Overall soundness of the banking sector as indicated by the BSI improved at end Q3 of 2023 compared to the corresponding period of the previous year. However, the index remained below 100 during the recent past, reflecting the challenging operating environment of the banking sector. Liquidity, market risk, capital adequacy, and profitability sub- indices improved at end Q3 of 2023 compared to Q3 of 2022, while asset quality and efficiency sub-indices deteriorated during the same period. Increasing Stage 3 Loans Ratios contributed to the deterioration of the asset quality sub-index, while rising operating expenses contributed to the deterioration of the efficiency sub-index.

The BSI is a composite indicator which reflects the overall stability of the banking sector based on developments in assets quality, liquidity, capital adequacy, resil- ience to market risk, profitability, and efficiency. The index is weighted based on the market share of each bank. BSI is to be interpreted by factoring that the index has been prepared based on SLFRS-9 data from Q1 of 2021 onwards.

The Financial Stability Review of 2023 identifies several vulnerabilities in the Sri Lankan banking sector. The report notes that the banking sector's exposure to the Sovereign and associated risks are being addressed through reforms to bring down the Sovereign-Bank Nexus. The report also highlights that banks were faced with foreign currency liquidity pressures due to freezing of cashflows of International Sovereign Bonds (ISBs), repayment of Sri Lanka Development Bonds (SLDBs) in Rupees, and the low rollover risk appetite of counterparties amidst uncertainty surrounding restructuring of sovereign debt. Additionally, the report notes that the Licensed Finance Companies (LFCs) sector experienced a significant contraction in its loans and advances portfolio, primarily due to challenges in its core business of leasing and hire purchase. The asset quality of the sector deteriorated, indicated by an increase in Stage 3 Loans to Total Loans. However, the report also notes that the capital adequacy of the banking sector recorded an improvement at end Q3 of 2023 compared to Q3 of 2022, as risk-weighted assets declined during the period, mainly due to the credit contraction, increased investments in Government securities, and the appreciation of the Sri Lankan Rupee.

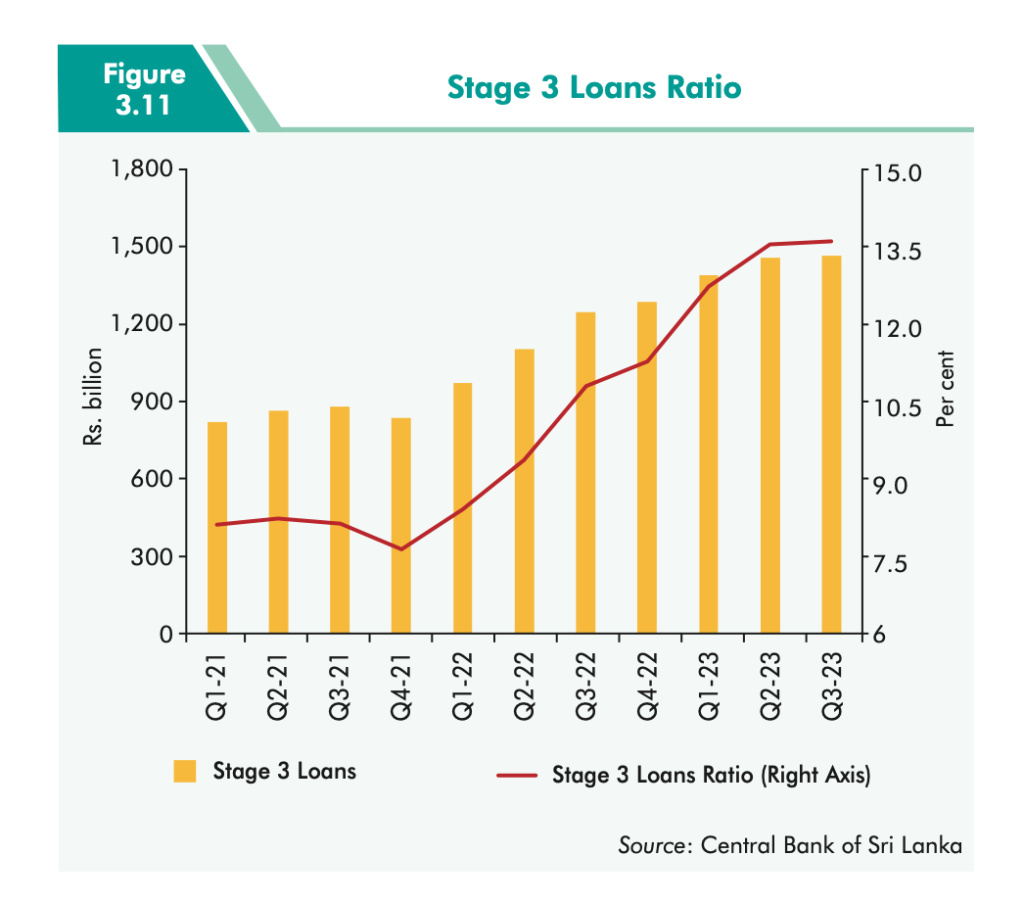

Overall default risk of the banking sector remained high, while some stabilisation of the risk was witnessed during Q3 of 2023. Default risk of the sector as indicated by the Stage 3 Loans Ratio (including undrawn amounts) increased to 13.6 per cent at end Q3 of 2023, compared to 10.8 per cent at end Q3 of 2022.

Decelerating, but high growth in stage 3 loans as well as the decelerating growth in total loans and receivables contributed to the increase in Stage 3 Loans Ratio during the year ending Q3 of 2023.

All the bank categories, i.e. D-SIBs, other domestic banks, and foreign banks, reported increases in their respective Stage 3 Loans Ratios during the year ending Q3 of 2023, although it was comparatively low for foreign banks when compared to domestic banks. D-SIBs reported the highest Stage 3 Loans Ratio of 14.1 per cent at end Q3 of 2023, which was above the sector average, indicating higher exposure to default risk.

Moreover, although the Stage 3 Loans Ratio of other domestic banks is low compared to D-SIBs, the increase in the Ratio was higher for other domestic banks, indicating higher build-up of credit risk during the period under consideration.

Reflecting adverse repercussions of the economic crisis, Household sector credit experienced a substantial y-o-y decline during the period under review. The level of credit in the Household sector which represents 42.3 per cent of the total formal financial sector lending4, reported a significant decline of 6 per cent as of end June 2023, compared to 8.1 per cent growth recorded at end June 2022 reflecting diminished demand for new loans from this sector due to elevated interest rates for loans and advances, deteriorating real income levels and high living costs. Moreover, this highlights the reluctance of formal financial sector lenders to provide new credit facilities within the current economic climate. Furthermore, the banking sector played a substantial role in meeting the borrowing needs of the Household sector, representing 70.7 per cent of the total, while the NBFI5 sector accounted for the remaining portion of loans obtained by households.

The NPL ratio of the Household sector was steadily increasing, amidst constrained debt repayment capacities of household borrowers. By end of June 2023, the NPL ratio for the Household sector increased to 17.7 per cent, a considerable increase from the 14.1 per cent recorded during the corresponding period of the previous year. The share of non-arrears loans7 within the total Household sector also gradually decreased since the beginning of 2022 while the share of arrears loans was on the rise in tandem, indicating a continuous deterioration in the credit quality of the Household sector which may persistent in the future if adverse economic conditions are to continue.

While the banking sector was the main source of credit for the Household sector, the NBFI sector accounted for the higher share of NPLs. Although, both the banking and NBFI sectors experienced a rise in their NPL ratios as at end June 2023, the NBFI sector accounted for 58.3 per cent of total non-performing advances of the Household sector, indicating higher potential for default risk.

https://www.cbsl.gov.lk/sites/default/files/cbslweb_images/publications/fssr/fssr_2023e.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home