The Cabinet recently sanctioned an increase in the Value Added Tax (VAT) rate, is due to come into effect on January 1, 2024. This amendment will increase the rate from the present 15% to 18%, marking the highest level in two decades.

Increase of Value Added Taxes from 15% to 18% is expected to result in a sudden increase in retail prices with effect from 1st January 2024, when suppliers pass on VAT to consumers.

According to experts any increase in VAT will lead to higher inflation and cause a fall in real disposable incomes which may cause a slowdown in GDP growth and rising unemployment.

Further raising VAT to 18% might lead to a rise in inequality because of regressive effects on low-income families. A value-added tax (VAT) is a tax on consumption. Poorer households spend a larger proportion of their income. A VAT is therefore regressive if it is measured relative to current income and if it is introduced without other policy adjustments.

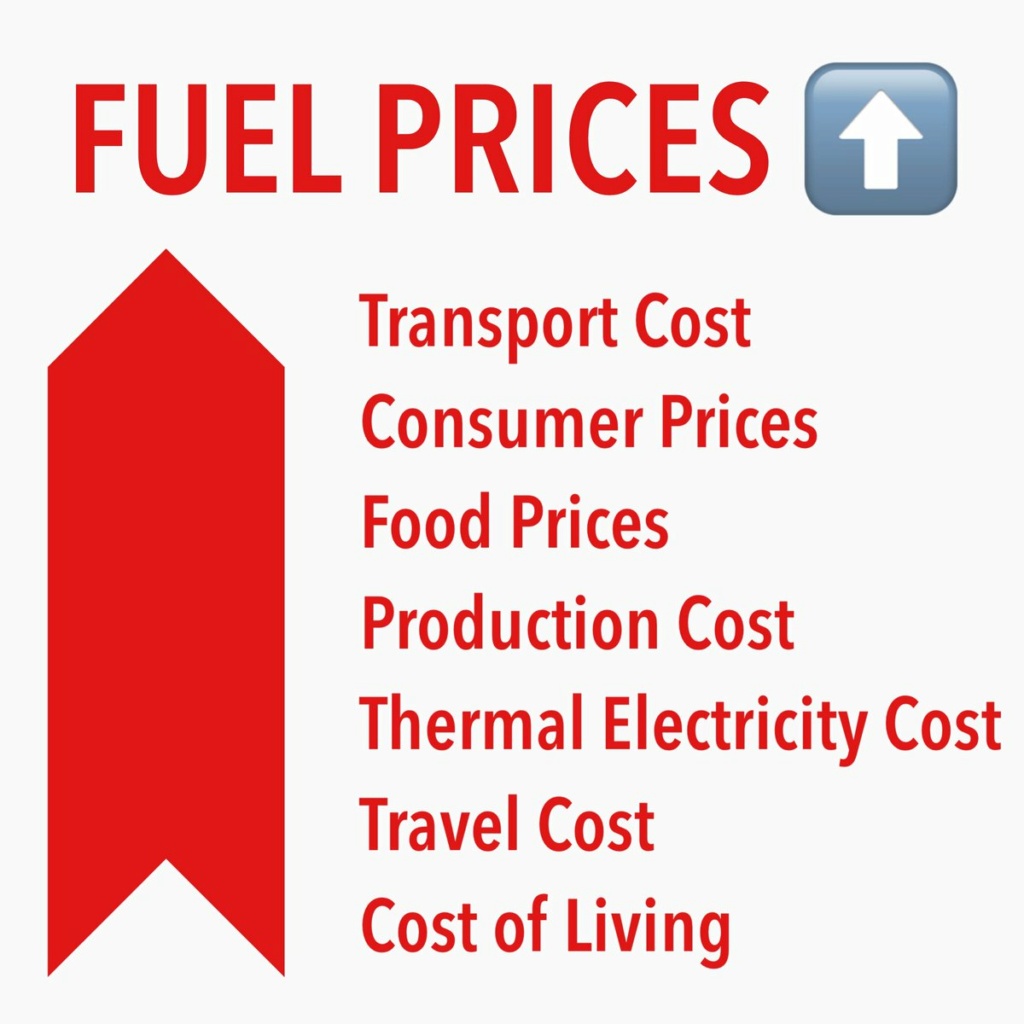

Further as shown above the increase in Fuel and LP Gas prices due VAT will have ripple effect on the economy.

Fuel and LP Gas, currently not subject to VAT, will also be charged at an 18% rate. However, the current Ports and Airports Development Levy (PAL) on Fuel and LP Gas will be removed from January 1st. Current PAL rates for Fuel and LP Gas are 7.5% and 2.5%, respectively.

Bottom line: if the CIF value of these two commodities remains the same,

This will make life difficult for millions of families who are just about managing and cause a fall in confidence and spending.

However according to IMF jump in VAT to 18% would increase tax revenue for the government and help to lower the fiscal deficit and eventually contribute to a lower level of national debt.

Instead of raising VAT to 18% the government might be better off widening the scope of VAT to include more items or focus instead on cutting VAT and corporation tax avoidance by businesses.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.