact on the Profit after Tax of the Banking Sector.

- DDO Impact on ISB's owned by Banks

Banks are likely to realise the full effect of the Domestic Debt Restructuring of the International Sovereign Bonds (ISB's) during the September quarter.

- Impairment due to Domestic Debt Downgrading

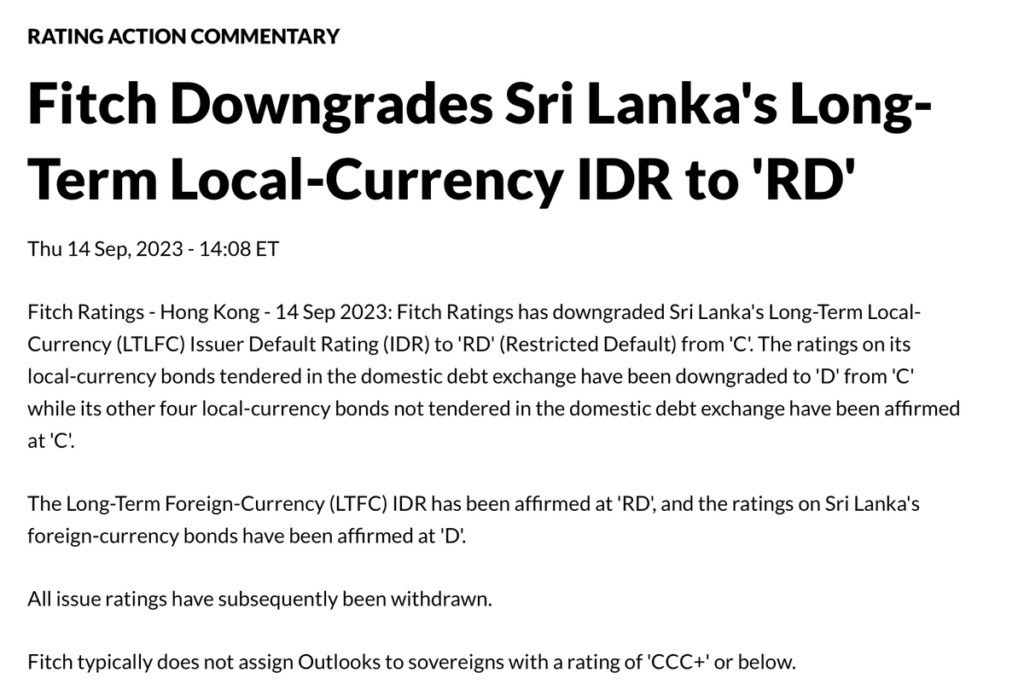

Fitch has downgraded Domestic Debt to 'Default' status, which would result in banks having to make impairment of assets.

On 14 September 2023, Fitch downgraded the sovereign’s Long-Term Local-Currency Issuer Default Rating following the completion of an exchange of treasury bonds for longer-dated ones, which forms a part of the Domestic Debt Optimisation program.

- Impact of Banking Sector Restructuring and Amalgamation

As per IMF agreement CBSL is required to determine the size, timing, instruments, and terms and conditions for potential government recapitalization of viable banks which are unable to close capital shortfalls from private sources by October 2023. Amalgamation and restructuring of banks would like to cause losses to the shareholders.

FINANCIAL SOUNDNESS INDICATORS

Q2 of 2023

https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/financial_soundness_indicators_2023_q2.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.