Based on the provided context information, here is a detailed analysis of the latest financial status and future outlook of Arpico Insurance PLC as of the end of December 2023:

Latest Financial Status as of December 2023:

- Net Assets Per Share: The unaudited net assets per share as of December 2023 stood at LKR 22.21, which is a decrease from the audited figure of LKR 31.20 in 2022.

- Market Price Per Share: The market price per share saw a highest price of LKR 22.50 and a lowest price of LKR 22.50 in 2023, indicating a stable market price in that period.

- Total Comprehensive Income: The total comprehensive income for the period ending 30th September 2023 was LKR 325,451,298, which includes a profit for the period of LKR 132,928,435 and other comprehensive income, net of tax, of LKR 192,522,863.

- Gross Written Premium: There was a decrease in gross written premium from LKR 564,586,267 in 2022 to LKR 434,817,499 in 2023.

- Investment Income: Investment income increased from LKR 123,813,762 in 2022 to LKR 145,718,897 in 2023.

- Market Capitalization: The market capitalization as of 30th September 2023 was LKR 1,688,875,379.

- Public Shareholding: The public shareholding remained at 10%, with 6,630,404 shares.

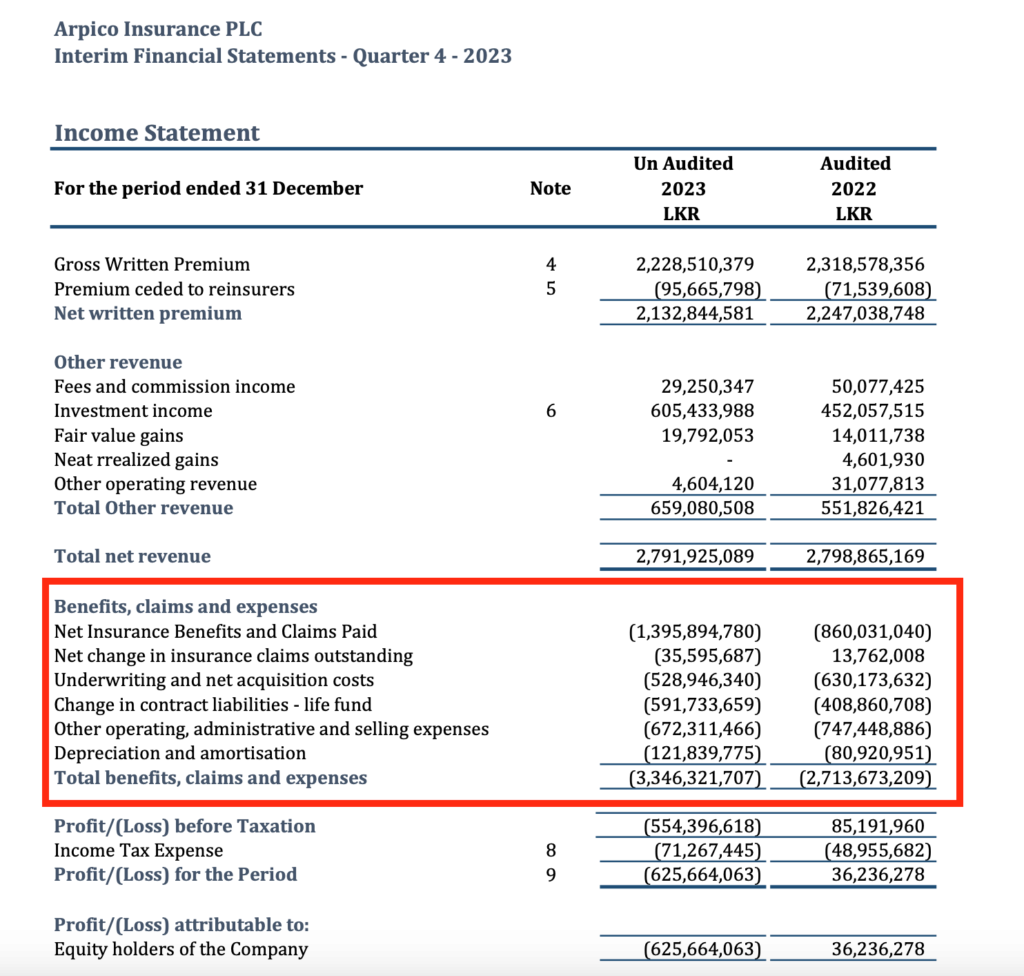

Arpico Insurance PLC, appointed industry veteran Kelum Senanayake as its Chief Executive Officer from 1 March 2021. He Made the history as the first Chief Executive being a MDRT achiever. Since his appointment company has performed poorly. Arpico Insurance PLC under his watch reported a loss of LKR 625mn for the financial year of 2023 (Unaudited), whilst all other insurance companies have shown remarkable profits during the period.

Future Outlook:

While the context does not provide explicit future projections, we can infer some aspects of the future outlook based on the data:

Market Stability: The stable market price per share at the end of 2023 suggests a level of market confidence in the company’s stability.

Investment Income Growth: The increase in investment income could indicate effective investment strategies that may continue to benefit the company if sustained.

Challenges in Premium Growth: The decrease in gross written premium may suggest challenges in premium growth, which could be an area of focus for the company moving forward.

Comprehensive Income: The significant other comprehensive income suggests that the company has profitable investments or assets that may continue to contribute positively to its financial health.

Regulatory Compliance: The company’s compliance with Sri Lanka Accounting Standard “LKAS 34 – Interim Financial Reporting” and the Companies Act No. 07 of 2007 indicates a strong regulatory adherence, which is crucial for maintaining investor trust.

It is important to note that for a complete and accurate future outlook, one would typically look for management discussion and analysis, market trends, competitive analysis, and forward-looking statements from the company, which are not provided in the context information.

This analysis and information is compiled by LankaBIZ (GPT) – Sri Lanka’s First ever AI Assistant for Stock Market and Research. Click below link to ask questions about any listed company in Sri Lanka.

www.lankabizz.net

Last edited by God Father on Tue Apr 16, 2024 12:29 pm; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home