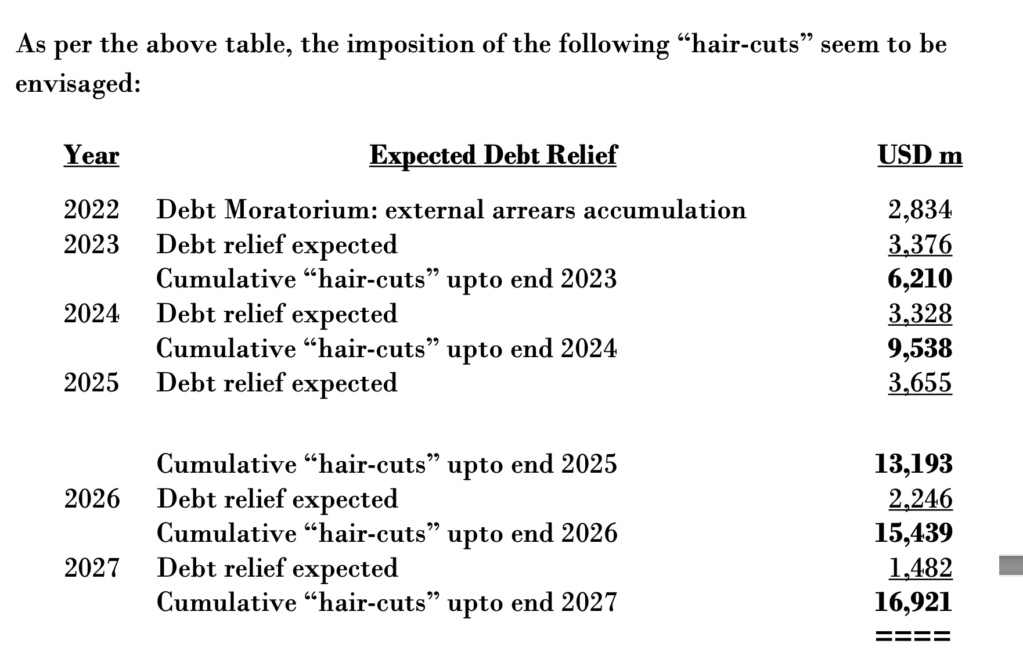

The IMF programme envisaged a "haircut" of 60% of the amounts due to Bilateral and Private Creditors so that the foreign-law debt of $ 27,943 mn could be cut by 60% amounting to $ 16,921 mn. (see page 26 of IMF Report of 20th March 2023). https://www.imf.org/-/media/Files/Publications/CR/2023/English/1LKAEA2023001.ashx

However, bilateral creditors have not granted a single dollar "haircut", and only agreed to a slight reduction in interest rate in some instances and a 2 year moratorium in payment period.

On that basis, the ISB holders also won't agree to a "haircut" on the grounds of "equitable treatment of all Creditors" principle.

Therefore, the Govt is now back to square One, and there won't be any reduction in the Debt to GDP ratio as touted by the Govt and CBSL.

Of the total public debt outstanding, it is stated that the total “foreign-law debt” amounts to USD 41,474 million, of which the “Official bilateral” creditors hold debt of USD 11,419 million, while “Private” creditors hold debt of USD 16,524 million, together totaling USD 27,943 million (page 45).

Since the IMF has assumed the total “debt relief” and “moratorium” of USD 16,921 million as per the Table at its Staff Report page 26, such “hair-cut” would amount to a massive 60.6% “cut” out of the total foreign-law debt outstanding of USD 27,943 million that is payable to those two categories of creditors. Therefore, if the IMF has worked out its debt restructuring and financing based on such a massive “hair-cut” being imposed, in all probability, such an exercise would result in dragging the economy and country into a serious uncertainty, intense risk, protracted litigation, and prolonged economic pain. Such an eventuality would definitely be counter- productive and unsustainable from the point of view of many creditors, including the several Sri Lankan commercial banks who reportedly hold a significant USD 1,750 million out of the International Sovereign Bonds, plus accrued interest.

It is noted that the IMF’s “External Financing Gap” and “Programme Financing” calculation also envisages an ISB inflow of USD 1,500 million in 2027. Such an inflow is envisaged even as the Government is expecting to impose a “hair-cut” of USD 1,482 million on its “Official bi-lateral” and “Private” creditors in the very same year. That contradiction indicates the absurdity of such an assumption which displays a total lack of understanding of “creditor-sensitivity” as well as even a modest degree of common sense, as it would be obvious that it would be well-nigh impossible to attract any ISB investment in a magnitude of USD 1,500 million, in such circumstances.

After preparing the “Programme Financing” calculations on the above basis, the IMF’s expectation seems to be for the CBSL to accumulate Gross International Reserves of USD 14,208 million, whilst defaulting on sovereign loan repayments amounting to almost a similar amount in those years. In fact, such GIR accumulation by the end of 2027 seems to be a rough mirror- image of the massive “hair-cuts” expected to be imposed on the country’s Official bilateral creditors and Private creditors, which those creditors would very likely consider quite unacceptable or even offensive, since the GIR build- up appears to be a mere transfer of the debts payable to the foreign-law creditors to the CBSL Reserves!

It is also a matter of grave concern that the Sri Lankan authorities as well as the IMF have both chosen (for some unknown reason) to completely ignore the “pipe-line” of highly likely FX inflows that were to be received by the Government at the time the untimely “debt default” was hastily announced by some officials. In this regard, while it must be mentioned that it is quite suspicious as to why those credible inflows have not been followed up at that time, it must be re-iterated that FX inflows around USD 7,150 million were highly likely to materialize within the 2nd, 3rd and 4th quarters of 2022 itself. In addition, the Peoples Bank of China SWAP of USD 1,550 million would also have become “usable” when those anticipated receipts materialized as the CBSL’s GIR would have then reached the reserve levels required for the PBOC SWAP to become operative for use.

However, due to the reckless debt default announcement, those promising inflows were summarily and instantaneously lost. If not, those timely “bridging finance” inflows would have been quite adequate to keep Sri Lanka solvent up to the end of 2024, by which time the improvements in workers’ remittances, exports, tourism receipts, service inflows, and other new avenues of “non-debt” inflows would have comfortably ensured Sri Lanka’s continued solvency and the maintenance of the country’s impeccable track record of being an honest and respected debtor-nation.

In that background, the IMF assumption that bi-lateral loan disbursements will record USD 1.5 bn in 2024 is simply “wishful thinking” unworthy of the IMF, since no bi-lateral creditor is likely to even consider providing further financing to a country/borrower which has just defaulted to the tune of (a currently projected) 60% of its outstanding debt due to the same creditor. The assumption that the ISB market could also be accessed by 2027 is another “pipe-dream” as no private creditor which is already suffering from a “hair-cut” of about 60% will be willing to further fund a debtor which has caused such a large loss to them. Similarly, the financing envisaged via T-bills and T-Bonds are also unlikely to be at the rates expected in the assumption, as already explained elsewhere in this analysis.

It is also shocking that this Debt Sustainable Analysis (DSA) does not propose or indicate a single “non-debt creating” inflow, which is the most critical element in restoring debt sustainability. After all, even in the case of a stressed debtor seeking further time from a local bank, the first question that the Bank asks is as to the sources from which the borrower expects new funds to settle the debt. Instead of following such a sensible and practical approach, all the assumptions listed by the IMF, relate to more debt inflows, which will surely lead to the further aggravation of the debt crisis. That is further confirmed in page 40 where it is shown that external debt is expected to rise from USD 58.7 billion at end-2022 to USD 69.8 billion by end-2028.

Therefore, since the DSA has been prepared with such ill-judged assumptions and glaring gaps, it is most unlikely that the situation will turn benign reasonably quickly, since these impractical assumptions will soon be exposed. Sadly however, the Programme will then be facing failure, to the consternation of those who expected much from it.

Last edited by God Father on Tue Jan 09, 2024 8:31 am; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home