(From Asia Securities)

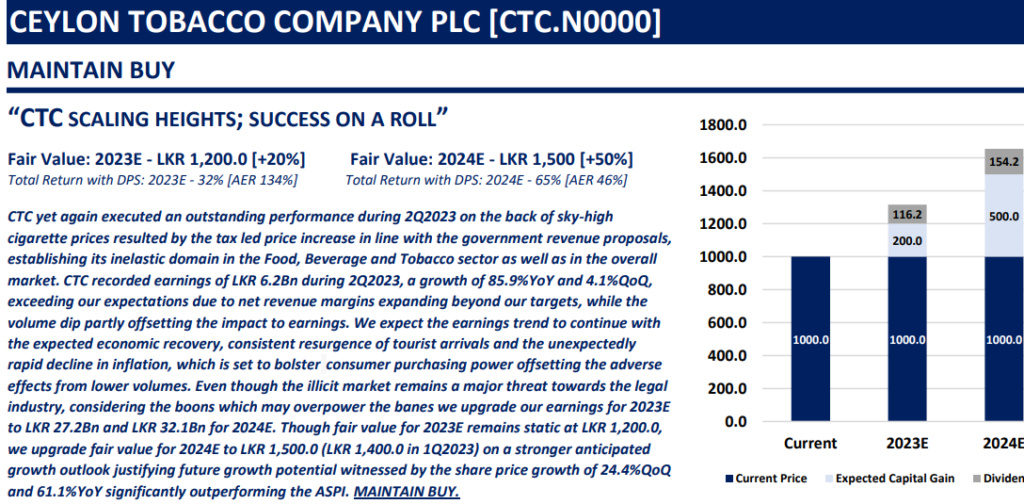

CTC yet again executed an outstanding performance during 2Q2023 on the back of sky-high cigarette prices resulted by the tax led price increase in line with the government revenue proposals, establishing its inelastic domain in the Food, Beverage and Tobacco sector as well as in the overall market. CTC recorded earnings of LKR 6.2Bn during 2Q2023, a growth of 85.9%YoY and 4.1%QoQ, exceeding our expectations due to net revenue margins expanding beyond our targets, while the volume dip partly offsetting the impact to earnings. We expect the earnings trend to continue with the expected economic recovery, consistent resurgence of tourist arrivals and the unexpectedly rapid decline in inflation, which is set to bolster consumer purchasing power offsetting the adverse effects from lower volumes. Even though the illicit market remains a major threat towards the legal industry, considering the boons which may overpower the banes we upgrade our earnings for 2023E to LKR 27.2Bn and LKR 32.1Bn for 2024E. Though fair value for 2023E remains static at LKR 1,200.0, we upgrade fair value for 2024E to LKR 1,500.0 (LKR 1,400.0 in 1Q2023) on a stronger anticipated growth outlook justifying future growth potential witnessed by the share price growth of 24.4%QoQ and 61.1%YoY significantly outperforming the ASPI. MAINTAIN BUY.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home